Reliable Yields Are the Best

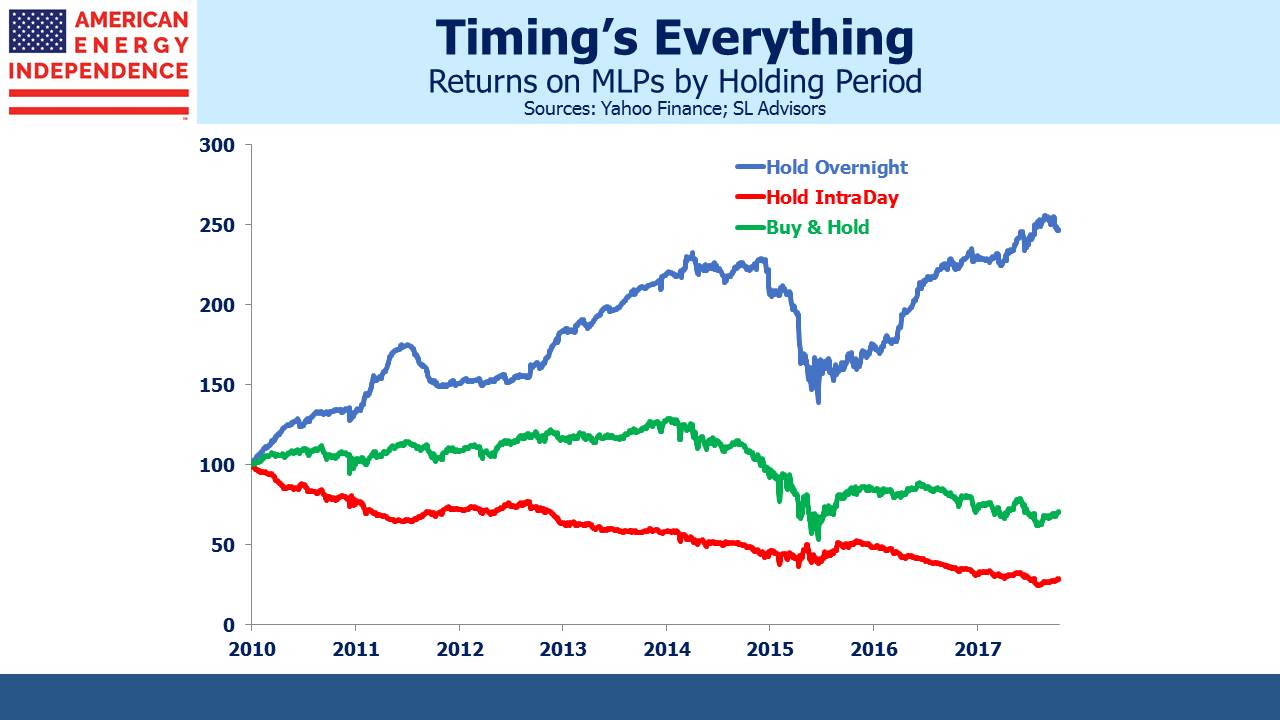

Before jumping at an attractive yield, investors should pause to consider its consistency.

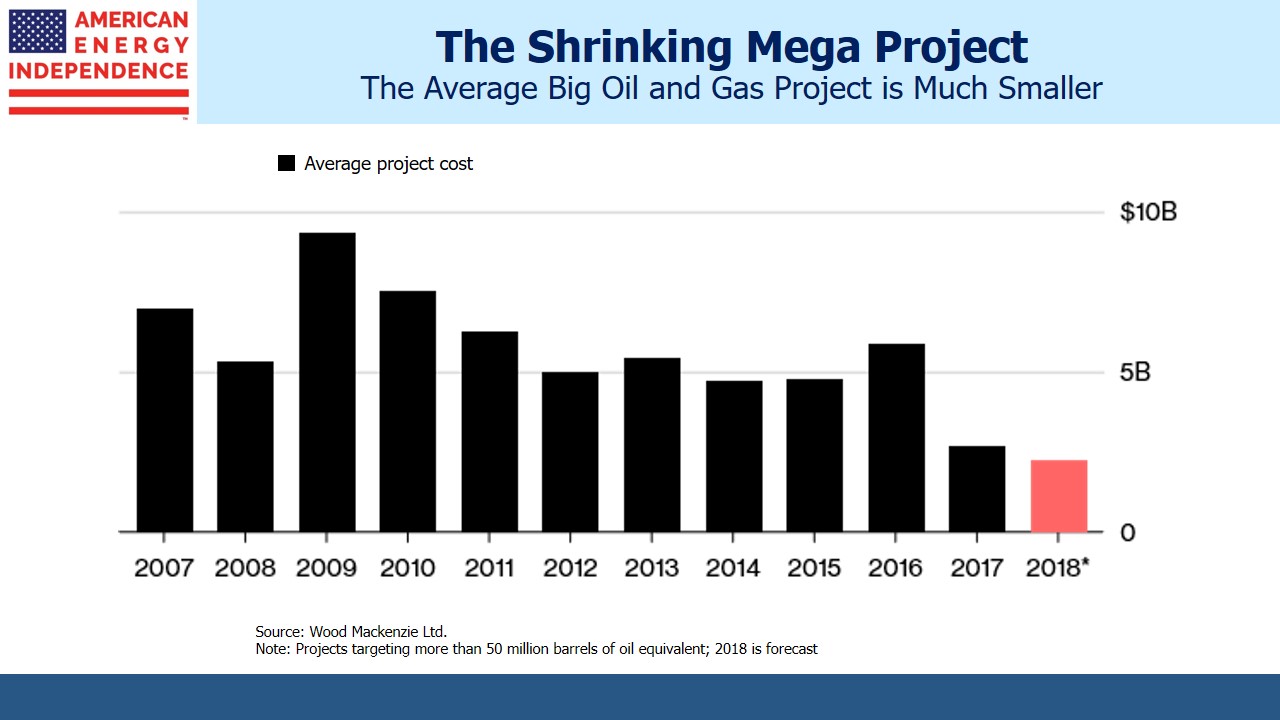

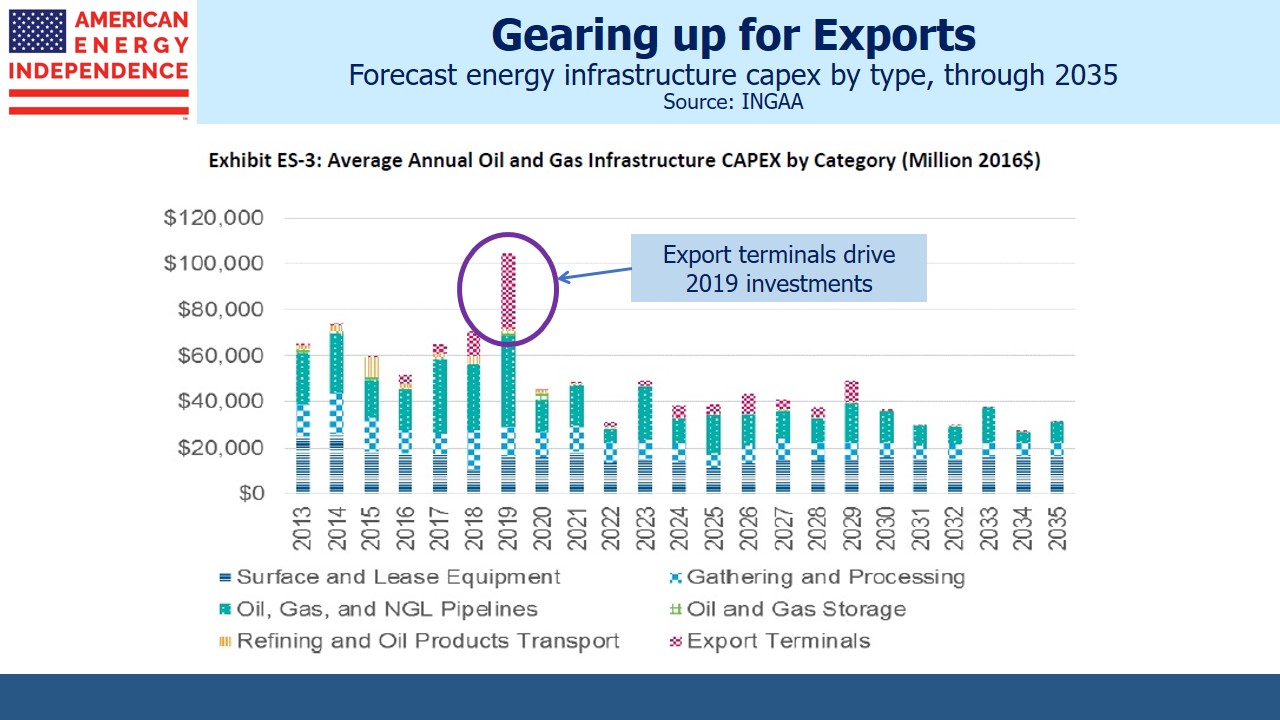

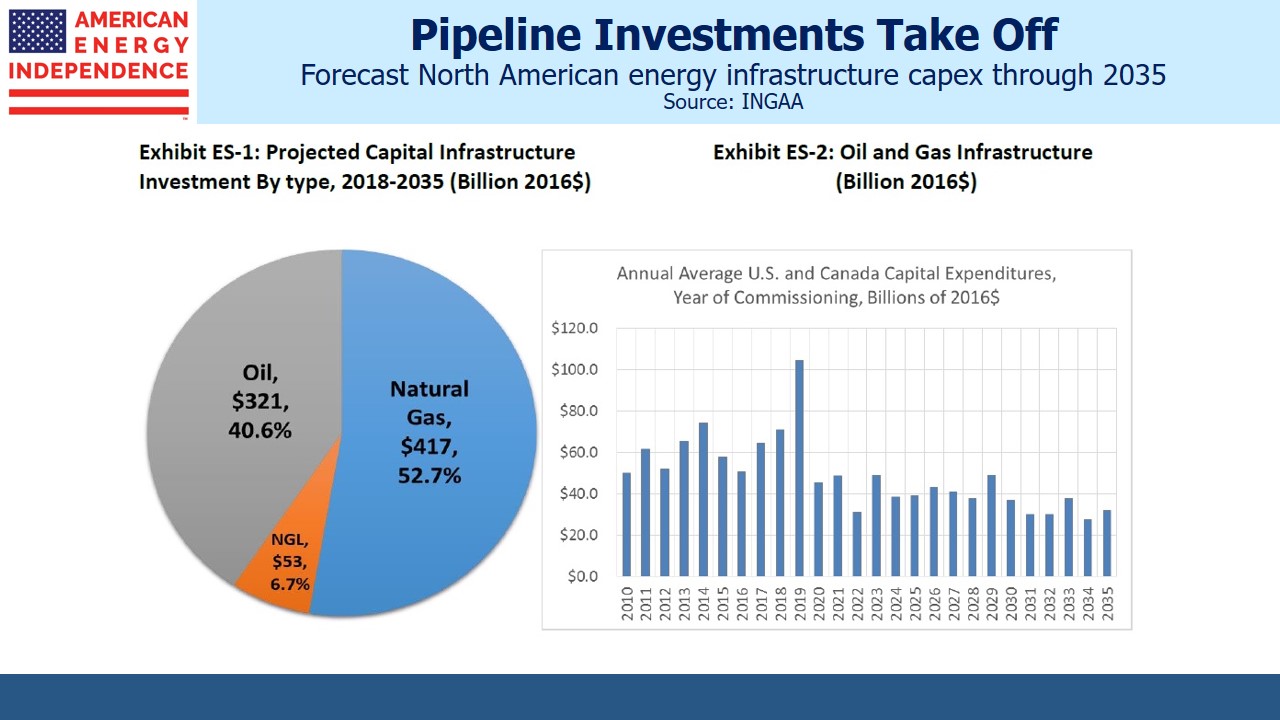

In recent years, traditional MLP investors were victims of one of the greatest betrayals in U.S. financial history. Older, wealthy Americans were drawn to companies that paid out most of their cashflow in distributions. For years, America’s energy came from roughly the same places in the same amounts, which meant little need for pipeline operators to re-invest in the business. The Shale Revolution changed all this – new sources of oil and gas required new infrastructure (see Will MLP Distribution Cuts Pay Off?).

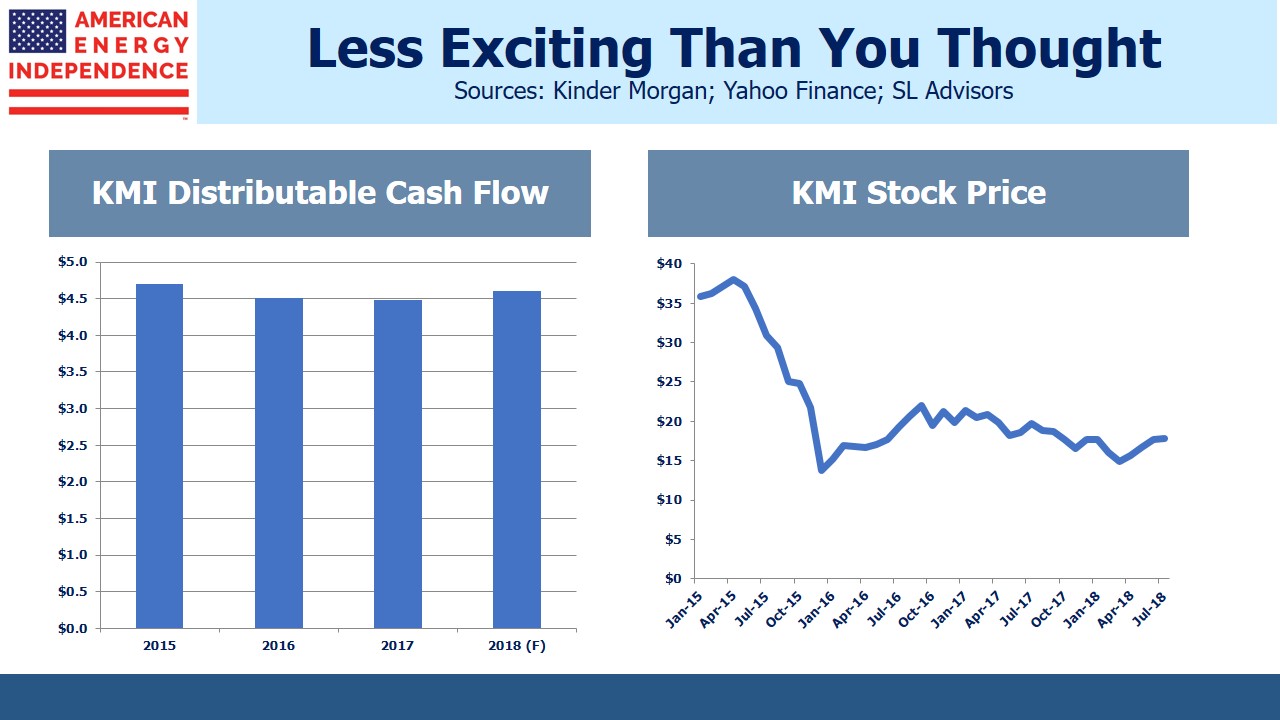

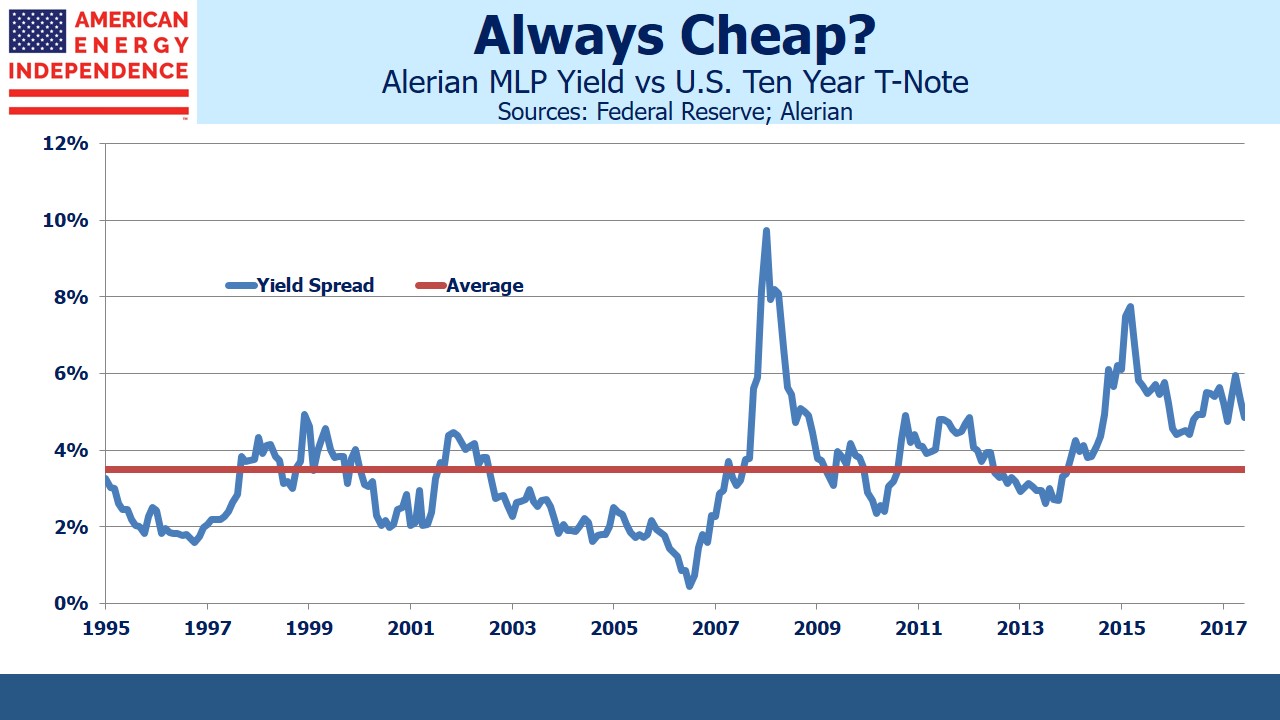

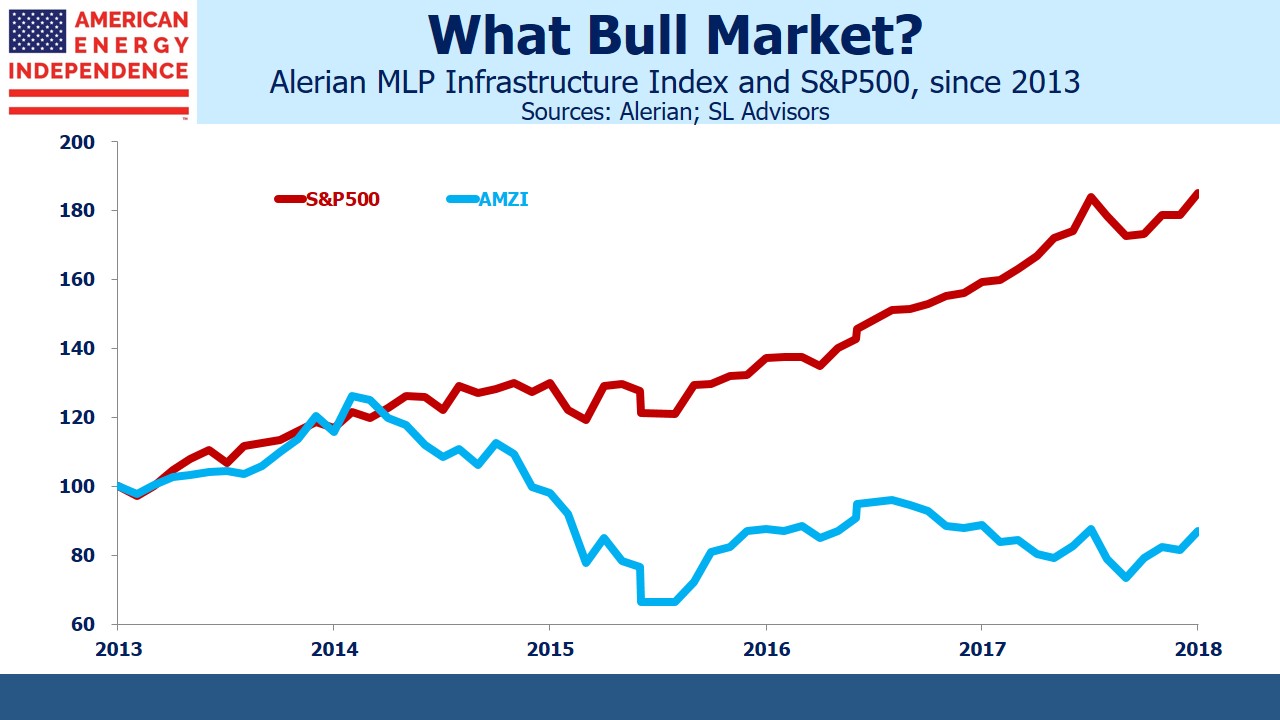

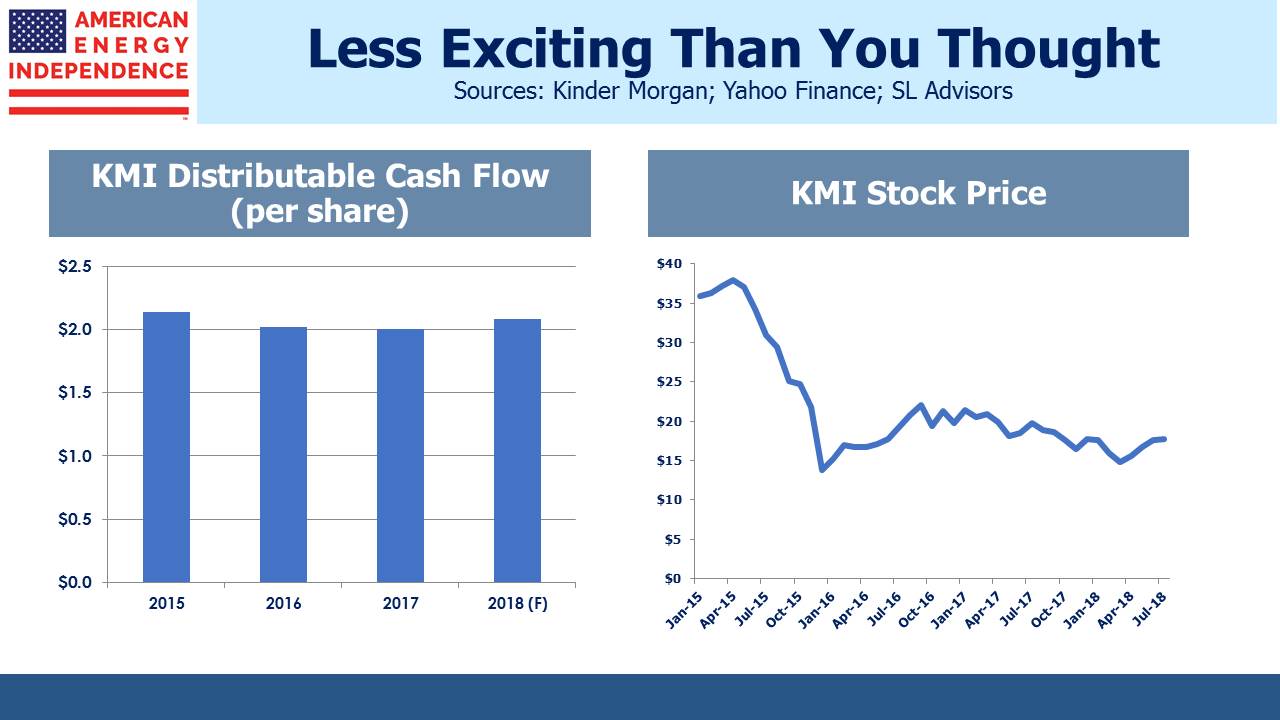

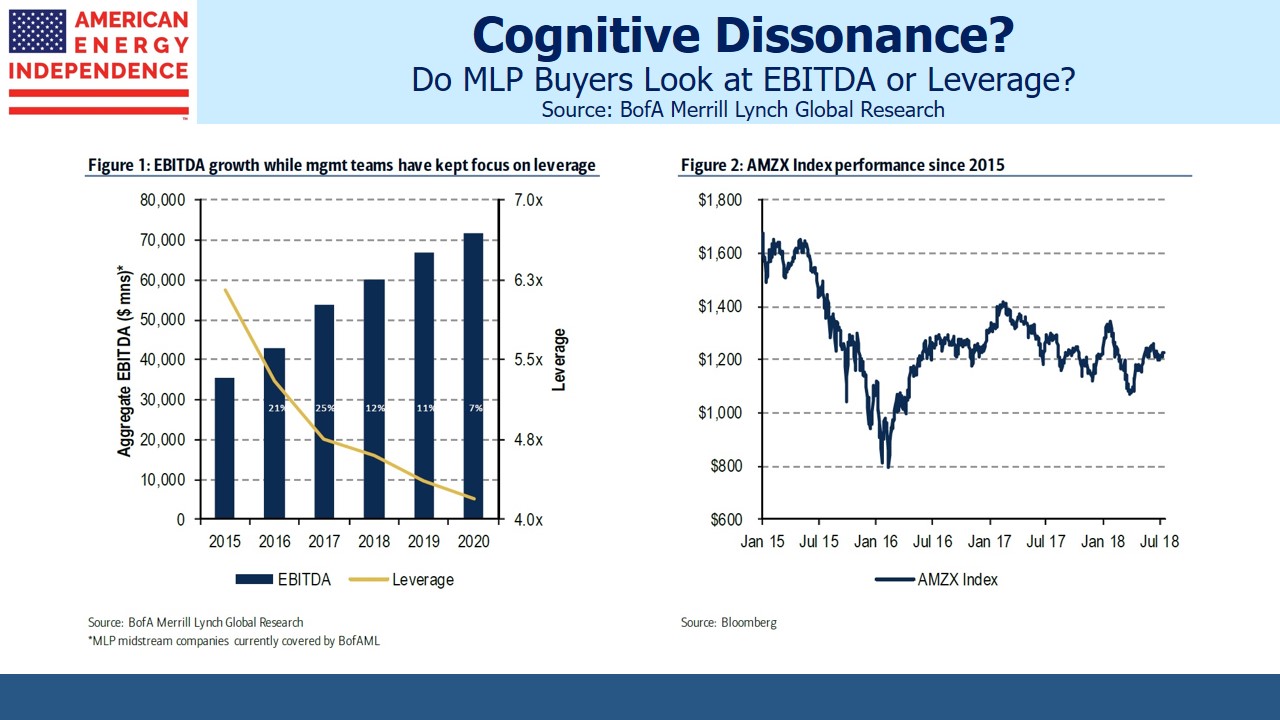

MLPs decided to grow, redirecting cashflows from payouts to new projects. K-1 tolerant, income seeking investors were the quintessential long term buyer sought by every CEO. All they wanted was stable income. Although for years MLPs provided this, in 2014-15 many of them seized the opportunity to be growth businesses, which redirected cash away from investors. Alignment of interests was lost. MLPs in aggregate demonstrated that Distributable Cash Flow would be paid to investors only as long as they didn’t have any better uses for it. Payouts were cut, trust was shattered. Today’s sector remains 28% below its August 2014 high, and its recovery offers something for everyone (see Growth & Income? Try Pipelines).

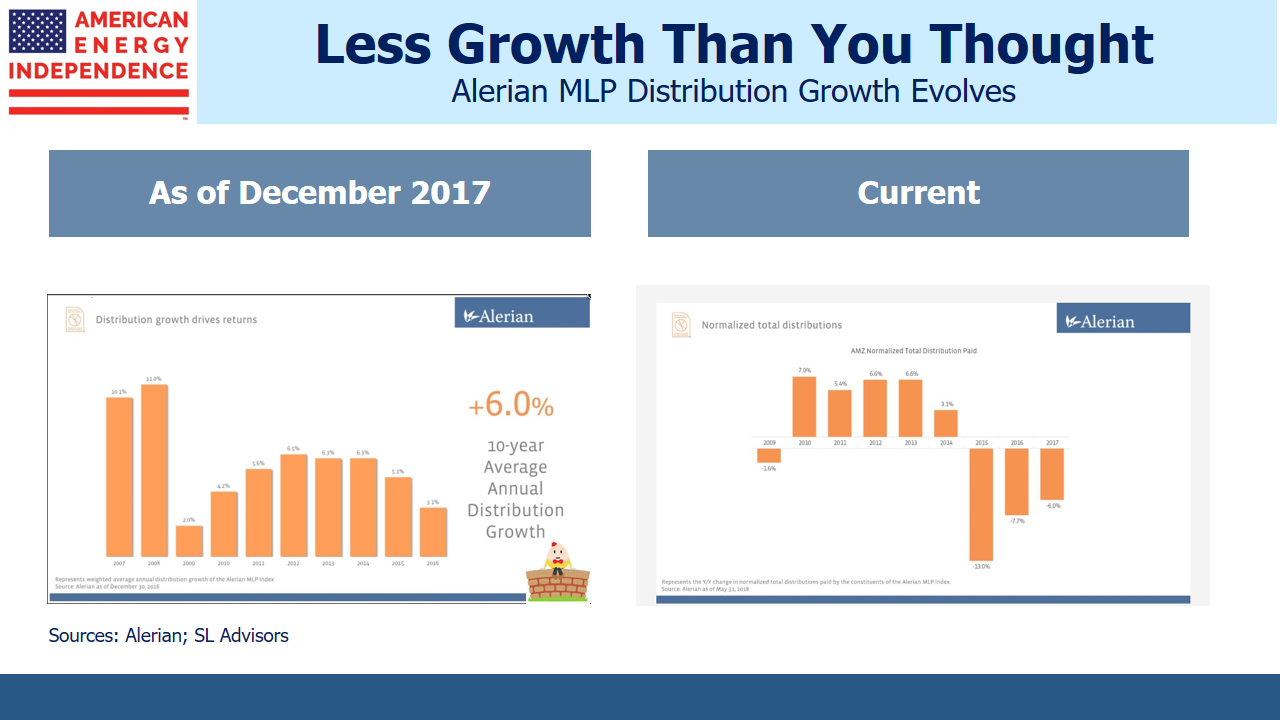

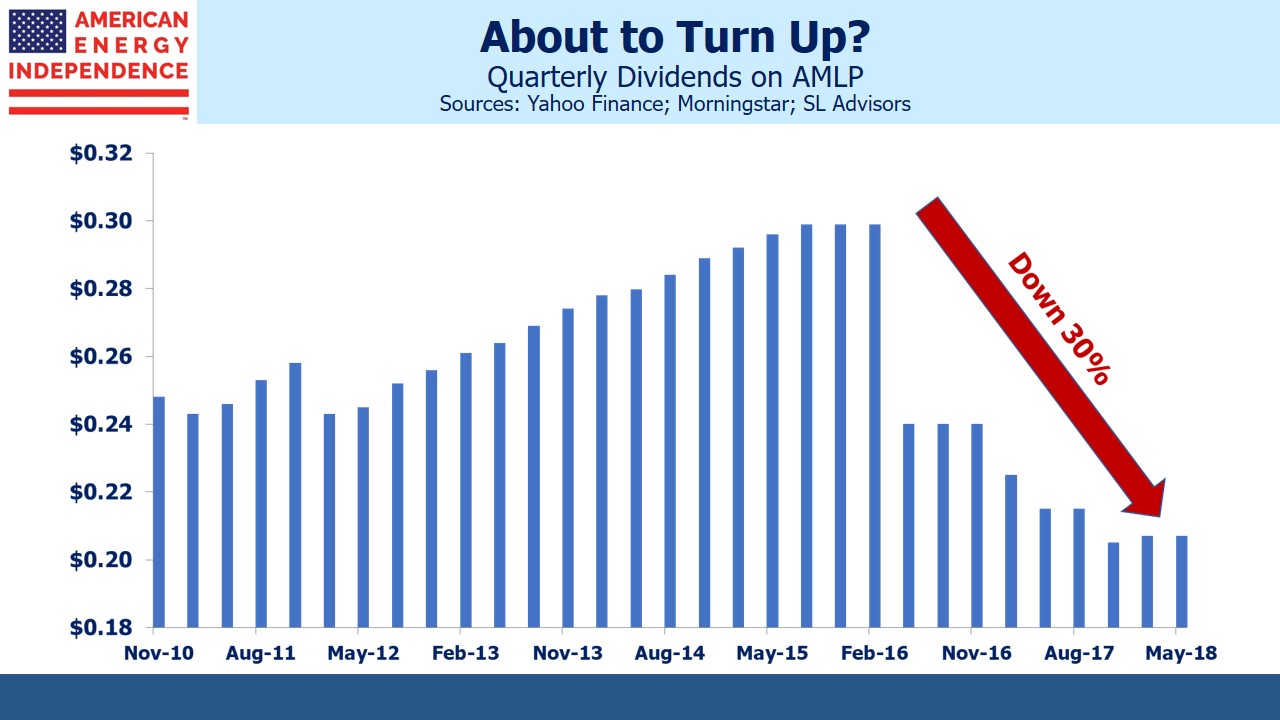

Stable and growing dividends remain highly valued. Although the Alerian MLP ETF (AMLP) has cut its distribution by 30% (see It’s the Distributions, Stupid!), Alerian used to post a chart with 6% average ten year distribution growth. Index components change, and Alerian was using the historic growth of existing index members regardless of how long they’d been in the index. This introduced a survivor bias, in that MLPs cutting distributions used to be dropped while the newly IPO’d ones they added were typically growing quickly. This confused many, because it failed to match actual investor experience. It seemed that everyone but Alerian knew MLP distributions were being cut. Facing growing criticism (see MLP Distributions Through the Looking Glass), Alerian revised their chart to better match reality.

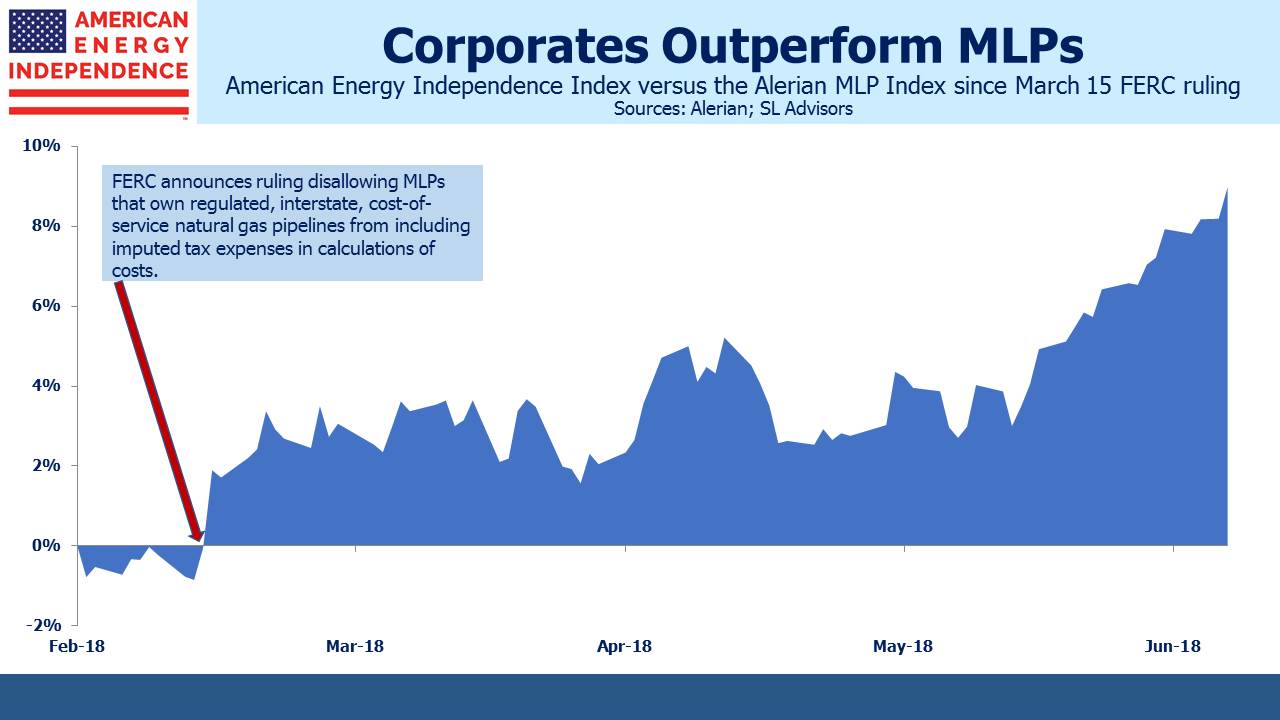

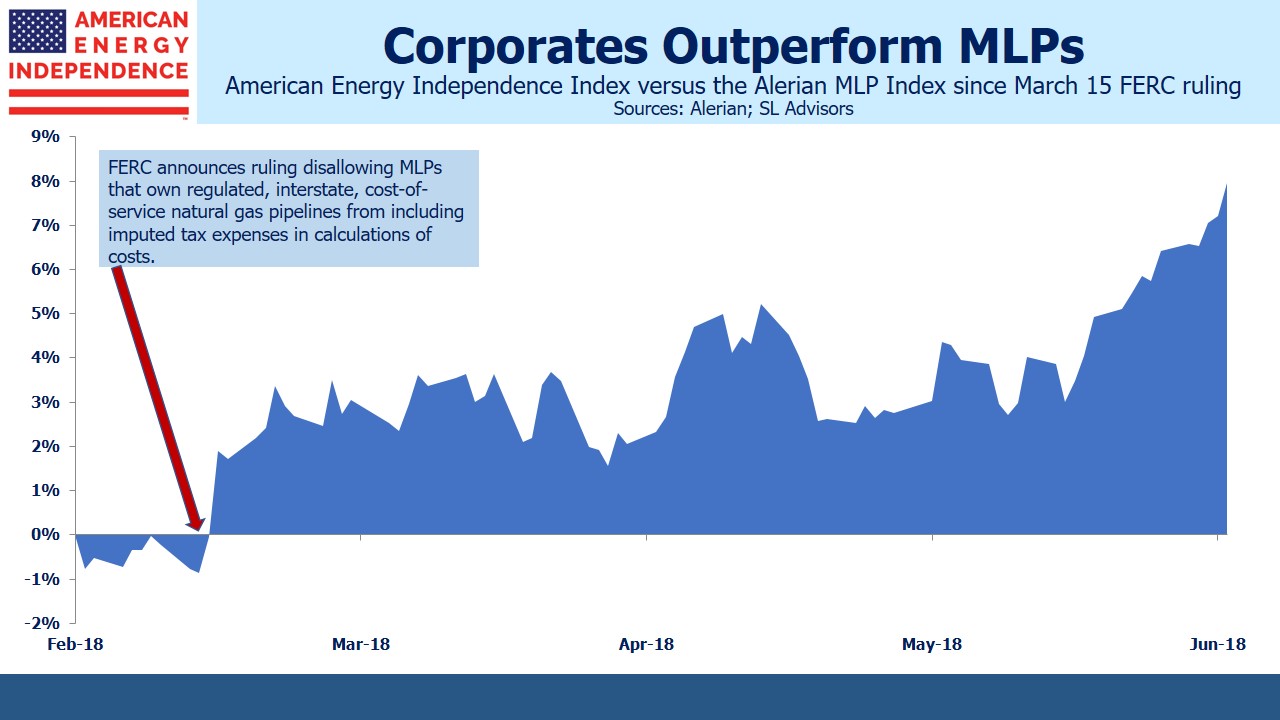

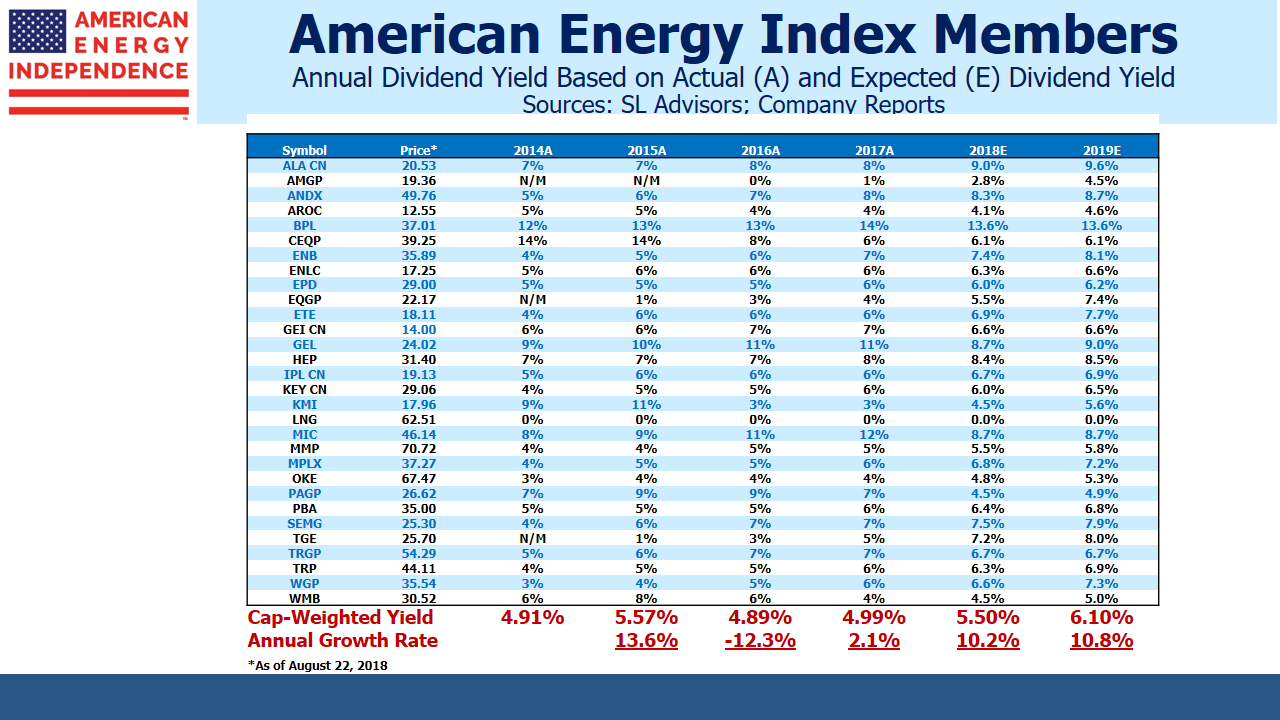

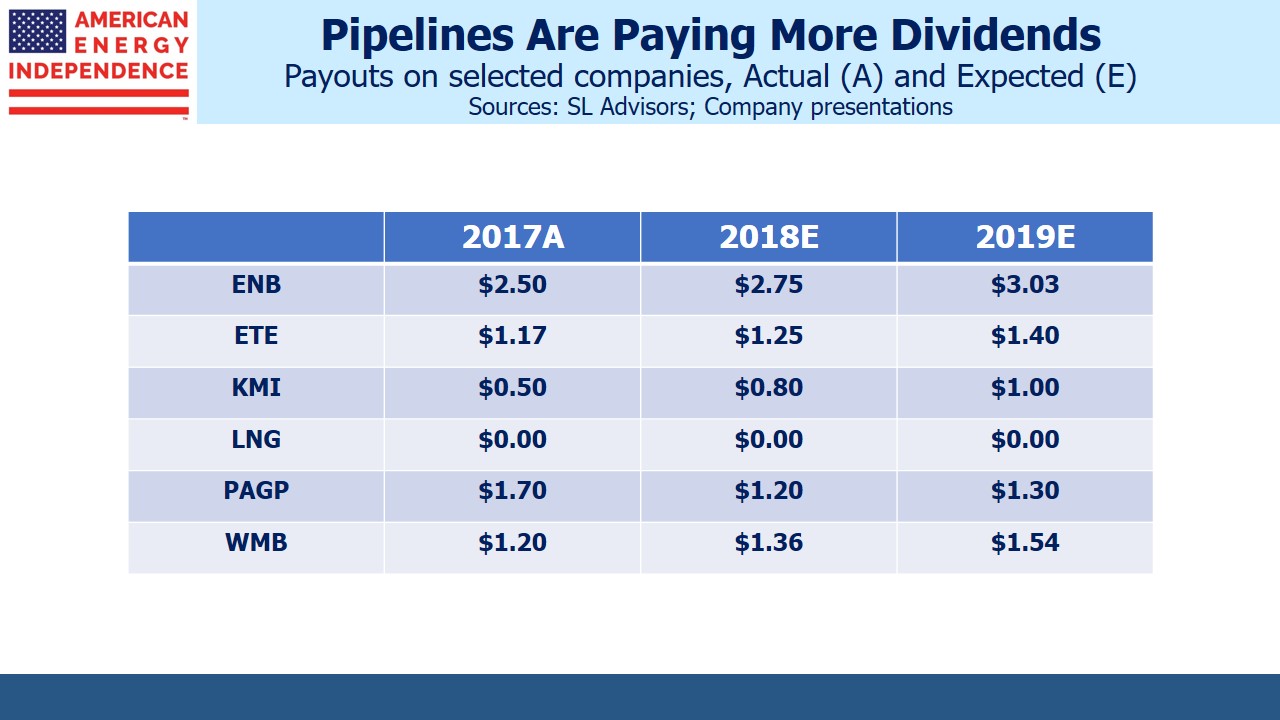

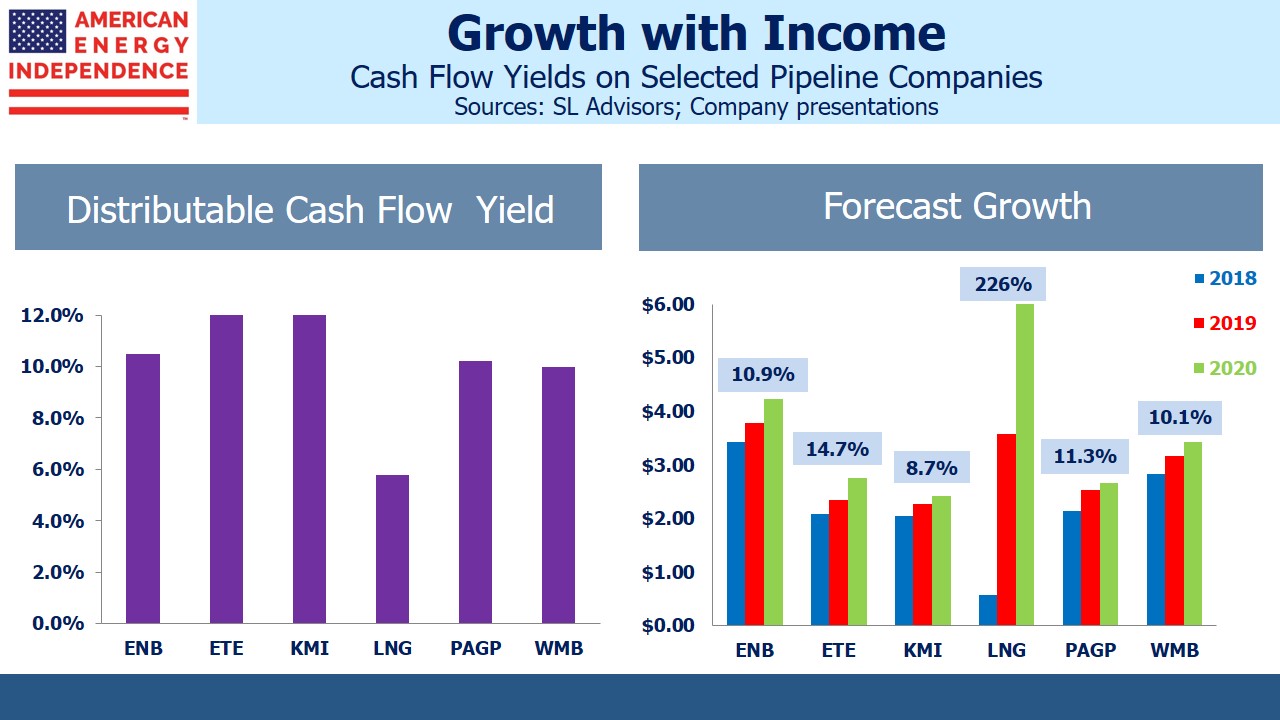

However, energy infrastructure overall has provided far more distribution stability than shown by MLPs. The American Energy Independence Index consists of the biggest pipeline companies in America, which are mostly corporations although it includes a few MLPs as well. It yields 5.5% based on 2018 dividends, a payout that is up 10% on 2017. We expect dividend growth of almost 11% next year. While income seeking investors are naturally drawn to attractive yields, the reliability of the payout is critical.

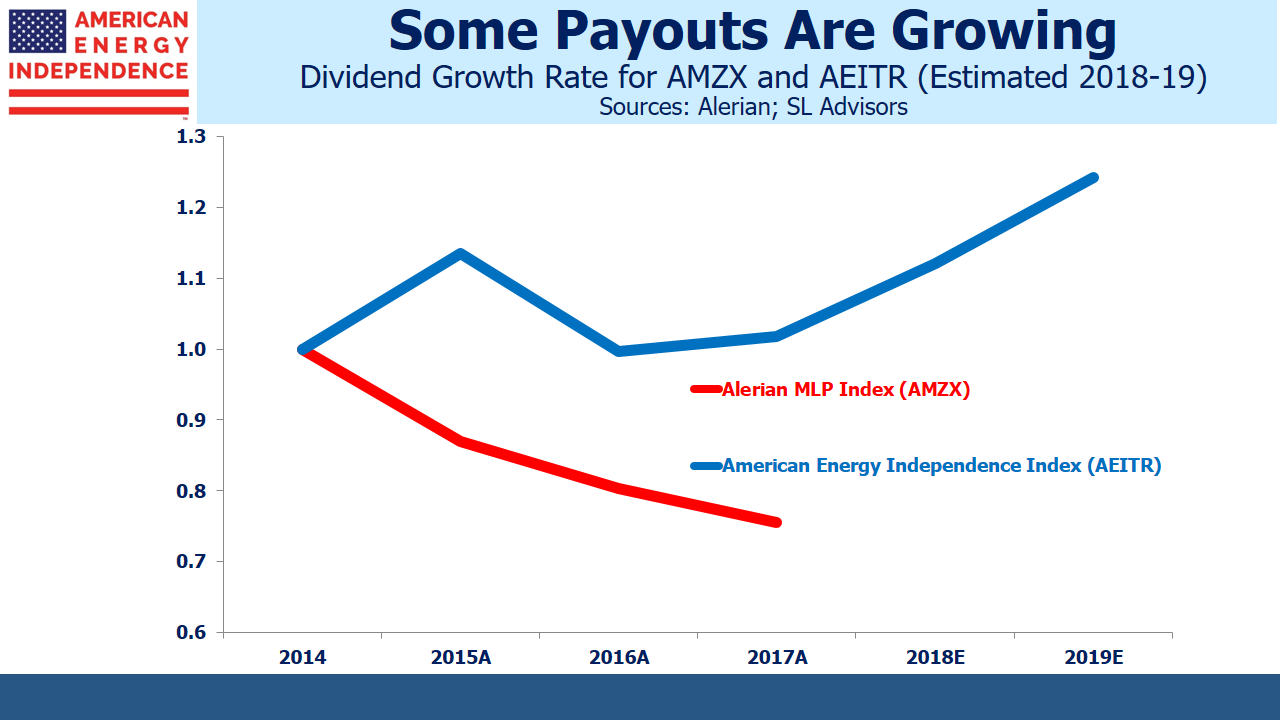

The chart shows that Alerian MLP Index dividends fell far more than for energy infrastructure as a whole. Moreover, they still have a long way to recover back to the levels of 2014. Although we think MLP distribution cuts are mostly behind us, the group’s history is one that income seeking investors shouldn’t soon forget. By contrast, American Energy Independence Index dividends dipped but quickly recouped their losses. The members of this index have demonstrated far more reliability with their payouts.

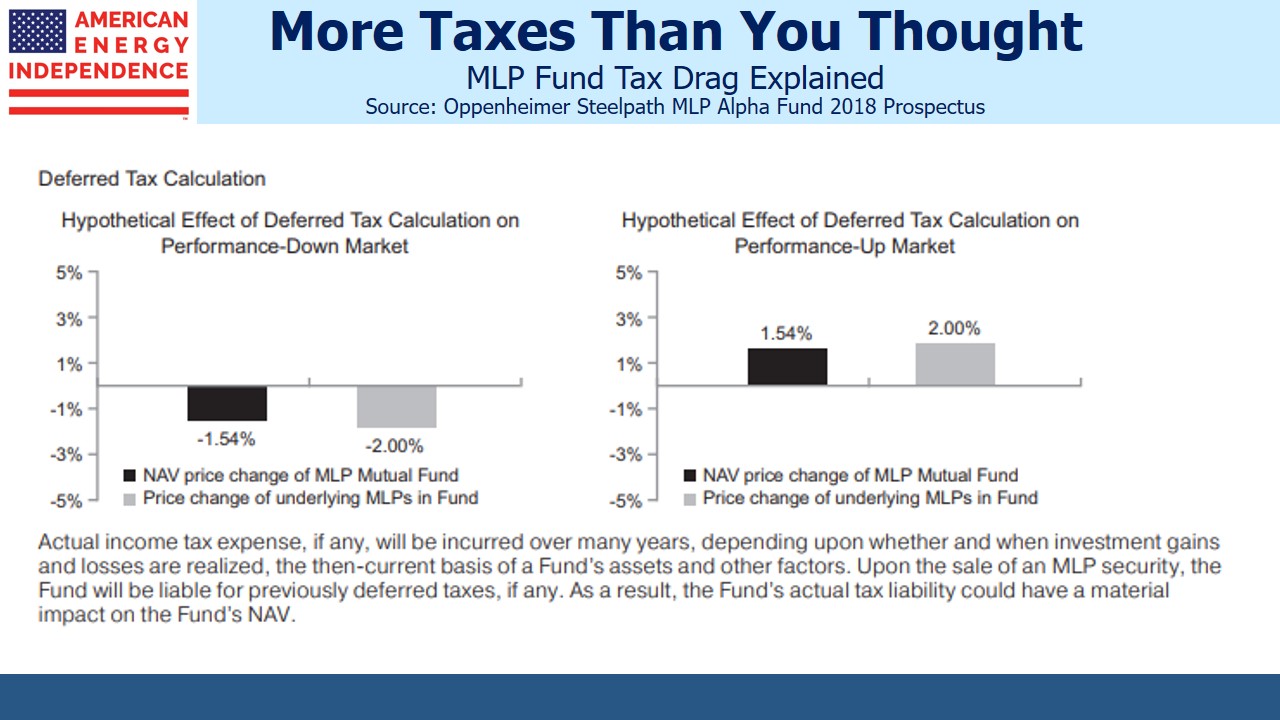

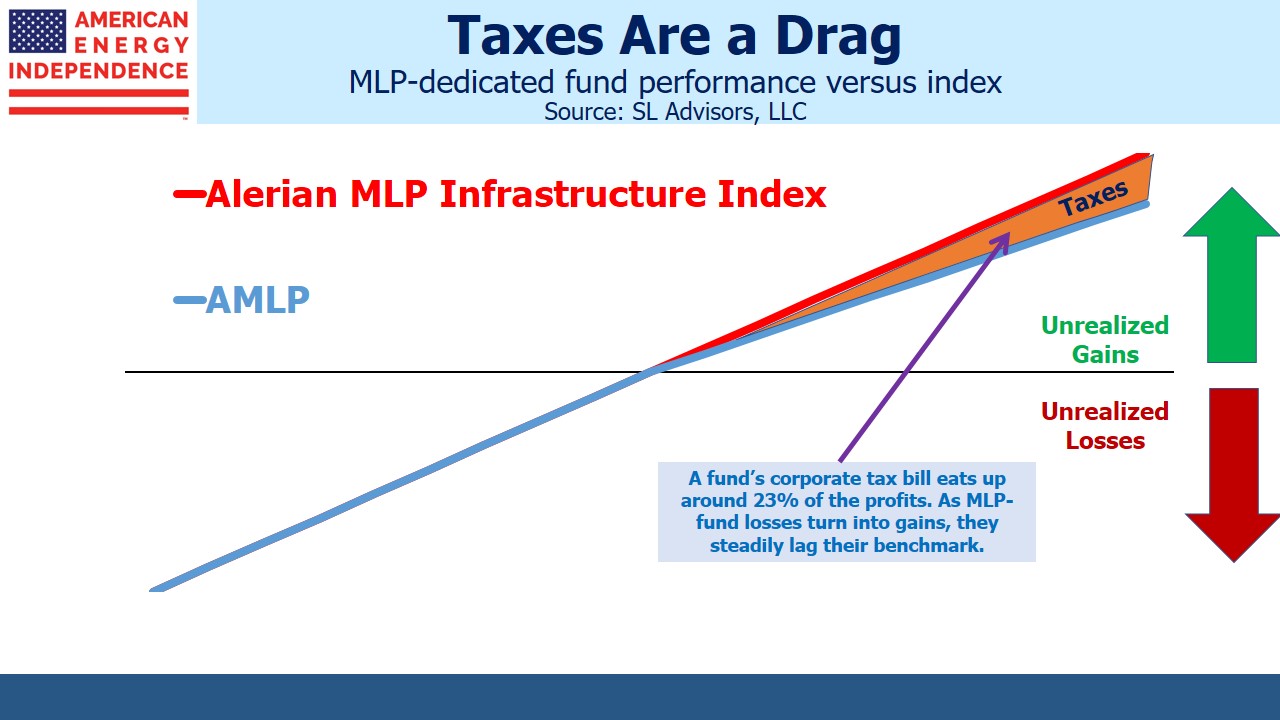

The Alerian MLP Index yields 7.3%, although it’s only accessible via structurally flawed MLP-dedicated funds that pay corporate tax (see The Tax Drag on MLP Funds). Because tax expense for such funds flows out of their NAV, in reality, the yield is lower. The energy infrastructure sector’s 5.5% yield is accessible through conventional, RIC-compliant funds with no tax drag. Corporations have managed their cashflows, including payouts, far more reliably than have MLPs. Moreover, those lower payouts have meant more retained earnings to be reinvested back into their businesses. This is what will drive the 10% annual dividend growth we expect 2017-19, a level MLPs failed to achieve even in the boom years leading up to the 2014-15 collapse.

As the second chart shows, when payouts are cut less in the short run, they grow faster over the long run. Energy infrastructure is a growth business that offers attractive yields. Investors who favor companies with a reliable history of dividends are likely to fare better.

We are short AMLP.

Presumably when Energy Transfer Partners (ETP) announces earnings next week they’ll be good. That was the clear message in the attention grabbing combination of ETP with its General Partner (GP), Energy Transfer Equity (ETE). The 1.28 exchange ratio represented an 11% premium but also a 30% distribution cut for ETP investors, given ETE’s lower payout. The new company anticipates coverage of 1.6X-1.9X by 4Q18, a Distributable CashFlow (DCF) yield of 11.5% based on its current price.

Presumably when Energy Transfer Partners (ETP) announces earnings next week they’ll be good. That was the clear message in the attention grabbing combination of ETP with its General Partner (GP), Energy Transfer Equity (ETE). The 1.28 exchange ratio represented an 11% premium but also a 30% distribution cut for ETP investors, given ETE’s lower payout. The new company anticipates coverage of 1.6X-1.9X by 4Q18, a Distributable CashFlow (DCF) yield of 11.5% based on its current price.