Later this month John Wiley will release Bonds Are Not Forever; The Crisis Facing Fixed Income Investors. Some might say that one book is enough for anybody to write, but I must confess the experience following release of The Hedge Fund Mirage in late 2011 was sufficiently positive that I decided to indulge my audience’s patience once more. Recent sales and media coverage related to The Hedge Fund Mirage have no doubt been supported by continued mediocre hedge fund returns delivered at great expense. The industry remains a soft target.

Bonds are harder to criticize. For one thing, bond investors really have done well for a very long time. There is no “Bond Mirage” to be written. Bill Gross may have had a hand in more wealth creation for clients than anybody. However, as comfortable as it is to invest in what’s been working well, the math of current yields represents a substantial constraint on anything like past performance repeating itself.

Bonds are harder to criticize. For one thing, bond investors really have done well for a very long time. There is no “Bond Mirage” to be written. Bill Gross may have had a hand in more wealth creation for clients than anybody. However, as comfortable as it is to invest in what’s been working well, the math of current yields represents a substantial constraint on anything like past performance repeating itself.

The most important step to getting a book published is a business plan which should include an assessment of other books on the topic. Although ruinously low interest rates are a topic on which millions of savers can quickly commiserate, Amazon’s offerings of bond books are heavily biased towards telling you how to buy bonds and which ones. The view that fixed income deserves a radically small portion of an investor’s assets is not one that has many proponents. As with hedge funds, much of the continuing support for owning bonds comes from those with a self-interest to maintain. In the last few months we have come across some extraordinarily poor advice.

One large firm acknowledged the poor return prospects in fixed income but still valued their diversification qualities (i.e. they’ll lose money when your other investments are profitable, which is supposed to be helpful). Another published a chart showing the uncannily strong relationship between the yield on ten year treasuries and the subsequent ten year holding period return (yes, really!). The author of that particular insight probably also marvels at just how reliably bond yields rise when prices fall (and vice-versa). Whether fixed income returns after taxes and inflation are modestly negative (the most likely outcome) or worse, the originators of the insights listed above will work hard to present the results to clients positively. They’ll need to avoid numbers though, because that’s unlikely to help. Adjectives such as “decent”, “acceptable under the circumstances” or “OK” will be favored over more measurable assessments.

One friend showed us a taxable trust for which she’s the beneficiary that retains a substantial fixed income holding yielding 1.5% — coincidentally the same as the management fee charged by the trust company (pun intended). The U.S. Treasury and managers of the trust are both doing well out of this arrangement, although unfortunately my friend is not.

While there’s plenty wrong with low interest rates, the approximately thirty year bull market in bonds has coincided with two other evolutionary shifts. One is that debt outstanding has, by any measure, soared to levels that until recent years would have been believed unsustainable. When other significant public obligations such as Medicare and unfunded public pensions are included along with consumer debt we collectively owe more than twice the size of the U.S. economy. The second is the steady growth in financial services, including securities trading, money management and banking of all kinds. Since the peak in inflation in the early 1980s we have a substantially bigger banking sector and far more debt, but approximately unchanged median per capita GDP. In short, there’s not a lot to show for all this borrowed money and frantic trading.

How this all resolves itself is unclear, but the Federal Reserve sees ultra-low interest rates as part of the solution. Indeed there is so much debt and so many borrowers that providing a return above inflation would seem to be against the public interest, a needless waste of money. To the extent that the Fed, and by extension the U.S. government, can control it they’re likely to side with borrowers over lenders and maintain low rates. The evidence so far is that they can pursue such a strategy indefinitely. Inflation is a time-honored solution to excessive debt. Combined with financial repression, a regime of rates maintained artificially low, this can allow debt to be repaid at a negative real cost. Whether rates and inflation move up together or remain low together, yields below inflation plus taxes appear inevitable.

The growth in financial services supported the growth in debt, through financial engineering that sliced up obligations to meet every conceivable investor’s taste. Markets developed for derivatives of all kinds from interest rate to credit risk and complexity combined with leverage in a profitable waltz until the music stopped in 2008. Although the benefits of this bigger financial sector are hard to identify in the rest of the economy, banks were hardly to blame for the financial crisis. Government policies that subsidized debt and promoted overinvestment in housing were a significant factor. However, the aftermath which included the TARP program created a popular perception that Wall Street nearly blew up Main Street.

The public policy response against banking is well under way, justified by the imperative of avoiding a repeat. Under such circumstances it’s hard to imagine a return to the pre-2008 interest rate regimes that generally provided reasonable returns to lenders. A “better bargain for the middle class” for which President Obama recently called, probably excludes interest rates high enough to compensate lenders for inflation and taxes. Bonds Are Not Forever does not take political sides. Saving for the future transcends politics, and both blue and red investors need to coolly assess the populist shift in Washington’s policy response to banking.

The question facing bond investors is, how to respond to this steady transfer of real wealth from savers to borrowers. Three central banks (U.S. China and Japan) own almost $6 trillion of U.S. government debt and they remain significant buyers. In addition, by maintaining short term rates at virtually 0% the Fed keeps additional downward pressure on longer term rates. Their motivation is not commercial, but low benchmark rates tug most other rates down, limiting the opportunities for a commercially driven bond investor.

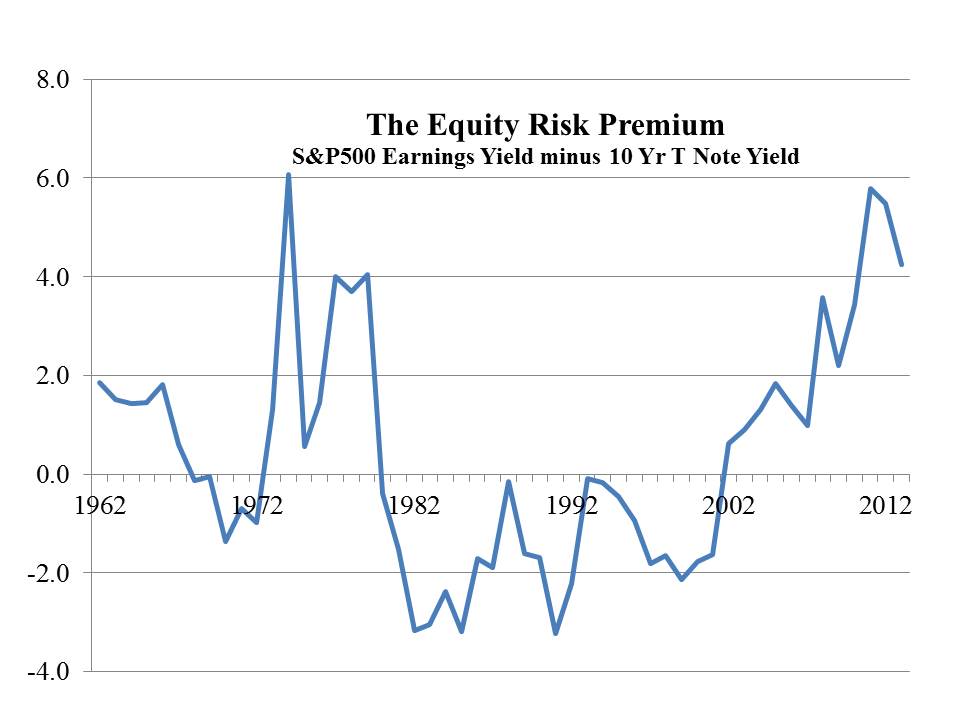

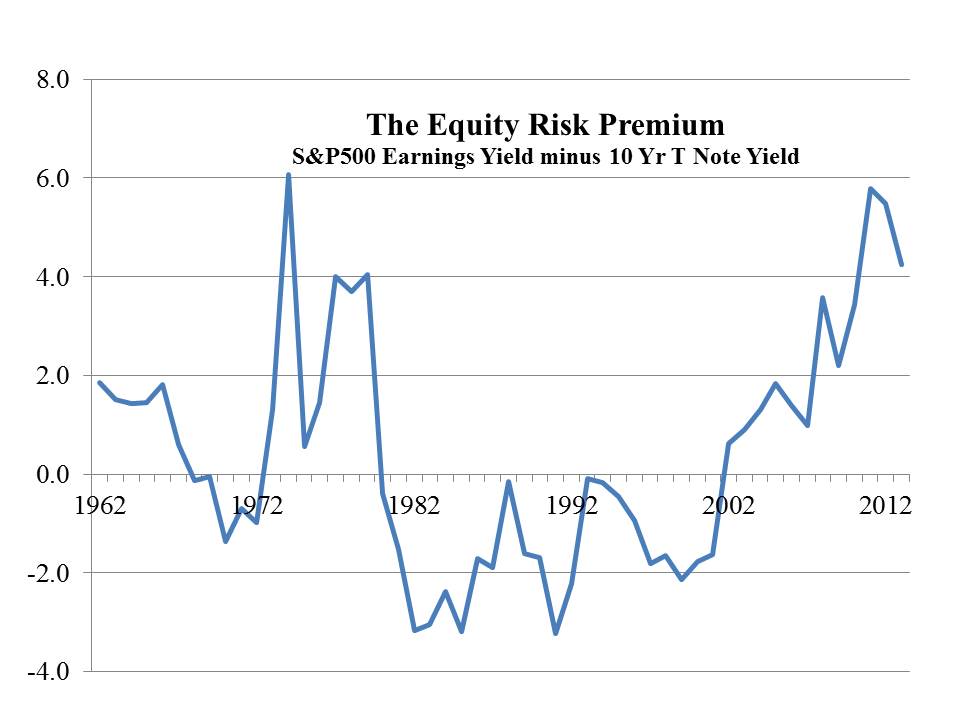

Hence, the radical advice to abandon the bond market as irretrievably distorted by government activity. If the Fed wants to own bonds so badly, let them own the lot! Take your ball and go elsewhere, to a place where the rules of private sector supply and demand still operate. The Equity Risk Premium, often reproduced on this blog, is a simple visual explanation of our bond-free investment philosophy at SL Advisors as well as the inspiration for the book. Bond yields are highly unattractive compared with the earnings yield on equities. The odds of bonds beating stocks over the long run are extremely poor. Meanwhile, the need for stable investment income is as strong as ever. Bonds Are Not Forever explains why investors should have low expectations for fixed income returns, and SL Advisors runs strategies designed to meet the need for stable investment income without using fixed income. Quite simply, the book explains the philosophy behind our investment business but also seeks to entertain the reader along the way. Clients of SL Advisors can expect to receive their autographed copy within a few weeks.