Carry Traders Get Carried Out

It looks like a big margin call started in Japan. The Japanese Yen has become a funding currency in recent years, a source of cheap financing with the proceeds reinvested in better returning assets – such as US$ listed AI stocks. Debtors benefit when the currency in which they’ve borrowed depreciates. The Yen offered low borrowing costs and a lower value – until it didn’t.

The proximate cause of the unwinding of this carry trade was the Bank of Japan’s modest 0.15% tightening last week. Friday’s weaker than expected US unemployment report was quickly interpreted as signaling a growth scare. The subsequent Friday-Monday sell off looks far more than is warranted by the data but has nonetheless triggered calls for a 0.50% cut in September, with another by December.

Perhaps big bank economists at JPMorgan and Goldman Sachs were sufficiently shocked by the carnage that they felt compelled to align their own revised forecasts with the market drama. Or maybe they expect the Fed will feel compelled to act on the market’s sudden swing from manic to depressive.

What hasn’t received much attention is that the market was far from cheap, a state that has steadily worsened during the year.

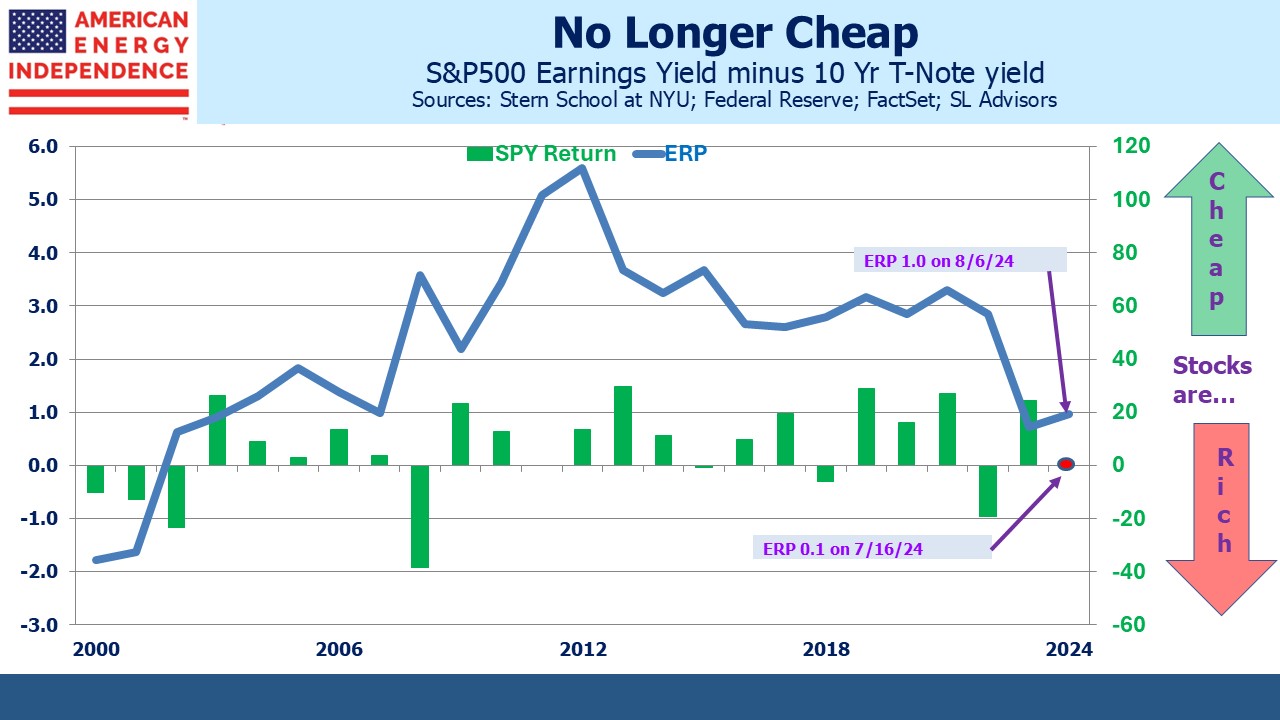

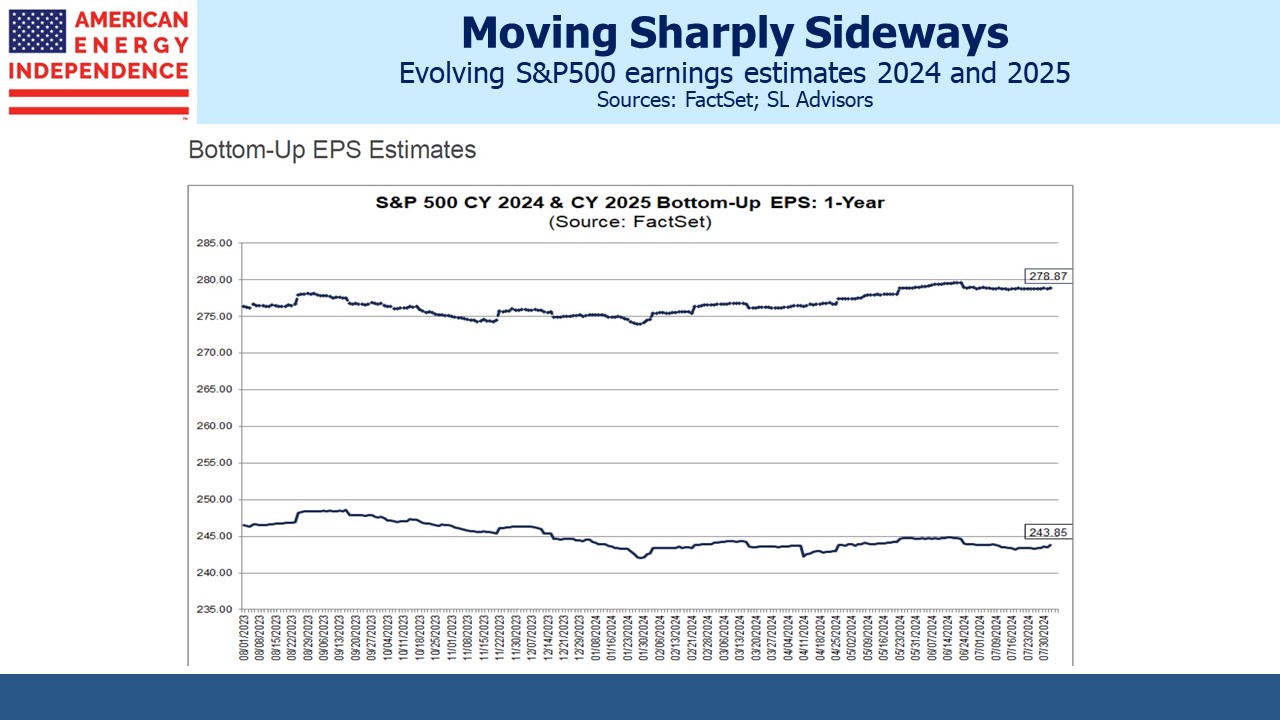

S&P500 earnings forecasts for this year and next have been trending sideways and are barely changed from a year ago. Stocks have risen largely on multiple expansion. The Equity Risk Premium (ERP, defined here as the S&P500 earnings yield minus the ten year treasury yield) slipped to 0.1 on July 16, when stocks made another high.

This is the lowest in over two decades, and essentially means that an investor eschewing bonds in favor of stocks with virtually no yield pick-up was fully relying on earnings growth to compensate for the increased risk.

Put another way, with forecasts of long term equity returns in the 6-8% range, riskless treasury bills yielding 5.3% look competitive.

The subsequent drop in equity prices and bond yields has improved relative value somewhat, but stocks remain historically unattractive on this measure. The great unwinding of the carry trade came, as these things usually do, at an inconvenient valuation point.

By now long-time readers are asking themselves when your blogger will explain what this means for energy stocks, especially midstream. Those long-time readers should know that the answer will soothe any concerns they might have about retaining pipeline stocks during a tempestuous market.

Start with leverage. Pipeline stocks have been paying down debt, such that large US c-corps and MLPs have Debt:EBITDA below 3.5X, in many cases on a path to 3.0X.

Dividends are comfortably within discretionary cashflow, covered by around 2X. 2Q earnings so far have been good. Targa Resources and Plains All American both raised FY guidance. Williams reaffirmed towards the high end of their 2024 range. Oneok reported good earnings. Two weeks ago Kinder Morgan provided an encouraging update on AI-driven natural gas demand.

It’s become normal for midstream earnings to meet or gently exceed expectations, and for Cheniere to do rather better.

Over the past decade US primary energy consumption has grown at 0.6% pa. Apart from during the pandemic and subsequent rebound, year-on-year changes are 1-2% or less. Commodity prices may gyrate wildly, but volumes are remarkably stable.

The outlook for natural gas demand continues to improve. The combination of AI and increased reliance on intermittent renewables means more natural gas – both because solar and wind can’t easily provide electricity with low harmonic distortions that delicate data center kit needs – but also because as unreliable power sources infiltrate the grid, assuring 24X7 supply relies ever more on dispatchable, traditional energy. Which is gas.

The unraveling of the Yen carry trade hasn’t changed any of this. Nor has midstream been a notable beneficiary of the leveraged speculator’s buying, meaning there’s little if anything to unwind.

Over the long run stocks are far more likely than bonds to preserve purchasing power. This is especially so if inflation eventually settles closer to 3% than the Fed’s 2% target. But the ERP relative valuation suggests little need for haste in committing cash. The exception is energy, where we believe the prospects are compelling.

As a reminder of the challenges in making money from renewables, Sunpower (SPWR), once a venerated solar power company with a $9BN market cap, filed for bankruptcy. Pipeline companies keep generating cash and are benefiting from energy transition subsidies from the Inflation Reduction Act.

If you have cash ready to commit, we think now is a good time to put some of it to work in midstream.

We have three have funds that seek to profit from this environment: