Filling Up

| “Yes, but are the pipes full?”

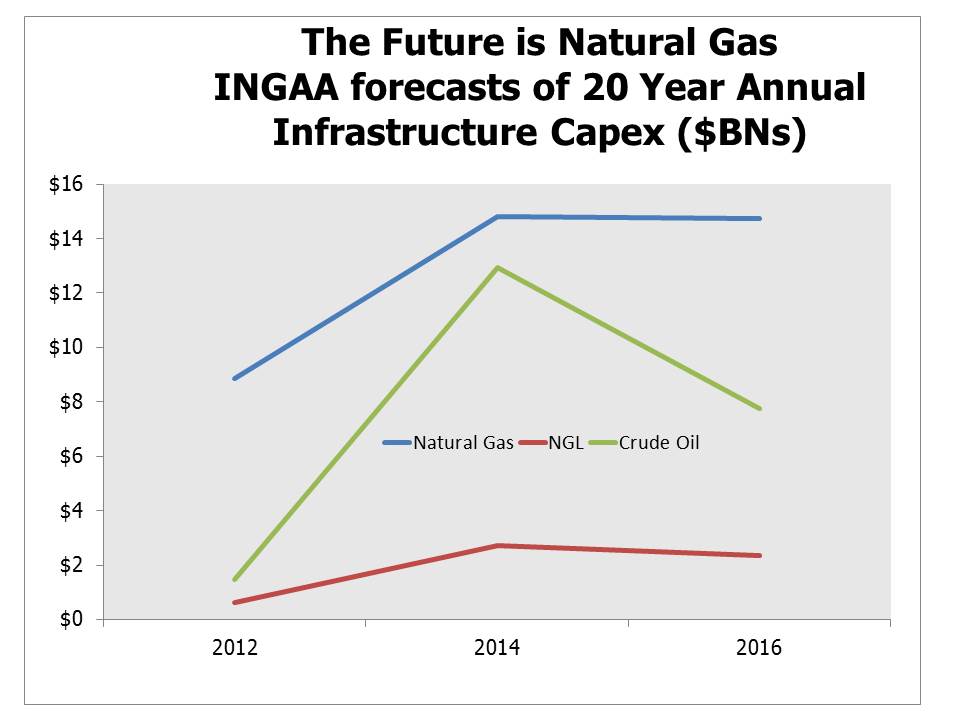

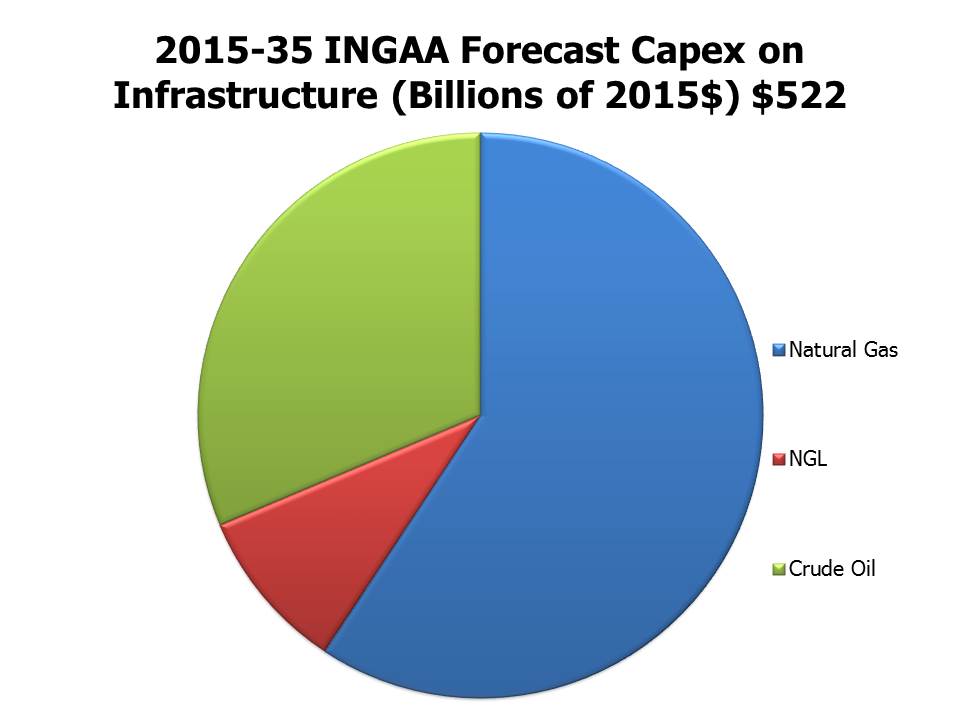

This was the pointed and entirely reasonable question of one investor several weeks ago after hearing that the energy infrastructure sector offered compelling value. It cuts directly to the crux of the issue. You can discuss the sanctity of contracts, stability of cashflows, limited commodity exposure and yet the most fundamental metric about any toll-based business model is how much of its capacity is being used. If you own a bridge you care little about the price of cars but are happy to see heavy traffic passing through your tollbooths. While Master Limited Partnerships (MLPs) never claimed immunity to falling oil and gas prices, high utilization of their assets is unambiguously good. It would be nice if there was a heat-map of all the pipelines in North America that showed their utilization with different colors. Sadly, no such scoreboard exists and so the view has to be assembled piece by piece. Earnings reports from individual MLPs provide a contemporaneous picture of utilization. Some first quarter reports have already been released and the signs are generally good. NuStar (NS) noted increasing demand for their Eagle Ford pipeline assets which was surprising given weakening output in that play. Noted shale driller Pioneer Natural Resources (PXD) reported higher than expected crude production with continued declining costs. Some of their horizontal wells extend over 10,000 feet laterally, improving productivity. They now expect production costs in 2016 of $9-11 per barrel of oil equivalent (BOE). In 1Q16 these costs were down 20% on the prior year’s first quarter. They report some wells have operating costs as low as $5-$7 per BOE. The clearest indication that existing infrastructure is being used is the need for more. For long term supply/demand, a good place to start is with the INGAA Foundation which periodically publishes their view on natural gas, natural gas liquids (NGLs) and crude oil and their corresponding infrastructure requirements. If the pipes/storage facilities/fractionators etc. are generally not fully utilized, the need for new infrastructure will be reduced. INGAA recently published an updated long term outlook. It’s instructive to link their 2012 and 2014 forecasts with their current one. Forecasting the supply and demand for natural gas, NGLs and crude oil over twenty years is by no means an exact science. Key inputs include economic growth in the U.S. and elsewhere, government policy regarding carbon emissions and, not least, the prices of the underlying hydrocarbons themselves. Like some Exploration and Production (E&P) companies, INGAA found itself swept up in the promise of the shale revolution. From 2012 to 2014 their estimate of new crude oil infrastructure investment jumped by a factor of eight, only to be slashed by 40% in response to the collapse in crude prices. INGAA’s current forecast of $7.8BN in annual crude oil-related capex is no more likely to be accurate than in the past, heavily dependent as it is on the future price of oil. In 2014 they based their $12.9BN (annual capex figures are all inflation-adjusted to 2016) forecast of annual capex over 20 years on $100 per barrel, and now they’re forecasting an eventual move to $75 by 2025 (the High Case) or by 2030 (the Low Case). Predicting the price of oil is hard. Although some commentators have claimed the U.S. is the swing oil producer with the ability to quickly ramp up production, PXD’s CEO Scott Sheffield highlighted that although their rig crews could bring a well online in 4-5 months, it would take the U.S industry two years to meaningfully increase production back up, due to a current focus on bringing down leverage as well as the time it takes to rehire and train workers. While the futures market lets you lock in the prices shown for a year or two, futures are a poor forecast of where the market will actually be. The spot price combined with the costs of storage, impacted somewhat by hedging activity, set the futures price. And yet today’s spot price pays little heed to the approximately $350BN of reduced capex by E&P companies globally, the approximately 5% annual depletion of today’s aggregate sources of production, the 1.5MM bbls/day of annual demand growth, or that global spare capacity is near the lowest levels in history. By contrast with the unpredictability of crude oil prices and the related infrastructure need, the outlook for natural gas has been remarkably stable. INGAA raised their expectations in 2014 and kept them unchanged in 2016. Beneath the figures though there are some substantial shifts. The north east U.S. is becoming a prolific regional exporter of natural gas, which is creating more demand for take-away capacity as well as causing the reversal of transmission pipelines to run from the north east rather than towards. Insufficient takeaway capacity in the Marcellus has hurt producers[1]. Liquid Natural Gas (LNG) exports via seaborne tankers are a growing source of demand, as are exports via pipeline to Mexico. Canadian bitumen-based crude oil production (‘tar-sands’) uses natural gas to heat the bitumen to a semi-liquid state. The long lead times for such projects assure that Canadian crude production will increase. INGAA went with a High and Low Case forecast in their 2016 release (figures above are based on the midpoint between the two). U.S. energy infrastructure is much more about natural gas and NGLs, with only 7% of pipelines being dedicated to crude oil. Infrastructure doesn’t get built without customers being signed up. Kinder Morgan (KMI) recently shelved their North East Direct (NED) plan to expand natural gas supply and storage to New England because they could only achieve a projected 6% return. A mild winter caused memories of $40 natural gas to fade in Boston (versus $2-$4 per MCF more commonly). While the project would have contributed to growing earnings at KMI, its cancellation shows why natural gas pipelines don’t normally sit unused. We are invested in KMI.

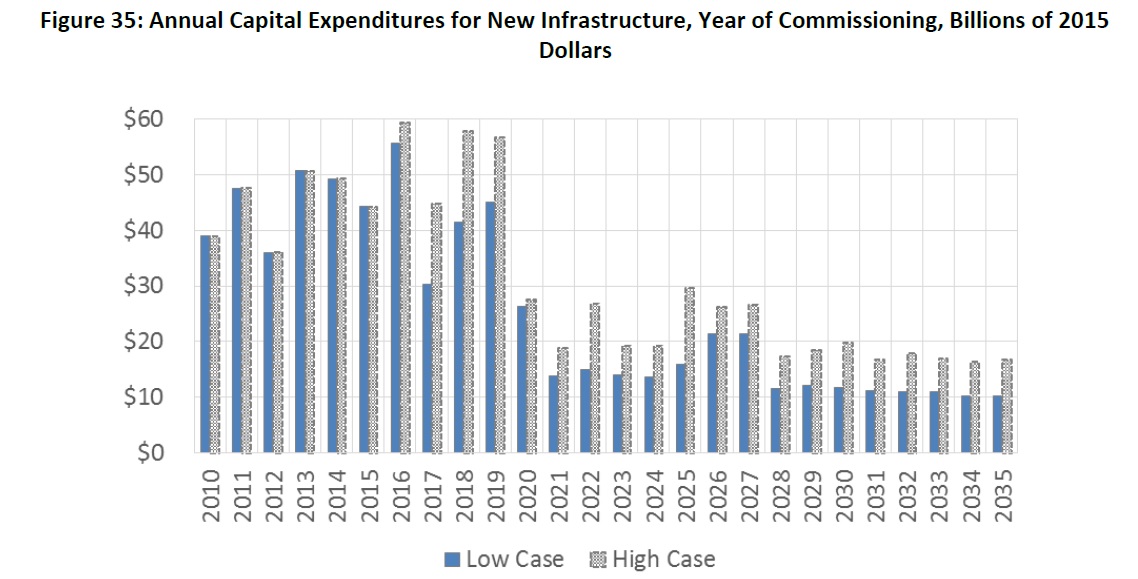

As the chart (from INGAA) showing annual capital expenditure highlights, a good portion of the infrastructure spend is set to occur within the next few years. Many of these projects are already under construction since the data is presented based on the year that a project is completed; a good portion of the capex will have occurred in prior years. In spite of last year’s MLP collapse, expected U.S. natural gas and NGL output didn’t change much; America’s energy infrastructure continues to be augmented. Moreover, a good part of the spending is occurring over just a few years. As this grows the asset base of MLPs, it will highlight the substantial advantages enjoyed by MLP General Partners (GPs), for at times of asset growth the MLP GP looks like a hedge fund manager. Our investing strategies and fund are designed to exploit this. |

[1] North American Midstream Infrastructure Through 2035: Leaning into the Headwinds. INGAA, Pg 36