BP Decides To Follow The Money

Some may find irony in BP dropping its goal of reduced oil and gas output by 2030 at the same time as Hurricane Milton is barreling towards southwest Florida – the second hurricane in two weeks.

Four years ago, BP pledged to cut hydrocarbon output by 40% within a decade. Two years ago they scaled it back to 25%. And now they’ve acknowledged reality because it’s easier to make money in traditional energy than in renewables.

Climate extremists will point to the millions in Florida preparing for another storm and the recent devastating losses caused all the way up to North Carolina as evidence of climate crisis. No one weather event can be attributed to a changing climate, but the Gulf of Mexico is a little warmer than normal. Naples, FL where we own a home endured a storm surge in 2017 (Irma), 2022 (Ian) and may get a second of the season as Milton follows Helene.

Higher CO2 levels may be the cause – certainty for or against is illogical because climate is so complicated, but the evidence for is mounting. In Pakistan the rational response to heatwave deaths this past summer is to spend more on air conditioning. In Naples we’ll invest in making our property more resilient to storm surges. Confronting the consequences of a changing climate is demanding an immediate response. This requires more steel, cement and plastic, three of Vaclav Smil’s four pillars of civilization, along with more energy.

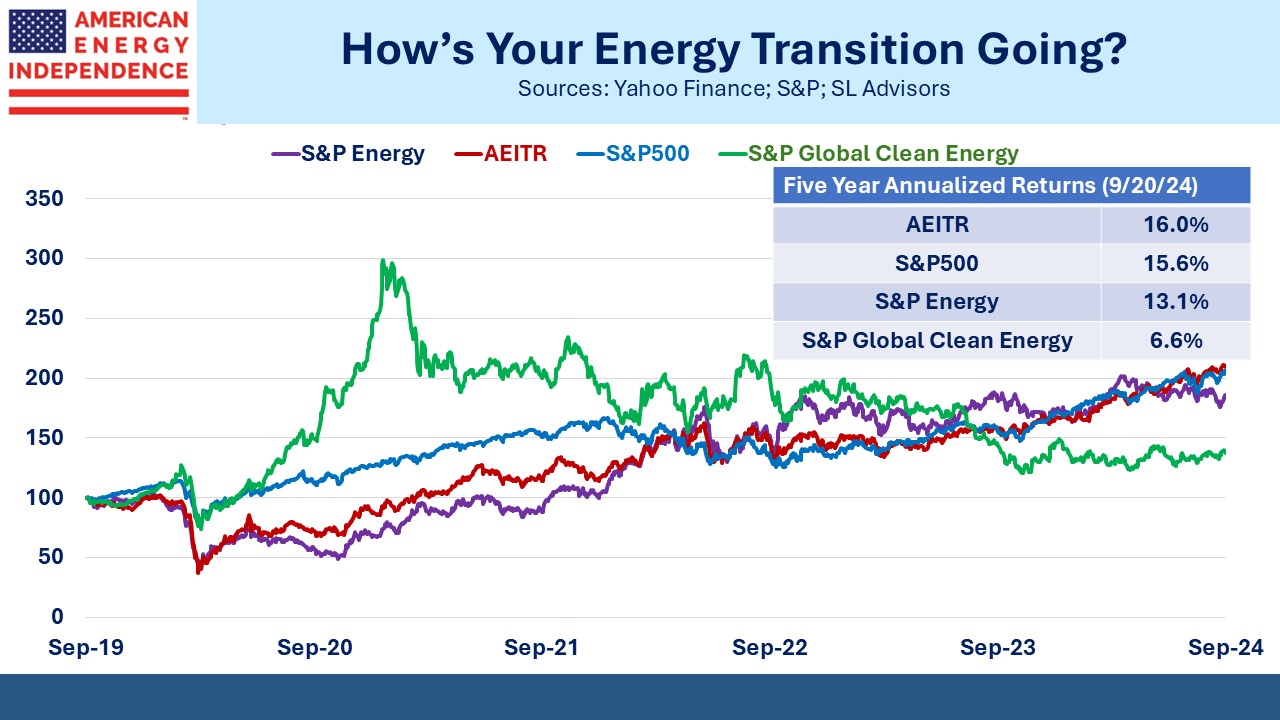

What’s clear is that left wing policy prescriptions to slow CO2 emissions are failing to make an impact, because they ignore the desire of developing economies to raise living standards, which requires energy. Solar and wind are a marginal solution, as they have been in the US as well.

History will show that a credible effort by OECD countries to reduce emissions was overwhelmed by the desire for higher incomes and more energy consumption across developing Asia, Africa and South America.

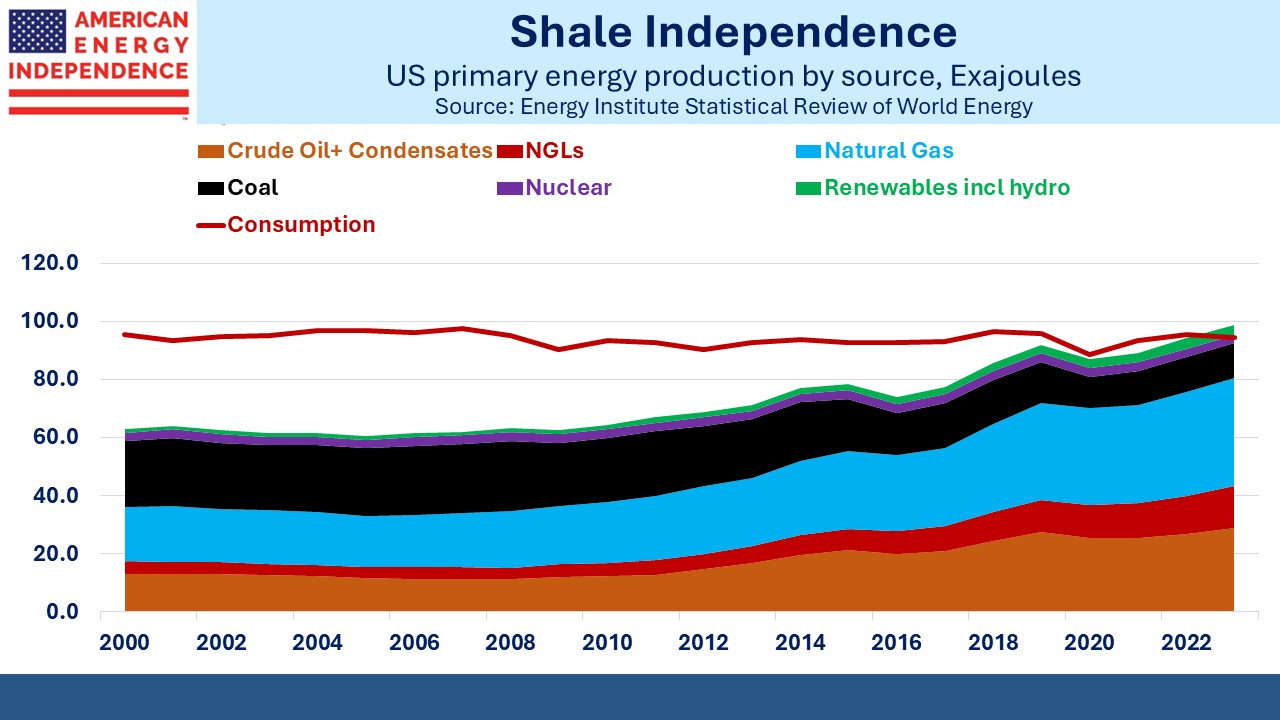

Since 2000, renewables including hydro have gone from 2.0% of US primary energy to 3.5% last year. Natural gas has gone from 30% to 38%. BP’s languishing stock price shows that they’ve discovered how to make a small fortune investing in renewables – start with a big one.

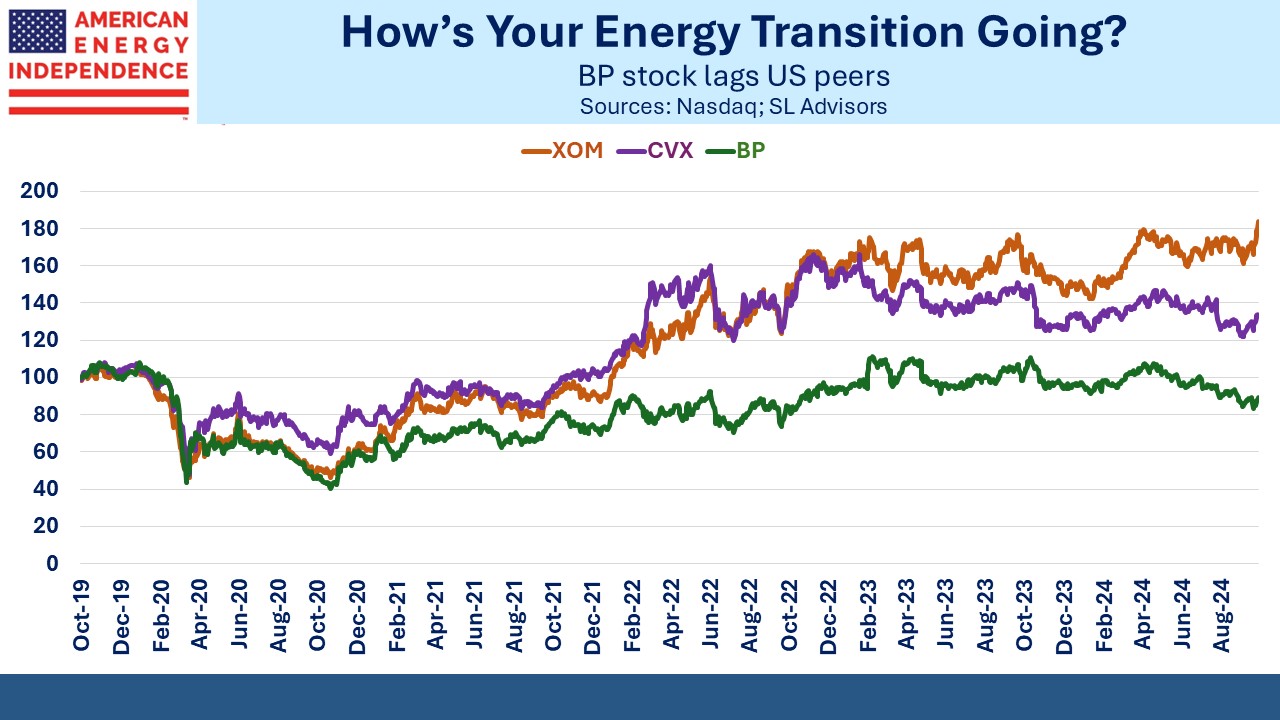

BP’s stock has lagged US peers Exxon Mobil and Chevron who never accepted that the world would quit using hydrocarbons. The transition to low carbon energy systems will be slow, needs to acknowledge that energy demand will grow and that solar and wind are an expensive, small element of the solution.

Public opinion is souring on the false promises of climate extremists that renewables are cheap and create jobs. The leader of Canada’s Conservatives Pierre Poilievre, likely to be Canada’s next prime minister based on opinion polls, has vowed to repeal the carbon tax that is intended to guide consumers towards low-carbon choices. He calls it, “an existential threat to our economy and our way of life.”

Neither Kamala Harris nor Donald Trump are saying much on climate change. There’s still no serious effort to help developing countries shift from coal to gas as the US has done. This remains the most obvious solution and as investors in natural gas infrastructure we’re positioned for it.

Things have turned out well for investors who understand these trends, such as U-Vest Financial, a fast-growing firm led by CEO Mike Davino based in Tallahassee, FL. Last week I was invited back to their annual meeting to discuss midstream and the energy transition. They identified the opportunity early in the cycle, to the benefit of their clients.

Each year it’s exciting to see the growth at U-Vest and the dedication their leadership team brings to the business. U-Vest is expanding because of its results but also because they’re adding advisors. If you’d like to join your practice with a dynamic team, reach out to me and I’d be happy to make an introduction.

Or you can click on this link.

BP is just one example of a growing realization that economics and public opinion aren’t with the Sierra Club and other climate extremists. Pragmatic choices are one result. The White House is backing more nuclear power. Constellation Energy hopes to restart a unit at Three Mile Island, although not the same unit that partially melted down in 1979. Microsoft is the potential customer. Holtec’s Palisades nuclear plant in Michigan is also planning to restart. Demand growth from data centers is driving this.

US natural gas is also benefiting, because it compensates for intermittent power and is abundant. BP has decided to stop paddling upstream. Others will follow.

We have two have funds that seek to profit from this environment: