Bond Rally Boosts Pipelines

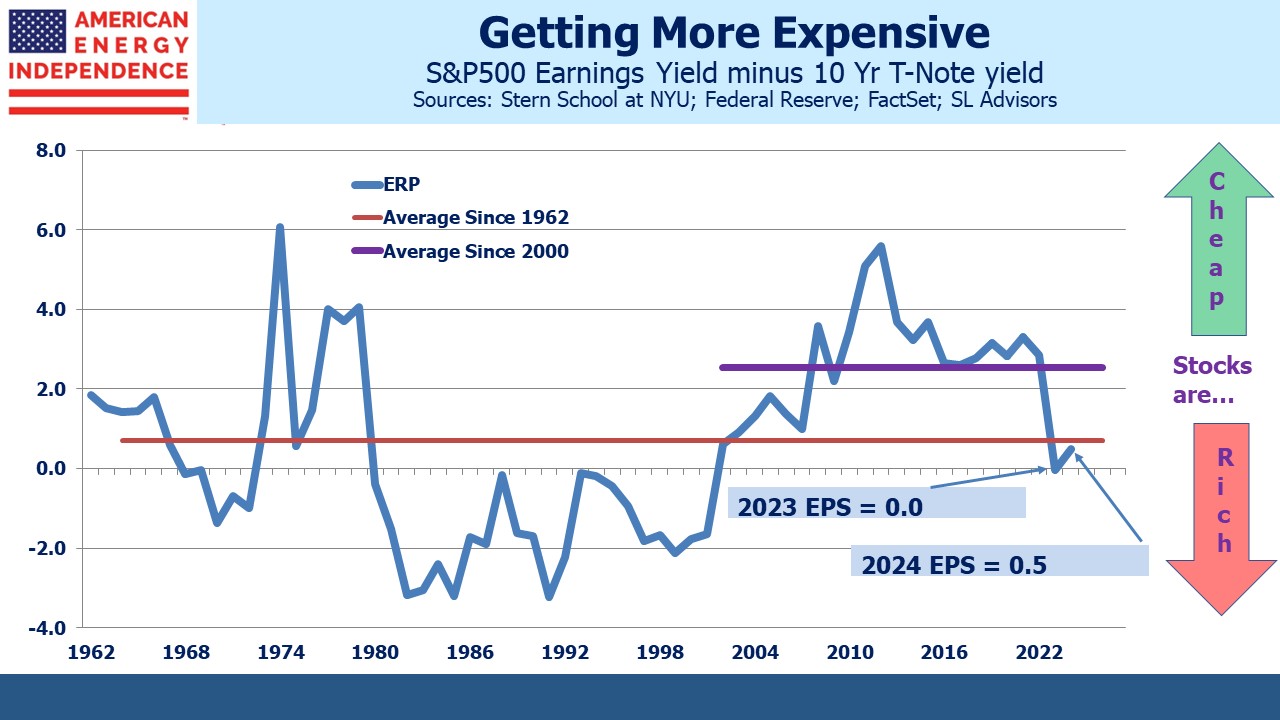

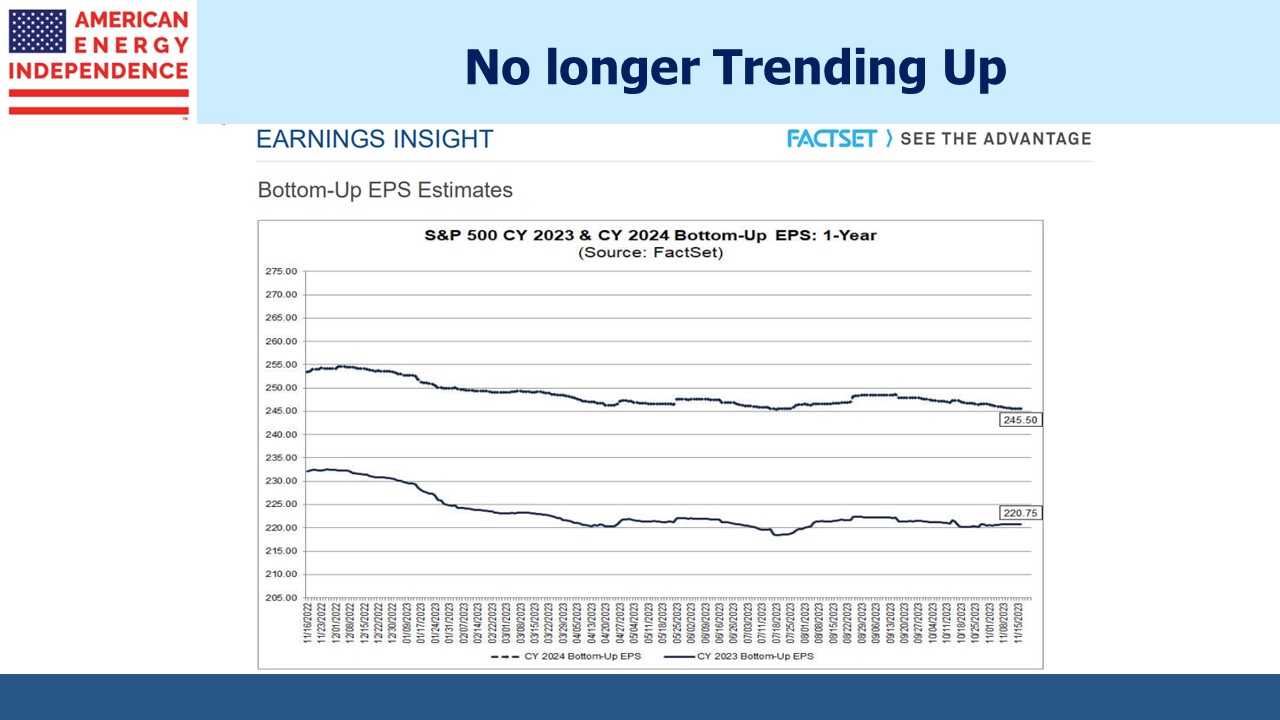

Bonds had a great month in November. The Bloomberg Agg was +4.5%. Ten year yields dropped 50 bps. Indications that the Fed will pause again were extrapolated into easing expectations as soon as next quarter. Lower yields help the relative valuation of equities, although Factset earnings forecasts are no longer trending upwards. Consequently, the rally in stocks in November offset the improved relative pricing created by lower bond yields. The Equity Risk Premium (ERP) continues to suggest that there’s little need to rush into stocks. It’s now below the average since 1962 and substantially below the average of the past two decades. Fixed income is becoming competitive once more.

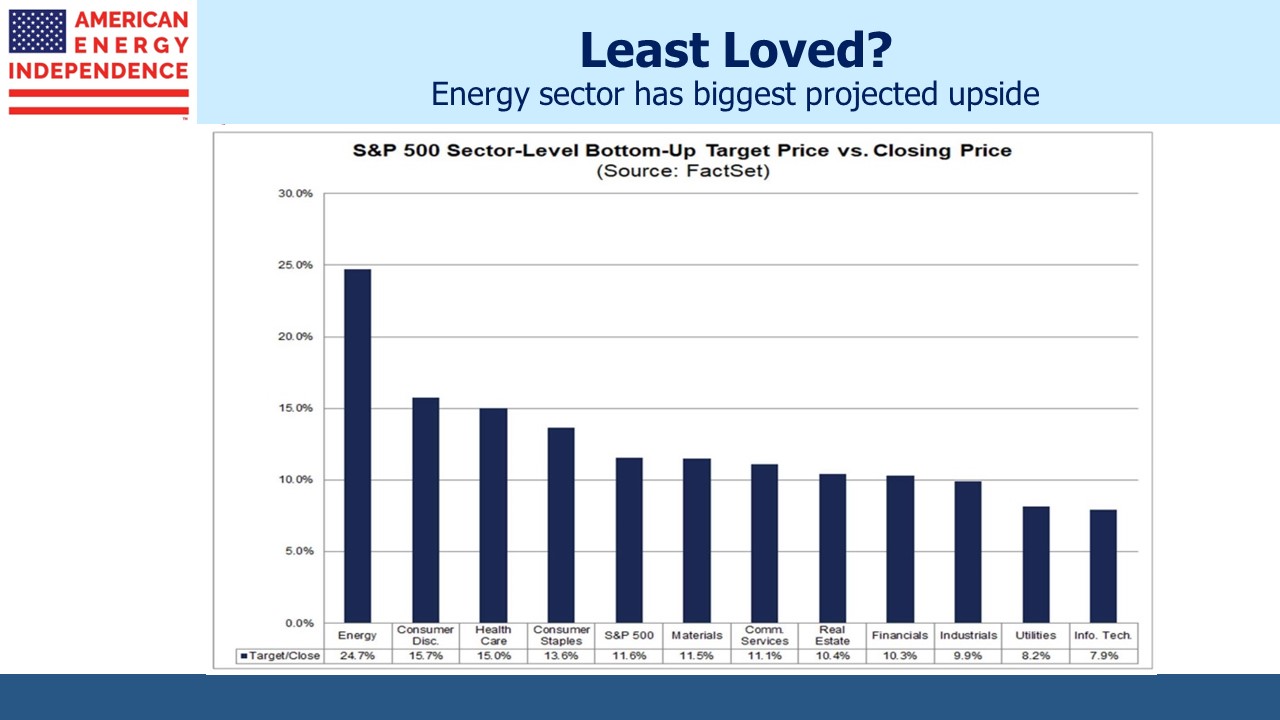

The interplay of price and earnings forecasts leaves the energy sector with the most upside according to analyst forecasts, a position it’s held for much of this year. Midstream energy infrastructure yields of 6-8% are attractive. Nonetheless, we’ve often been challenged on this by financial advisors noting that riskless three month t-bills yielding 5.4% seem better.

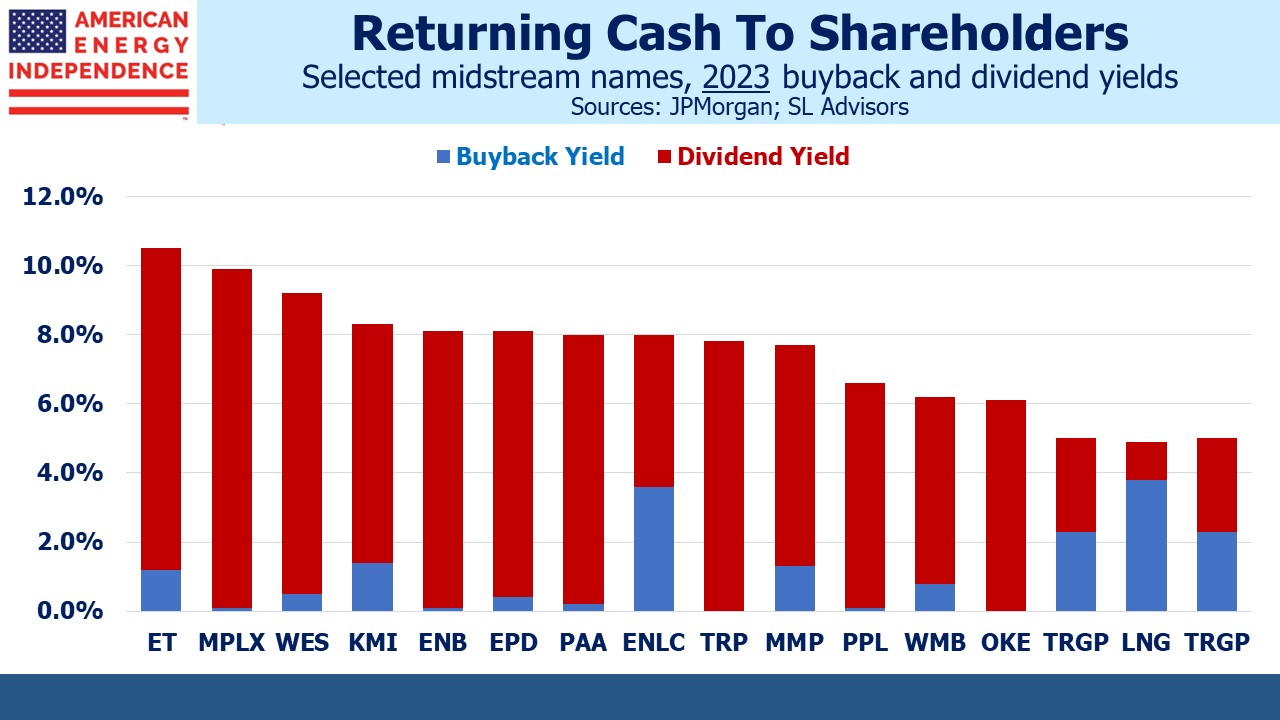

The obvious response is that t-bill yields may fall – the rally in bonds shows the market expects as much within the next couple of quarters. Pipeline dividends are unlikely to fall – JPMorgan is forecasting median dividend increases of 5-7% for large cap US midstream corporations and MLPs. They expect more modest 3% growth for Canadians (Enbridge just raised their payout 3.1%). But their yields are higher.

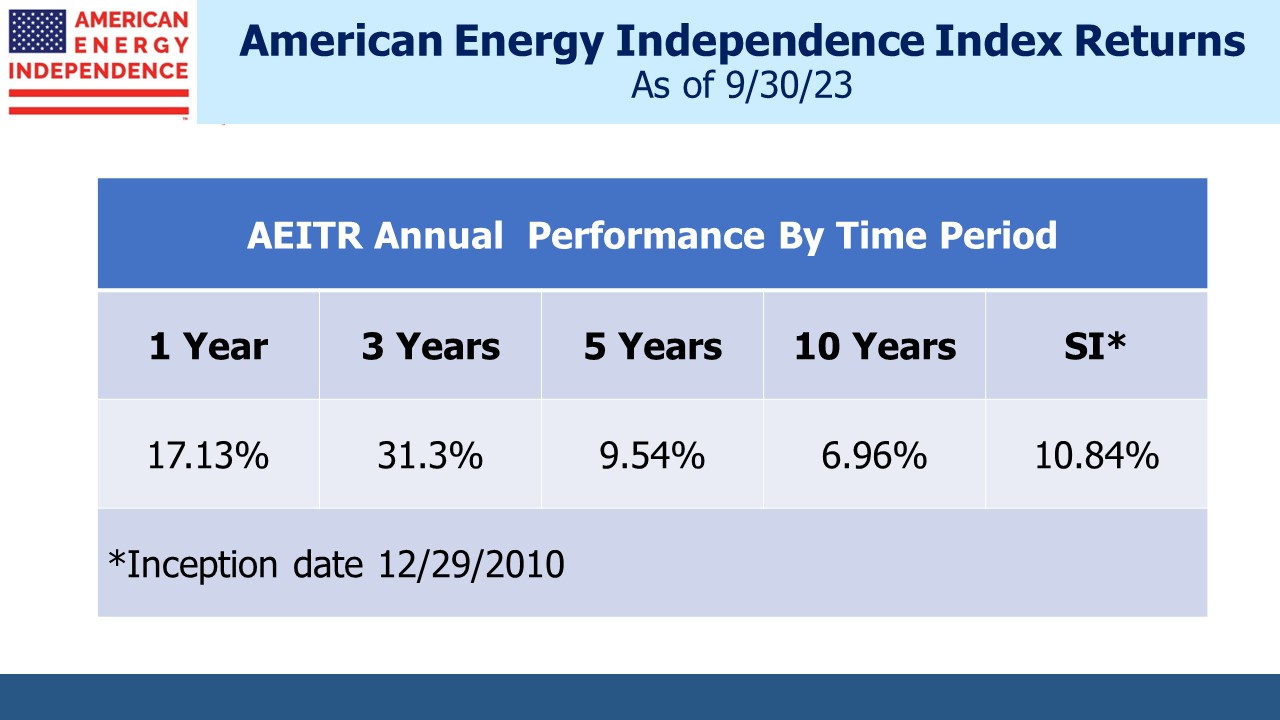

Falling yields without a recession may be the most positive environment for this sector. Investors searching for income should increasingly be drawn to investment grade names with dividend yields above treasuries and the ability to raise them as well as repurchase shares. The American Energy Independence Index returned +8.1% in November, bringing its YTD return to +15.9%.

We’ve also fielded questions on the impact on natural gas of Israel’s invasion of Gaza in response to the October terrorist attack by Hamas. It’s understandable given that Russia’s invasion of Ukraine last year sent European gas prices skyrocketing. This created profitable opportunities for US LNG shippers such as Cheniere to arbitrage between cheap domestic prices and Germany’s need to replace Russian supplies.

By contrast, offshore natural gas production in the eastern Mediterranean has continued although it was briefly halted by the Israeli government at the outset of hostilities. Israel has one Floating Storage and Regasification Unit (FSRU) six miles offshore. Last year Germany scrambled to lease most of the world’s available FSRU’s so they could import LNG. Until then they had none. But there’s been no disruption to Israel’s gas supply.

More meaningful to Israel’s ability to supply it armed forces is crude oil, 60% of which comes from Kazakhstan and Azerbaijan. These two Muslim countries have shown little inclination to curb supplies out of solidarity with the Palestinians. In any event, other producers would surely step in if needed, including the US.

The outlook for global natural gas demand remains constructive. Cambodia just canceled a planned coal-burning power plant and intends to substitute with natural gas power supported by LNG imports, a first for the country.

Cheniere continues to sign long term LNG contracts. They minimize commodity risk, providing gas at whatever is the prevailing US market price and concentrating their economics on charging for liquefaction services. But last week they agreed to provide LNG to Austria’s OMV at a price linked to the European TTF benchmark. If you’re wondering how LNG tankers reach land-locked Austria, the answer is that OMV operates an LNG terminal in Rotterdam. Canada’s ARC Resources will supply the natural gas, also at a price linked to the TTF which will limit Cheniere’s risk.

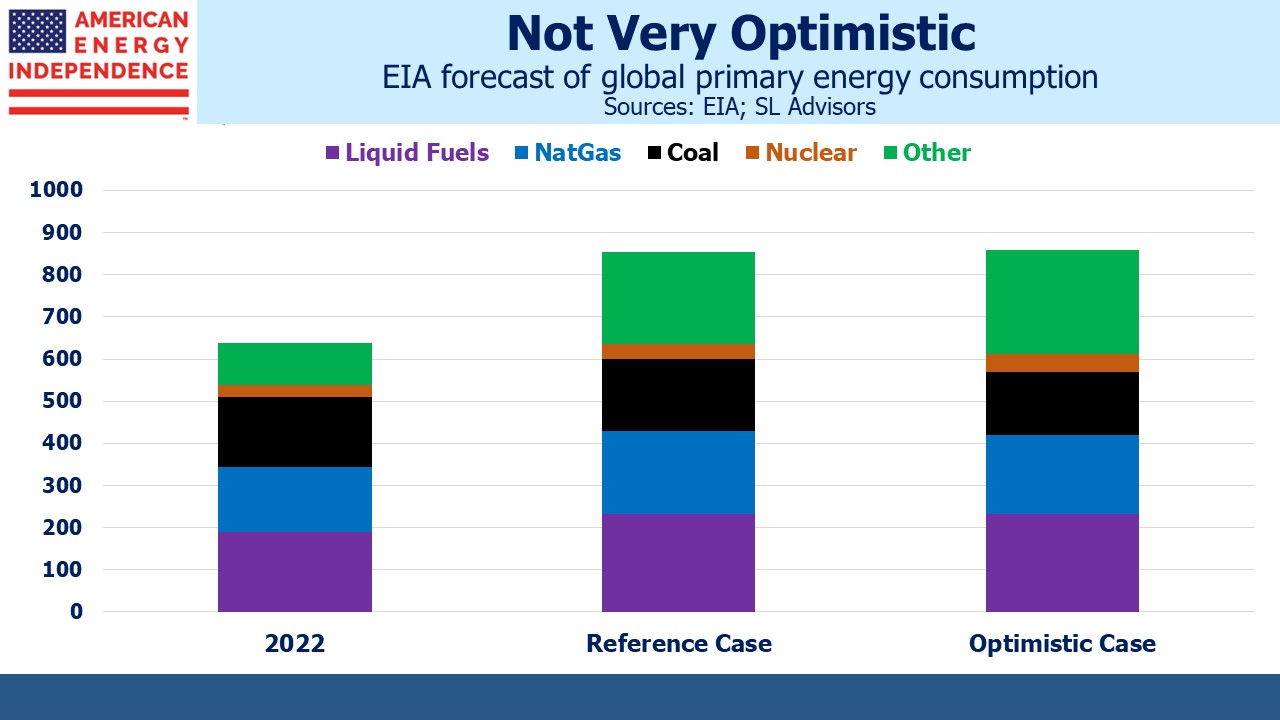

Attendees at the COP28 climate conference reading the EIA’s Today in Energy last Thursday will be dismayed to learn that global CO2 emissions from coal, oil and natural gas are all likely to be higher by 2050 in spite of the UN’s goal that they reach zero. This is based on existing policies and represents a base case. But in their 2023 International Energy Outlook, even the most optimistic scenario which they call the Low Zero-carbon Technology Cost Case, fossil fuels represent 66% of primary energy. Today it’s 80%, and the Reference Case assumes 70%. While the EIA expects growth in renewables like every serious forecaster, fossil fuels will need to grow as well to meet higher overall energy consumption. CO2 emissions in the optimistic case are still higher by 2050, at 38 Billion Metric Tonnes (GigaTonnes, or GTs), versus 41GTs in their base case and 35.7GTs today.

Part of the problem is that consumers are balking at the cost of the energy transition. Unsold electric vehicles sitting on dealer lots and multi-billion-euro losses on wind turbines are examples. Democrat political leaders starting with Biden have emphasized jobs, but it’s becoming increasingly clear, as it always was to us, that reducing CO2 emissions is worthwhile but also very expensive.

We have three have funds that seek to profit from this environment: