Kinder Morgan Isn't Greek

Over the past week we’ve witnessed a negotiation of monumental incompetence. Greece’s Prime Minister Alexis Tsipras successfully won a referendum rejecting bailout terms that were no longer on offer, presided over the subsequent freezing up of the economy as the banks were forced to close and finally agreed to worse terms than he and Greek voters had only just rejected. In most countries Tsipras would have been thrown out of office; in some he would have been overthrown by the military and imprisoned or worse. In Greece, the poor population is so punch-drunk from their economic depression they can barely grasp how poorly they’ve been led. It’s provided somewhat macabre viewing as the current crisis is resolved while setting the stage for the next one. As much as we may criticize our own elected leaders, the depths of governmental ineptitude can extend farther than most of us imagined elsewhere.

Greece has been a factor affecting financial markets of late, as have the negotiations with Iran over its nuclear program and the popping of the Chinese equity market bubble. It has most certainly been a period of macro concerns, with little fundamental news until recently to aid investors. Greece has been resolved as far as its ability to cause a financial shock; the deal with Iran looks as if it will lead to more oil supply while hopefully making the world marginally safer. Chinese equities continue to gyrate unpredictably. So it is that with two of these three concerns resolved for now in their market impact, investors can turn to corporate earnings to obtain a bottom-up view of their investments, having seen them buffeted of late by top-down developments.

Kinder Morgan (KMI) released their 2Q15 earnings on Wednesday. If you look through one of their investor presentations from six months ago, there’s not much difference between what they were saying in January and what they said on their earnings call. Earlier this year they projected dividends of $2 for 2015, and last week announced a 2Q15 quarterly dividend of $0.49, on track for $2. The company continues to target 10% annual dividend growth through 2020 which, when you stop to consider for a moment, is an uncommonly long forecast period that few companies match. Their backlog of projects also grew from $18.3BN in the prior quarter to $22.0BN, led by a $3.3BN planned investment in the North East Direct project (NED).

NED will eventually reduce the pipeline congestion that restricts the flow of natural gas to New England in the winter, something we wrote about in February (see Why Boston Pays High Prices For Electricity), thereby making greater use of domestic output in the Marcellus and Utica shale. Events in Greece, Iran and China don’t have much bearing on this project, but it’s investments like this one and many others that are expected to provide the growth in earnings to support KMI’s projected 10% dividend growth.

At its current stock price of $36.89, its $2 projected 2015 dividend yields 5.4%. It’s rarely wise to assume that sellers are anything other than intelligent, and certainly those who sold KMI at the time of their last earnings release in April when the stock was above $43 made a good trade, benefiting from the macro events cited above. Other macro factors may continue to dominate in the weeks ahead, but a 5.4% yield with 10% growth looks better than most investment opportunities out there.

We are long KMI.

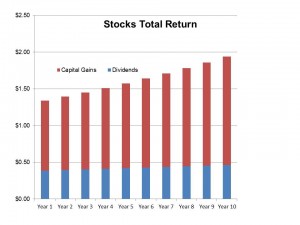

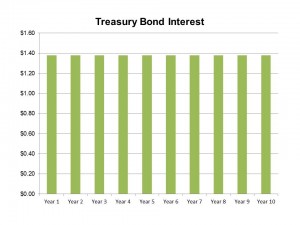

ed while stock dividends grow. The S&P500 currently yields around 2%. Historically, dividends have grown at around 5% annually. So if you invested $100 in stocks today you’d receive a $2 dividend after the first year but if past dividend growth of 5% annually continued, in ten years your $2 dividend would have grown to $3.26. Put another way, if dividend yields are still 2% in ten years time, your $100 will have grown to $162.89 (that’s the price at which a $3.26 dividend yields 2%). Since returns on stocks come from dividends plus their growth, a 2% dividend plus 5% growth equals a 7% return. Naturally, the two imponderables are (1) will dividends grow at 5%, and (2) will stocks yield 2% in 10 years (or put another way, where will stocks be?). These are the not unreasonable questions of the bond investor as he contemplates a larger holding of risky stocks in place of bonds with their confiscatory interest rates.

ed while stock dividends grow. The S&P500 currently yields around 2%. Historically, dividends have grown at around 5% annually. So if you invested $100 in stocks today you’d receive a $2 dividend after the first year but if past dividend growth of 5% annually continued, in ten years your $2 dividend would have grown to $3.26. Put another way, if dividend yields are still 2% in ten years time, your $100 will have grown to $162.89 (that’s the price at which a $3.26 dividend yields 2%). Since returns on stocks come from dividends plus their growth, a 2% dividend plus 5% growth equals a 7% return. Naturally, the two imponderables are (1) will dividends grow at 5%, and (2) will stocks yield 2% in 10 years (or put another way, where will stocks be?). These are the not unreasonable questions of the bond investor as he contemplates a larger holding of risky stocks in place of bonds with their confiscatory interest rates. xes, around $0.38. This assumes the Federal dividend tax rate and the ObamaCare surcharge but excludes state taxes.

xes, around $0.38. This assumes the Federal dividend tax rate and the ObamaCare surcharge but excludes state taxes.

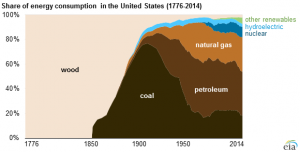

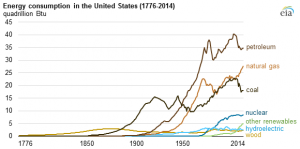

historical context. Our use of natural gas has been increasing but our use of petroleum has if anything decreased in the past several years. However, the big story here is our decreasing reliance on imports. The

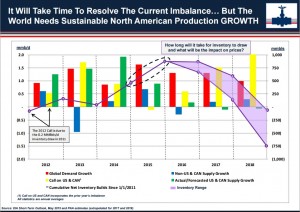

historical context. Our use of natural gas has been increasing but our use of petroleum has if anything decreased in the past several years. However, the big story here is our decreasing reliance on imports. The  profitable to hold crude oil for future delivery if the storage costs can be covered, and in some cases oil tankers act as temporary floating storage.

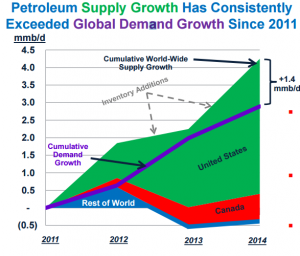

profitable to hold crude oil for future delivery if the storage costs can be covered, and in some cases oil tankers act as temporary floating storage. wn. Moreover, North America has met more than 100% of this increase in global demand, since output in the rest of the world has net fallen somewhat. This simple graphic illustrates as well as anything that the Shale Revolution in the U.S. has not just been a North American story but has impacted the global oil market, most obviously through the drop in prices since last Summer.

wn. Moreover, North America has met more than 100% of this increase in global demand, since output in the rest of the world has net fallen somewhat. This simple graphic illustrates as well as anything that the Shale Revolution in the U.S. has not just been a North American story but has impacted the global oil market, most obviously through the drop in prices since last Summer.