The Pro-Energy Election

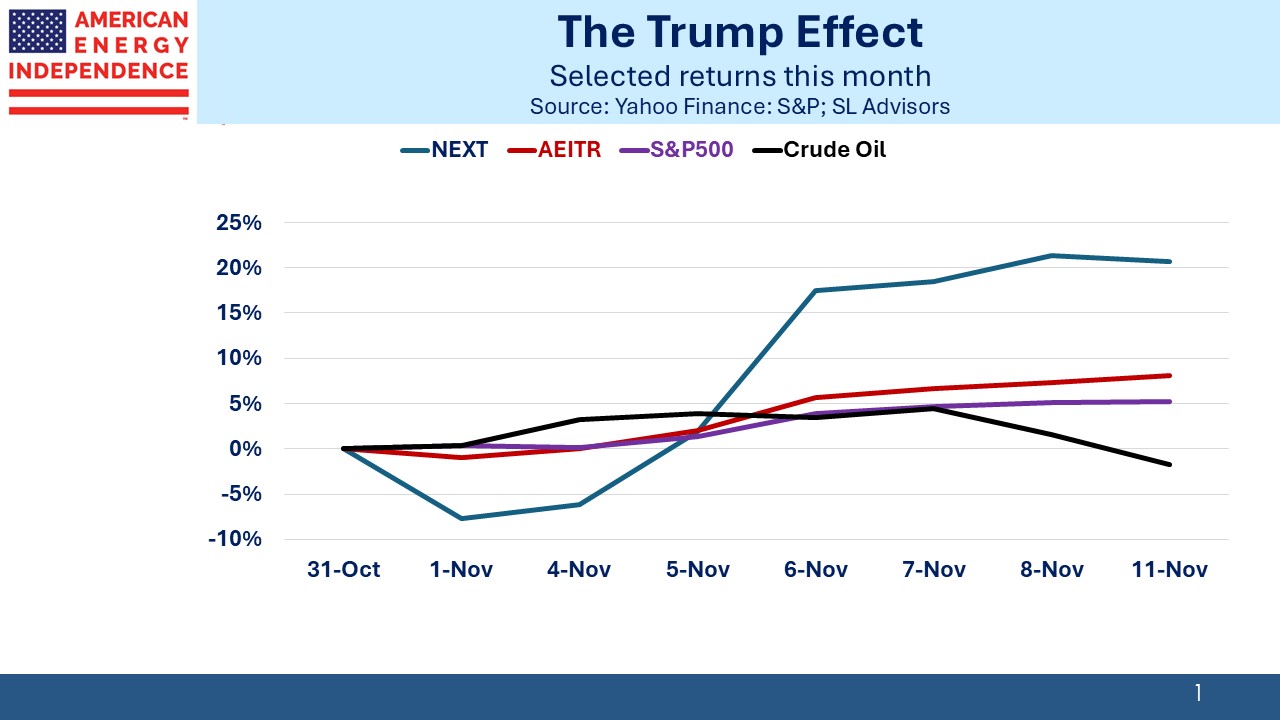

As the market absorbed last week’s election results, energy was the clear winner. On the week, midstream infrastructure returned +8.4% while the S&P500 was +4.7%. The main driver of outperformance is the expectation of a regulatory regime not beholden to climate extremists. The pause on LNG export permits will be lifted. Although many expected this to be the case even with a Harris victory, the ascendancy of Trump and the Republicans means that the government will genuinely seek to facilitate more exports.

The outlook for increased oil and gas production is less clear, 90% of which takes place on private land. Opening up more Federal land to drilling might help at the margin, but E&P companies are widely expected to stick with the capex discipline that has prevailed in recent years.

Midstream economics is about volumes, and we just might be headed towards a Goldilocks period of modestly higher domestic production that retains a focus on per share returns rather than volume growth.

3Q24 earnings have come in mostly at expectations with a few positive surprises. Targa Resources (TRGP) raised their dividend by 33% on the back of strong results. Their stock has returned +136% YTD, a figure that looks more like an AI stock than a stable midstream company.

Natural gas demand looks certain to benefit from AI data centers, with unprecedented capacity additions to power generation widely expected. Energy Transfer reported 16 Billion Cubic Feet per Day (BCF/D) of new natural gas demand, although not all these requests will translate into actual volumes. Total US production is expected to come in at around 103 BCF/D this year. Wells Fargo expects Musk to be an influential White House advocate on AI.

Cheniere once again beat expectations with 3Q EBITDA of $1.48BN, ahead of the $1.41BN consensus number. They raised their FY2024 guidance again and increased their dividend by 15%. The Corpus Christie LNG export terminal loaded its 1,000th cargo in September, bound for Italy. Along with their Sabine Pass facility, they’ve loaded 3,720 cargoes over the past eight years.

It’s also worth noting that while the Democrat climate change agenda didn’t resonate with voters as much as other issues such as immigration or the economy, European buyers of US LNG exports are very climate conscious. Consequently, Cheniere announced steps to achieve the highest standards of methane emissions, recognizing its importance to some of their buyers.

Williams Companies met expectations. Their 3.4% dividend is 2.2X covered by adjusted funds from operations.

The sector remains cheap, as measured by Enterprise Value/EBITDA. 2025 distributable cash flow yields are generally >9% with 10% growth expected 2025-26.

The Trump impact on crude oil prices is hard to gauge. Some additional US production may simply offset less exports from Iran as the incoming administration tightens sanctions. US intelligence found that Iran was trying to assassinate Trump during the election. It’s usually best to be successful in such attempts. “When you strike at a king, you must kill him” is attributed to Ralph Waldo Emerson.

In his first term Trump squeezed Iran with sanctions, and this time around will be similar.

Russian oil has generally been getting to buyers, albeit at discounted prices. Crude notably weakened in the days following the election. Oil prices have decoupled from the pipeline sector, reflecting different economics and reduced midstream leverage.

US natural gas prices should move higher. LNG exports are already set to double over the next five years as new terminals are completed. Going from 12-24 BCF/D will mean almost a quarter of US output is going overseas. And Trump has promised an improved regulatory environment, which will help although the legal system remains a tool for climate extremists to impose delays and uncertainty.

NextDecade rallied strongly following the election. Phase 2 of their development will now be freed of the LNG export permit pause that the Biden administration imposed early in the year. The more immediate challenge is for FERC to issue a revised Environmental Impact Statement after a DC circuit court rejected the one in hand (see Sierra Club Shoots Itself In The Foot).

The US badly needs to reform its permitting process to prevent climate extremists from finding a liberal judge to overturn issued permits on an environmental technicality. This will require Congressional action, and while both parties should be able to find areas of agreement, the outlook is unclear following the election.

The COP29 climate conference begins this week in Baku, the capital of Azerbaijan, a major exporter of hydrocarbons. The US is expected to withdraw from the Paris Agreement, the third time the US has left a global climate accord.

Two thirds of Azerbaijan’s GDP depends on hydrocarbons, so it takes an especially gullible liberal to believe that country has a sincere interest in reduced global emissions. China continues to persuade apologists to overlook their enormous coal consumption (>55% of the world’s total) and instead praise their huge commitment to solar and wind. China is more correctly viewed as increasing their reliance on domestic energy sources, both renewables and hydrocarbon.

Increased US LNG exports will continue to help the planet by displacing coal consumption.

In our opinion, US natural gas infrastructure remains in the sweet spot of investment opportunities following the election.

We have two have funds that seek to profit from this environment: