Another Pleasant Suprise From Cheniere

On Monday evening Cheniere provided their third revised EBITDA guidance of the year. It’s good that they’re not based in the EU where they would be a target of the planned windfall profits tax. Cheniere has raised guidance by $1.2BN (after 1Q earnings), $1.6BN (after 2Q earnings) and now another $1.2BN pointing to a range of $11.0-11.5BN.

Cheniere now plans to direct around 40% of Distributable Cash Flow (DCF) to shareholder returns, including a 20% dividend hike and an expected 10% growth rate in the future. European LNG demand has helped push margins higher. 2022 is turning out to be an exceptional year and the company is guiding for EBITDA in subsequent years around $7BN, although some analysts believe that is conservative. Their long term “take-or-pay” contracts provide almost 20 years of cash flow visibility. We are long-time investors in Cheniere

The news from Cheniere provided a pleasant distraction from the inflation numbers for energy investors. The core CPI number (ex-food and energy) was sharply higher than expected at 0.6%, well above July’s 0.3% figure. Inflation expectations have remained surprisingly constrained over the past couple of years. Ten year inflation expectations as derived from the treasury market are 2.4%. However, the Fed will worry that stubbornly high inflation will become embedded in consumer expectations. In our opinion savers should plan on a higher inflation rate when assessing their retirement outlook.

The resilience of midstream energy infrastructure compared with the S&P500 reflects the explicit inflation linkage many pipelines offer (usually via the Producer Price Index). We think it’s an excellent component of any equity portfolio.

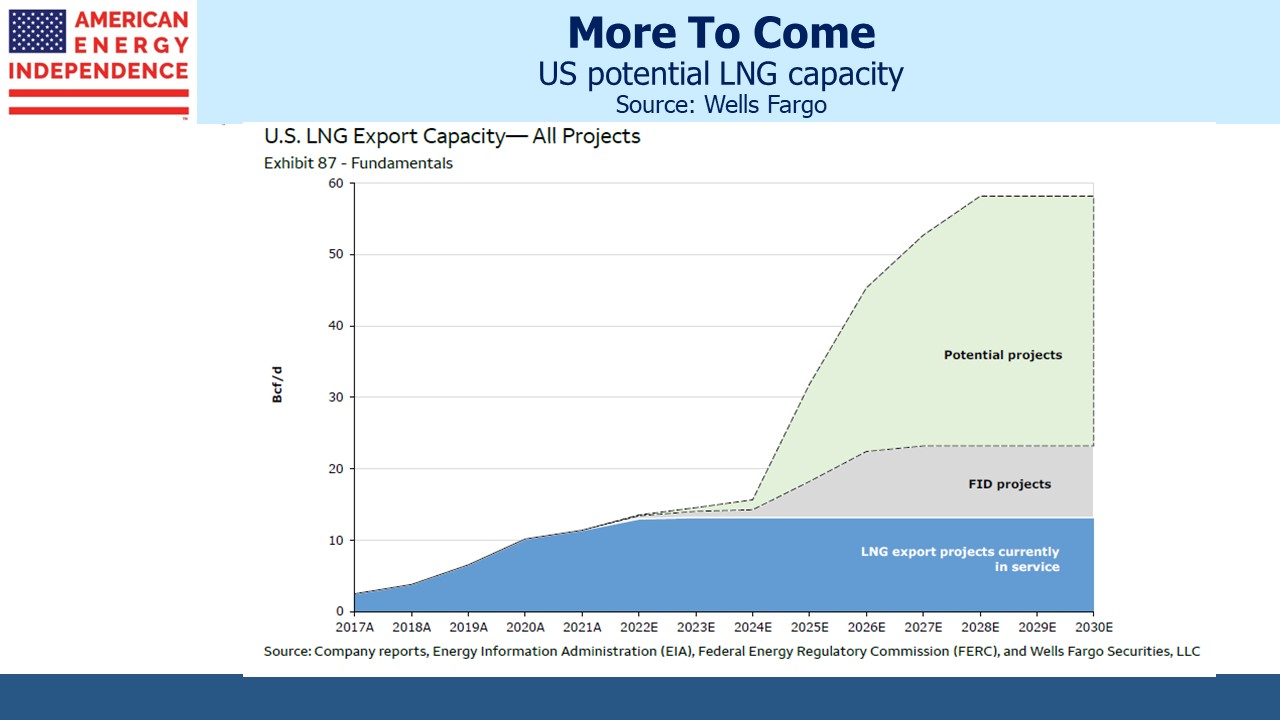

The US exports around 11 Billion Cubic Feet per Day (BCF/D) of Liquefied Natural Gas (LNG). This will rise modestly over the next couple of years to around 13 BCF/D, but may increase sharply beyond that depending on which projects can sign enough long term contracts to reach a Final Investment Decision (FID).

There are few pureplay LNG export opportunities available beyond Cheniere. NextDecade (NEXT) and Tellurian (TELL) are both early-stage companies with plans to build facilities over the next few years. Of the two we prefer NEXT for its superior governance, but both companies will likely draw increased interest as investors consider other companies that may emulate Cheniere’s success.

The collapse in Russia’s exports of natural gas (methane) to western Europe highlight the expense involved in transportation. Methane moves by pipeline or LNG tanker. Russia invested billions of roubles in the infrastructure to support Nord Stream 1 and 2. These pipelines have no alternative use. Although China is an obvious alternate buyer, more billions of roubles will be required to build the necessary infrastructure. Moreover, as noted in an FT article, China will be a difficult customer. No country wants to be overly reliant on a neighbor for energy. Fixed infrastructure that straddles national borders, such as pipelines, will increasingly require the near-certainty of stable relations. The post-Ukraine world is one where energy supplies can be leveraged for political gain. Energy security makes imported seaborne natural gas in the form of LNG a more flexible alternative, even if it costs more. Consequently, global demand for LNG is likely to benefit from this type of geopolitical analysis. The US is well positioned to benefit.

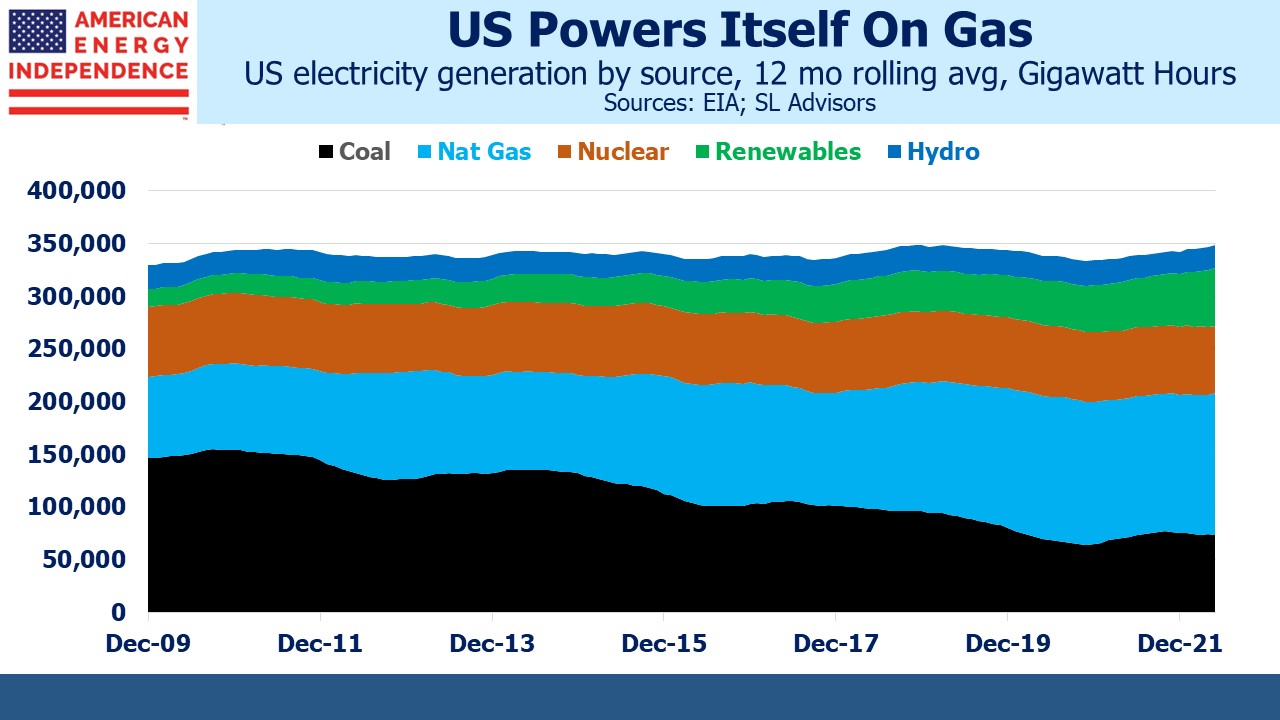

The US Energy Information Administration (EIA) recently announced that 24% of US electricity generation came from renewables during 1H22. It’s hard to share their enthusiasm for this milestone, since it comes with unreliability and higher prices (see California and Germany). The EIA noted that both hydro and wind, which are the majority of renewables, provide more output in the first half of the year than the second. In the case of hydro it’s because of melting snowpack. Wind evidently has its own seasonality as well. Over the past twelve months renewables are 16%, up 2% year-on-year.

Although it’s politically correct to celebrate increased use of renewables, the dominant story about US power generation for at least the past decade has been the switch away from coal. Since 2012 natural gas has gone from 28% to 38% of our electricity. Over the same period coal has dropped from 39% to 21%. Hydro and nuclear have each dropped slightly, by 1%, and renewables have increased by 10%.

It’s also interesting to see that electricity demand has barely grown over the past decade, reflecting improving energy efficiency across our economy.

The EIA has noted in the past that most of America’s drop in greenhouse gas emissions is the result of coal to gas switching. Natural gas remains the most interesting story in the energy markets.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.