Another Climate Conference

COP28, the annual UN climate conference, starts tomorrow in Dubai in the United Arab Emirates (UAE). It’s easy to criticize the world’s efforts at reducing global Greenhouse Gases (GHGs). They over-emphasize intermittent solar and wind instead of going all in on nuclear and should replace coal with natural gas.

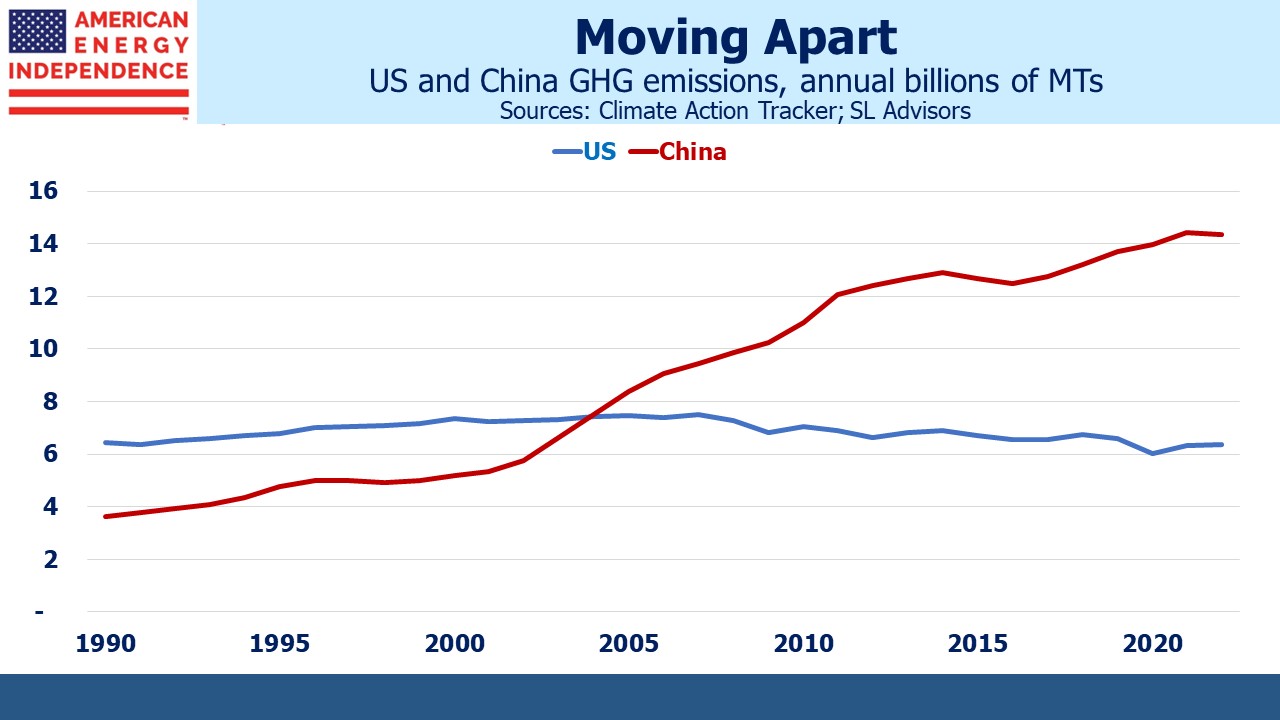

China gets a free pass to increase emissions through at least 2030 so their living standards can modestly catch up with the west. The US didn’t impose the decades of growth-stultifying communist central planning in 1949 that caused their living standards to fall behind. But we’re supposed to cut GHGs while theirs grow. President Biden and Xi Jingping, leaders of the world’s top two emitters, the US (6.4 billion Metric Tonnes (MTs) of CO2 equivalent and falling since 2007) and China (14.4 and rising) won’t be attending. The UAE, OPEC’s third biggest producer of liquid fuels, is planning to use the presence of so many energy executives in Dubai to discuss oil deals.

The US just auctioned 35,000 acres of Wyoming land to oil and gas drillers, demonstrating that the White House is acting with more pragmatism and less emotion than left-wing Democrats might like. As St. Augustine might have said, “Give me 100% clean energy (chastity), just not yet.”

3,700 US auto dealers are calling on the Administration to slow regulations requiring two thirds of new cars to be battery electric by 2032. Electric Vehicle inventories in the US are up fivefold over the past year, according to digital listing platform CarGurus.

Climate extremists despair at the apparent lack of progress. But there is plenty of evidence that the world’s energy producers are adapting to the energy transition.

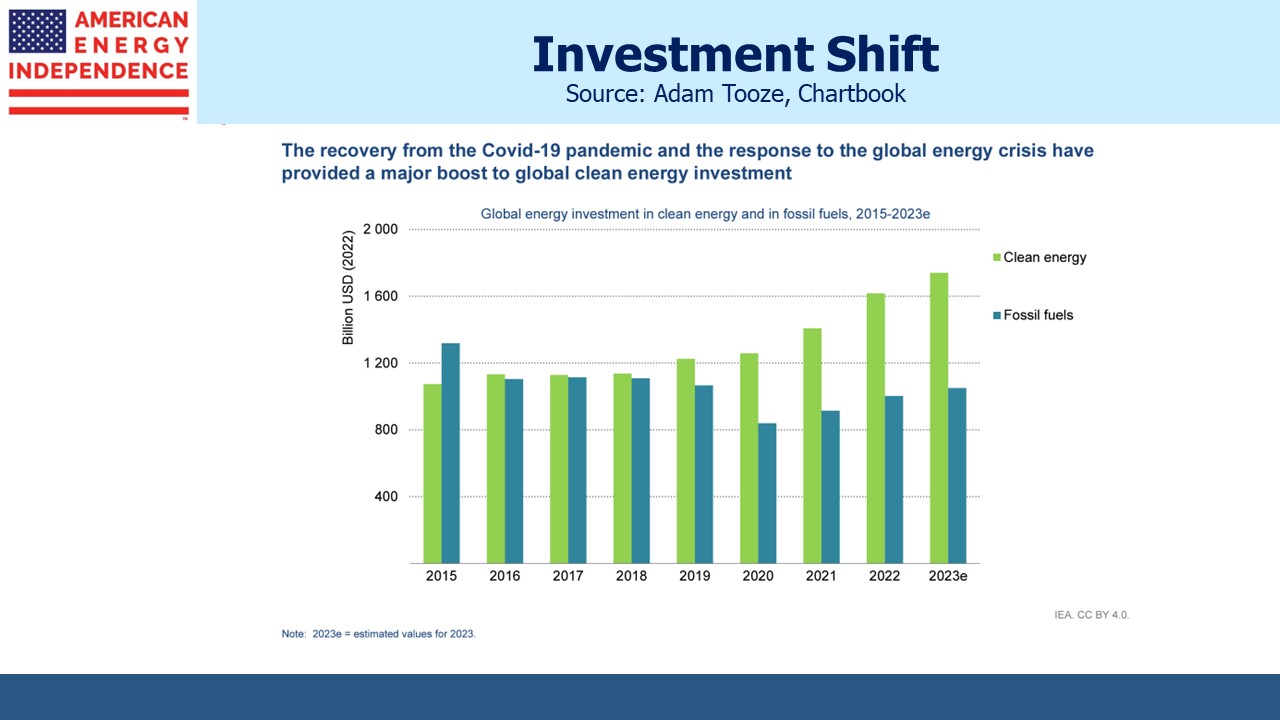

Global investment in fossil fuels has yet to recover to pre-pandemic levels in real terms, while renewables investment has increased by around half in five years. Given the long lead-time in developing new oil and gas reserves, caution around capital commitments that require a decade or more to deliver a return is prudent. By most measures the world is going to be short of crude oil since demand continues to grow. The Energy Information Administration (EIA) sees global liquids consumption rising by 1.4 Million Barrels per Day (MMB/D) next year to 102.44 MMB/D, 0.4 MMB/D faster than production. China’s oil consumption grew at 3.5% annually over the past decade.

Nonetheless the price of crude has confounded many bullish oil forecasters this year.

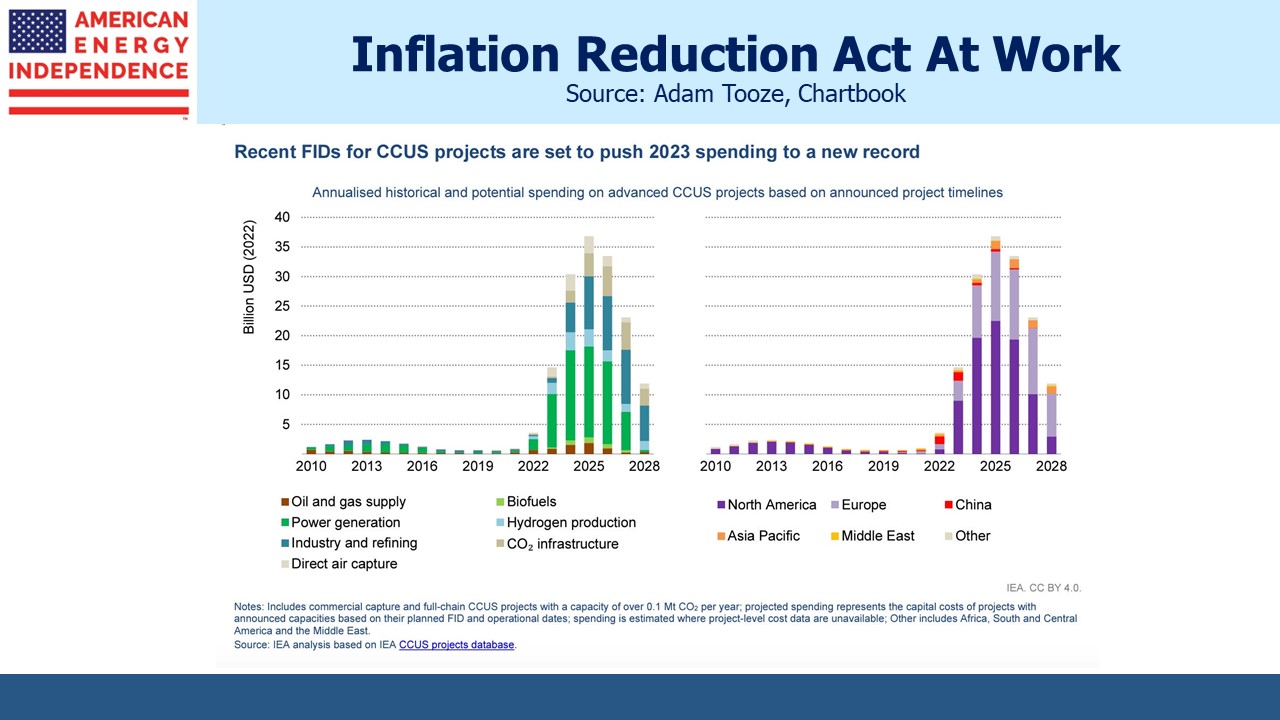

Carbon capture received a big boost from last year’s Inflation Reduction Act (“Green Spending Act”). With tax credits for Direct Air Capture (DAC) of CO2 rising to $180 per MT, private sector investment is picking up. More than half the new capital dedicated to the sector over the next three years is expected to be in the US. The power sector, where concentrated emissions of CO2 can be sourced, will receive around half of planned investment over that time. Removing CO2, long criticized as impractical and ruinously expensive, is becoming an important tool (see Carbon Capture Gaining Traction).

American Airlines is buying carbon credits from a company that turns sawdust and tree bark into compressed bricks that are then coated and buried. This prevents the biomass from otherwise decomposing and releasing CO2 into the air. American Airlines is paying $100 per MT for the credits. Burying sawdust seems an unlikely way to reduce CO2 levels, but Graphyte’s backers include Bill Gates’s Breakthrough Energy Ventures. The company expects to start producing the bricks next month and believes their technology is cheaper than other types of carbon capture.

It’s likely that innovation in this sector, spurred by the Green Spending Act, will continue to lower costs while adding new methods.

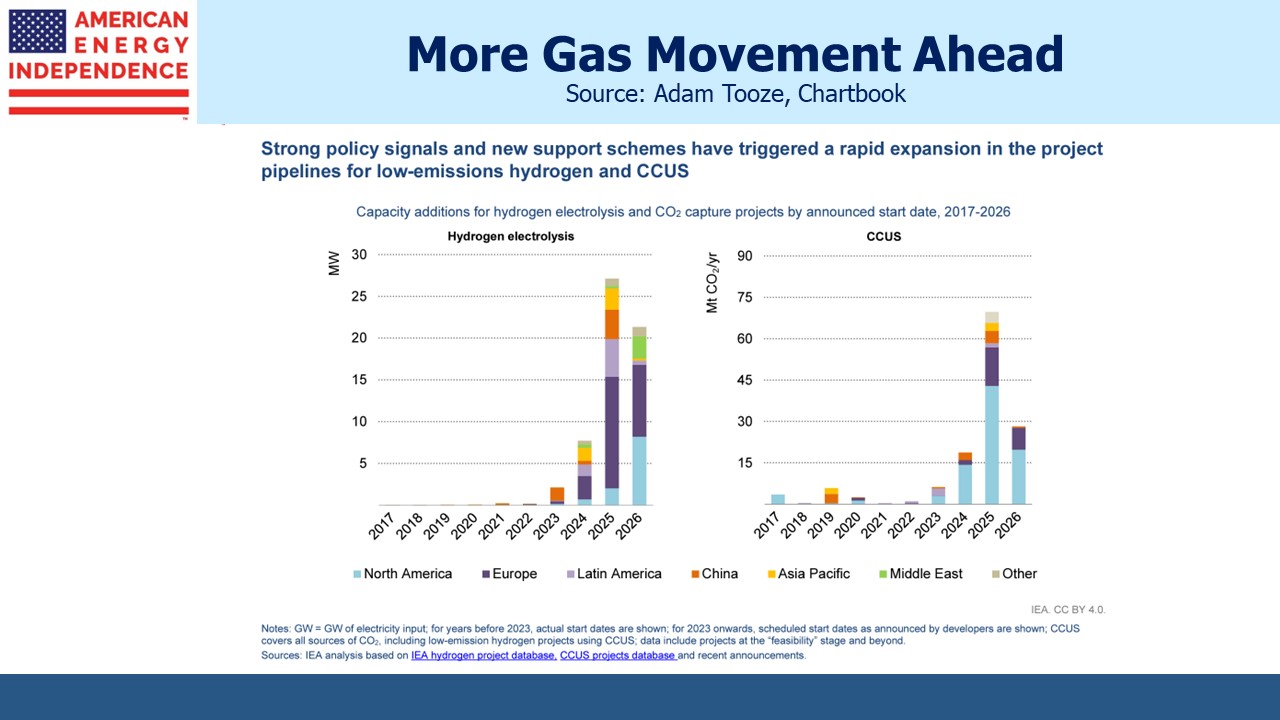

Federal support is also stimulating new investment in pipelines to move hydrogen and CO2. Hydrogen offers promise when blended with natural gas at low percentages but generates Nitrous Oxide (NOx) at higher concentrations, as noted in this comment on a previous blog post.

The US is leading the world with new investment and innovation in reducing emissions from today’s energy and removing CO2 from the atmosphere. We’re also exporting increasing amounts of natural gas to our trading partners and allies, enabling them to use less coal for power generation. The US has a great story to tell on climate change and the energy transition, one that is underpinned by today’s midstream infrastructure companies. Climate extremists are wrong to focus their criticism on rich countries. The path of emissions in China and whether they eventually peak and then fall, will determine global levels.

We have three have funds that seek to profit from this environment: