AMLP’s Tax Bondage

Tax Freedom Day is that point in the year when you’ve figuratively earned enough to pay all your taxes. For the rest of the year you can feel as if your income is your own. Naturally, it can never come soon enough. Investors in the hopelessly tax-burdened ETF, the Alerian MLP Fund (AMLP) face the contrary prospect: the point at which their investment returns are taxed at the fund level before anything is paid out. If the opposite of freedom is bondage. AMLP investors recently passed Tax Bondage Day.

This comes about because AMLP is not a conventional ETF, but is a tax-paying C-corp. Anecdotally, it’s clear few investors realize this, because most ETF’s are RIC-compliant and therefore not taxable at the fund level. Conventionally, you don’t stop to consider whether the ETF you own is taxed like a corporation. But AMLP is a C-corp, paying taxes on its earnings before paying out what’s left to holders.

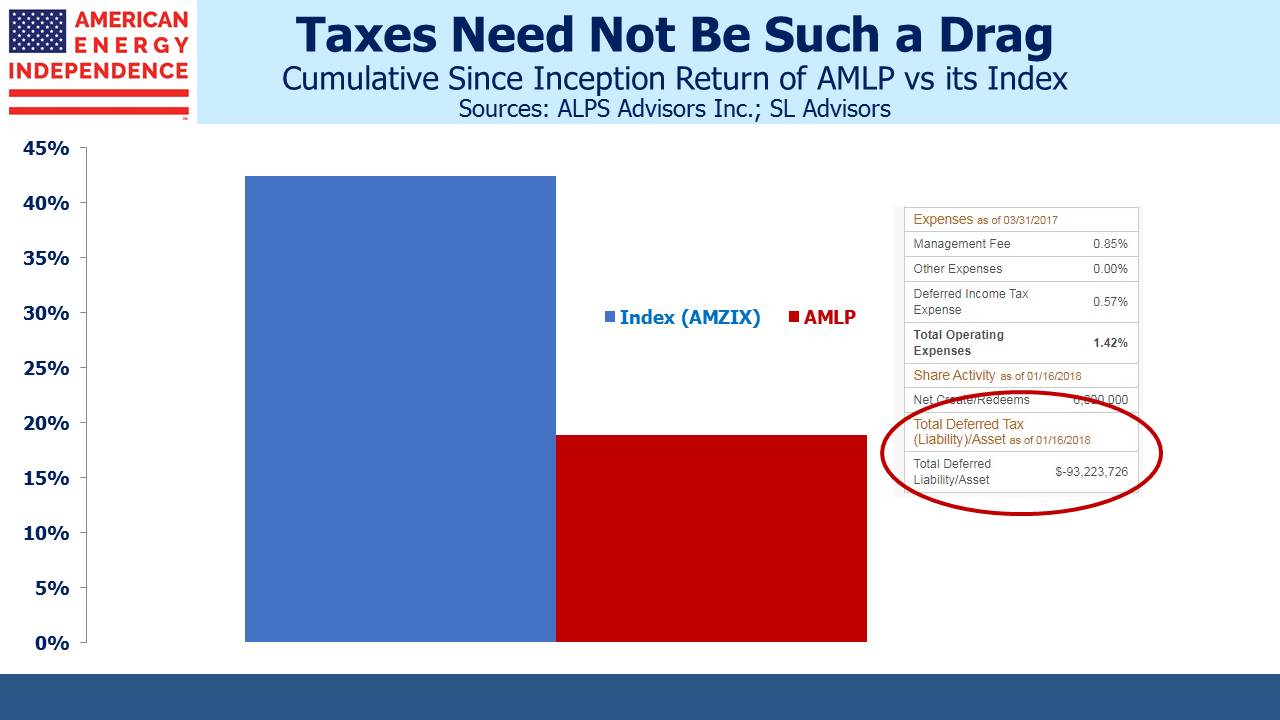

The weakness in energy infrastructure last year wiped out unrealized gains for AMLP and many other tax-burdened MLP funds. Since you don’t owe taxes on losses, AMLP’s Deferred Tax Liability (DTL) was eliminated. However, the sector has been recovering since late November, and probably the only negative consequence of the rebound is that AMLP now has unrealized gains once more. Therefore, it has begun to owe corporate taxes again. As of January 16th it owed $93MM, a cost in addition to and approximately equal to their annual management fee. As the market rises, so will their DTL.

You can find further detail on this issue from past blogs. Hedging MLPs explained how AMLP is useful as short position, because the tax drag will limit its appreciation to 79% of the market’s whereas it can still fall 100% of the market. Some MLP Investors Get Taxed Twice and Are You in the Wrong MLP Fund both examine the implications of a tax-paying C-corp for investors.

The reduced corporate tax rate means the tax drag is less than it used to be – and it’s been substantial. Since inception, AMLP has returned less than half its benchmark, largely because of tax expense. The reduced corporate tax rate will help, but it’ll still represent a serious drag on returns. Many investors are expecting strong performance over the next couple of years. Valuations are attractive, and energy lagged the market substantially in 2017. Seeing your fund hand over 21% of a double digit return before paying distributions will represent a substantial cost, and an unnecessary one because there are correctly structured energy infrastructure ETFs around that aren’t subject to corporate tax. It is possible to invest in the sector via a RIC-compliant vehicle.

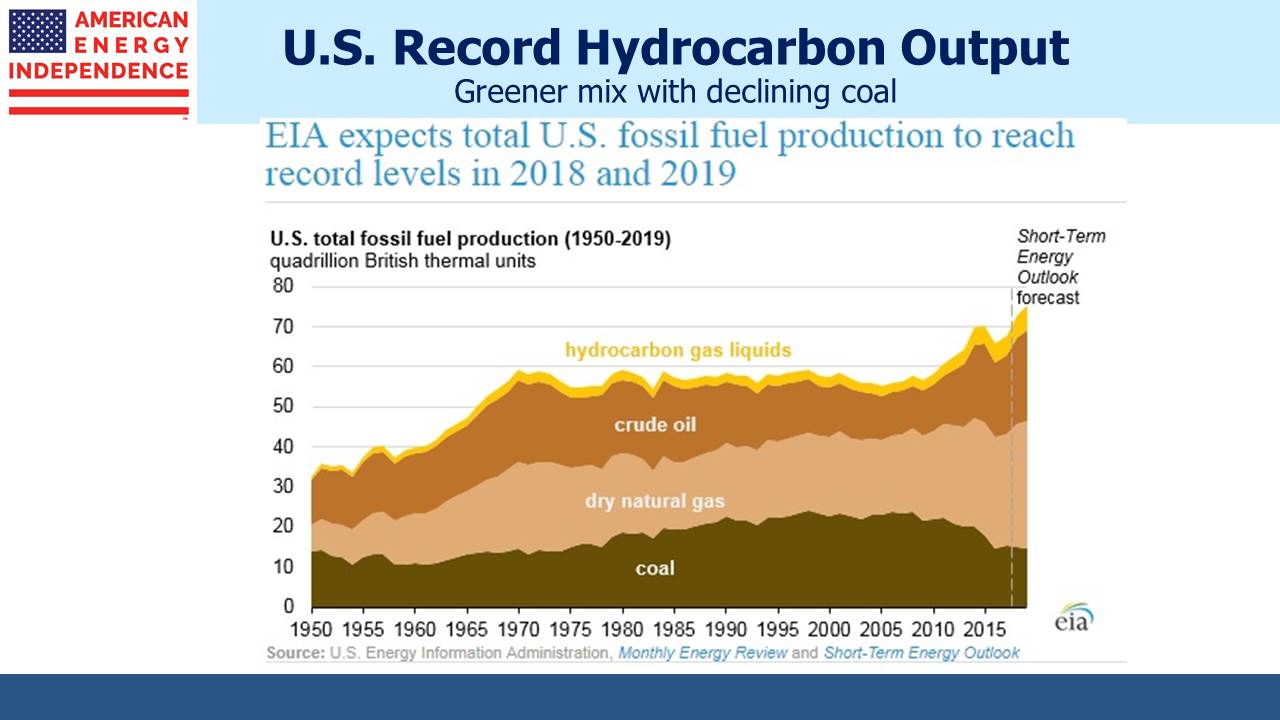

On a different topic, the U.S. Energy Information Administration confirmed its forecast of record hydrocarbon production in 2018. Natural gas and natural gas liquids broke records in prior years, but this year crude oil production will also breach a previous high. Moreover, the mix of hydrocarbons should please almost everybody because it’s moving heavily away from coal and towards cleaner-burning natural gas. America’s emissions are moving in a better direction, thanks to the Shale Revolution.

The investable American Energy Independence Index (AEITR) finished the week -1.5%. Since the November 29th low in the sector, the AEITR has rebounded 12.8%.

We are short AMLP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Trackbacks & Pingbacks

[…] The chart below shows the 2013-14 expense ratios of some of the biggest MLP-dedicated funds. Although corporate tax rates are now lower, the structural inefficiency persists. If MLPs do manage a couple of years of outsized performance, investors are likely to be surprised at the expenses that are deducted from their returns. Getting the sector right but picking the wrong investment is an avoidable tragedy (see AMLP’s Tax Bondage). […]

Leave a Reply

Want to join the discussion?Feel free to contribute!