America’s Favorite Energy

When it comes to energy, the media has a decided liberal bias. With a few exceptions, journalists covering this sector breathlessly highlight the phenomenal growth of renewables and criticize those evil fossil fuel companies who supply 82% of the world’s primary energy. The solar/wind juggernaut is barreling along and if you don’t jump on you’ll be on the wrong side of history.

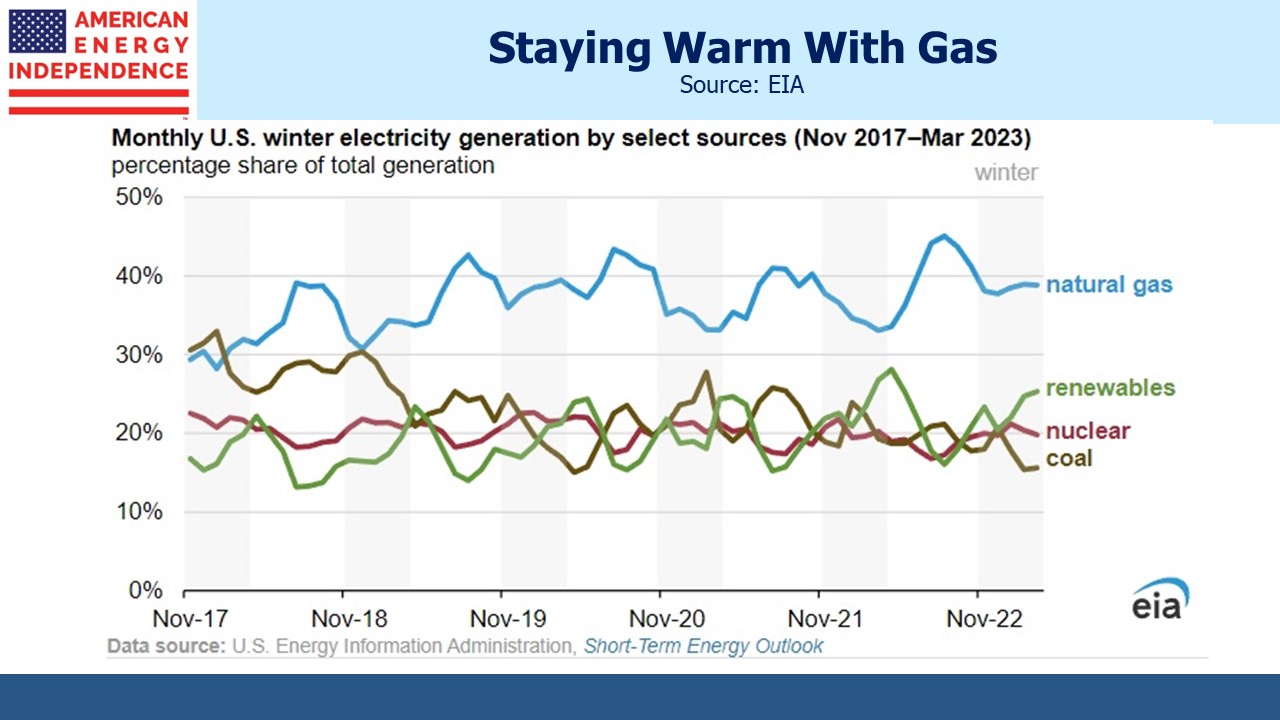

Bloomberg’s Naureen Malik, who’s not an obvious proselytizer for intermittent energy, recently noted that natural gas power plants represent a disproportionate share of outages during bad weather. Natural gas is America’s favorite fuel, providing 40% of US electricity generation last year and projected to rise to 41% this year. That’s three times the share of solar and wind.

If natural gas power plants sometimes fail during extreme weather, it reflects choices made about investing in hardening them. In some cases, spending on solar and wind has taken priority. It doesn’t reflect any inherent flaw in natural gas, which is why it’s America’s favorite fuel.

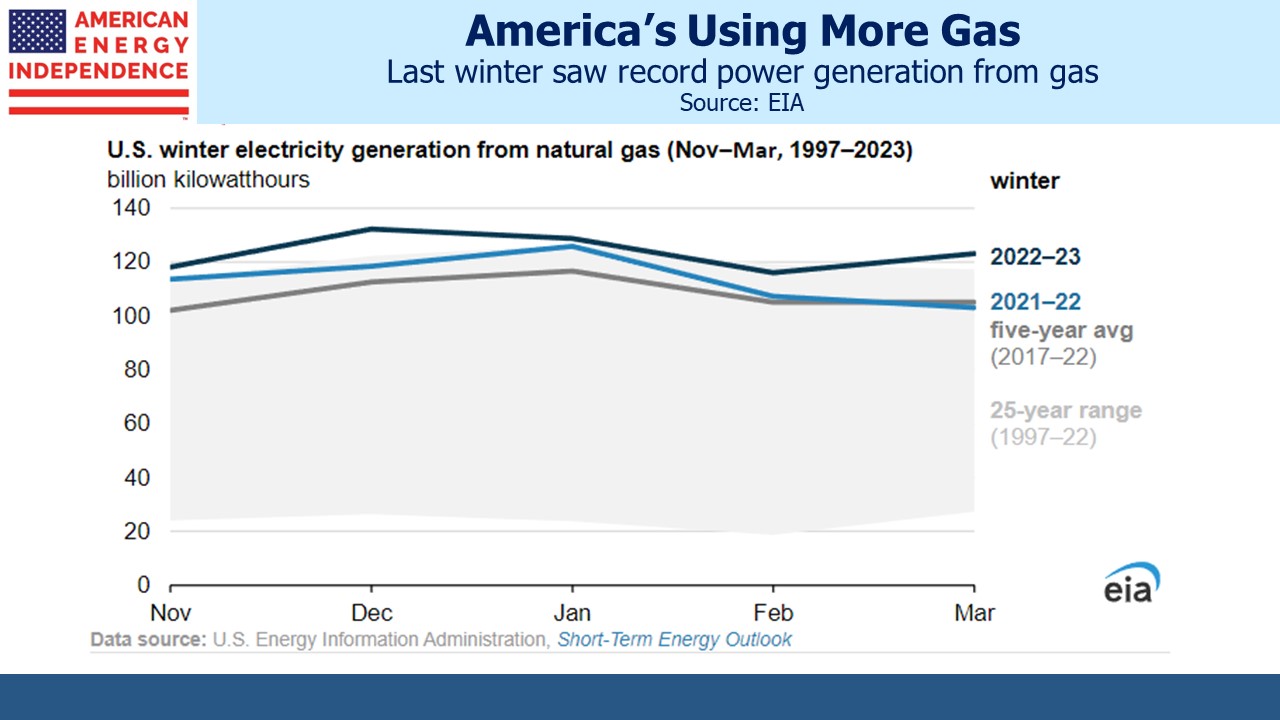

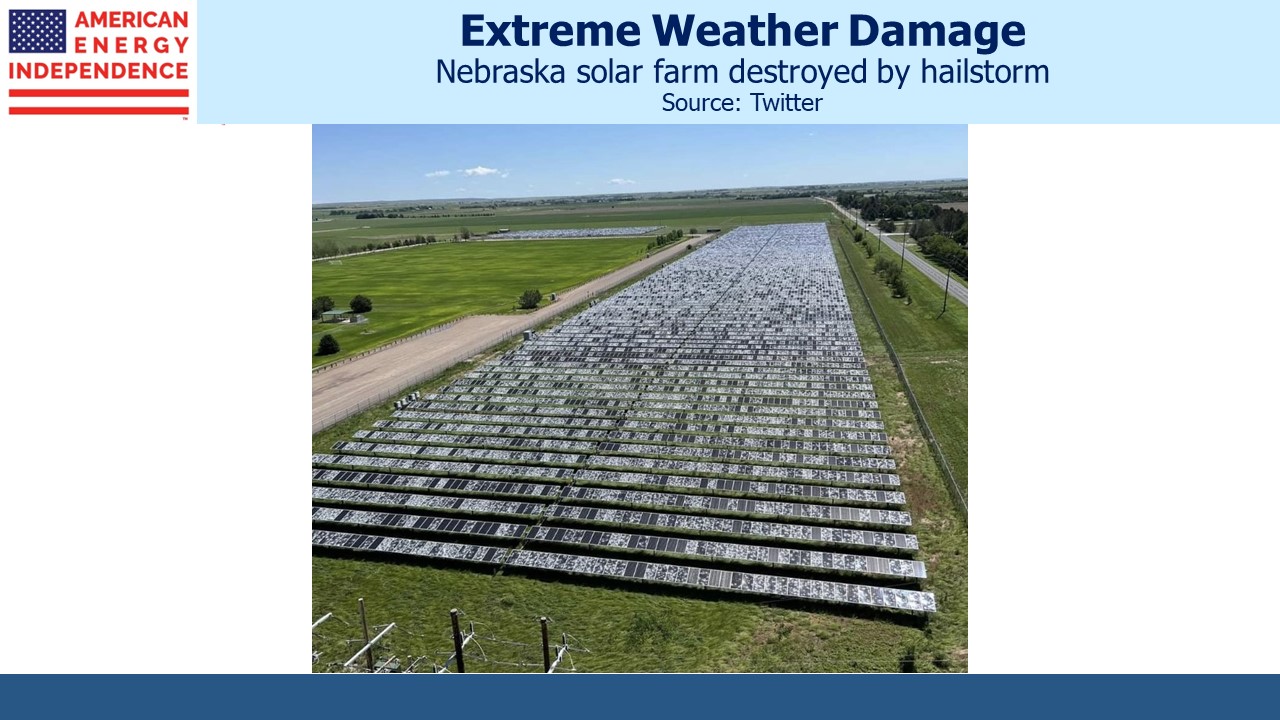

Last winter natural gas provided a record amount of power. What’s disproportionate is the media coverage of renewables relative to their impact. Solar panels aren’t just vulnerable to cloudy days, but also to hailstorms, as the photo from Nebraska shows.

The chart showing share of electricity generation by source hardly suggests that utilities are drawn to the resilience of solar and wind. Bloomberg’s Malik might have presented a more balanced perspective by including such charts.

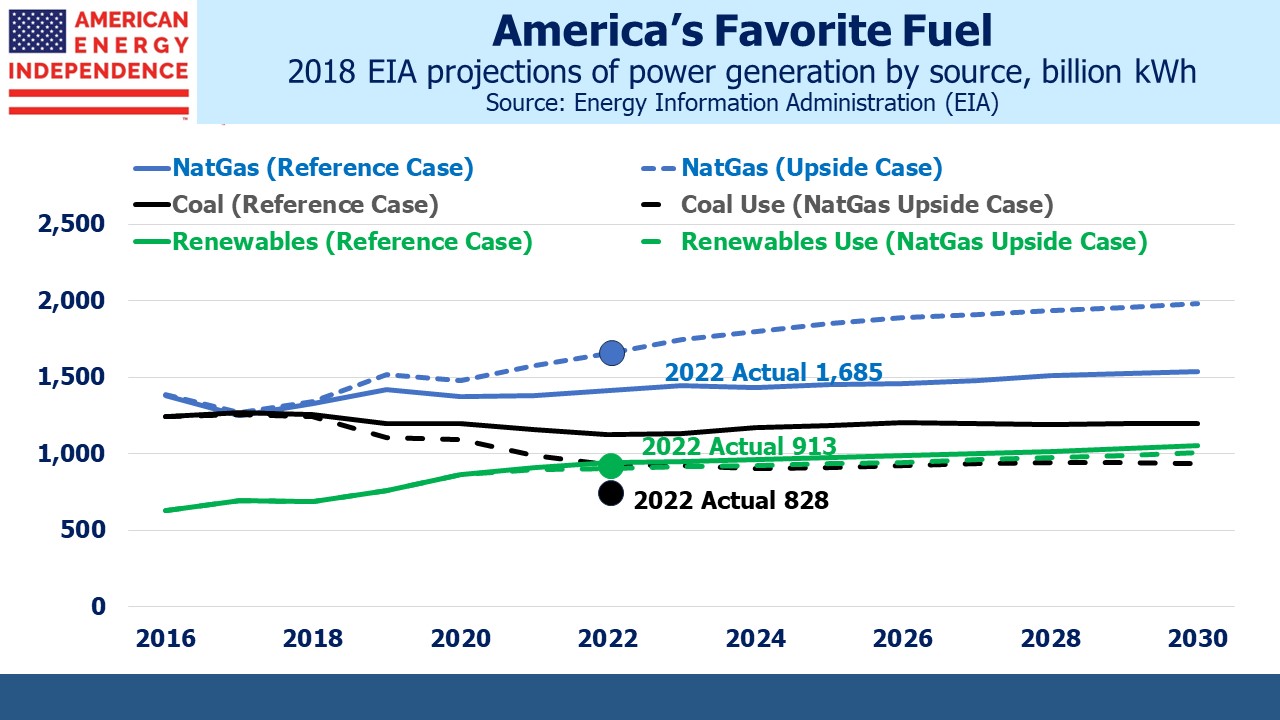

The EIA provides substantial data on current energy consumption as well as projected use. Their Annual Energy Outlook includes several scenarios as well as their Reference (or Base) Case. The most bullish natural gas scenario they model is the High Oil and Gas Resource and Technology Case. It’s labeled the Upside Case in the chart.

The steady growth in US natural gas consumption over the past five years hasn’t drawn much coverage, but since 2017 its use in power generation has grown at a 6% Compound Annual Growth Rate (CAGR), around the same as renewables. Because natural gas is our biggest source of electricity generation, the 418 billion kWh five year increase is almost double that from renewables (222 billion kWh). Coal use has declined at an 8% CAGR. This story doesn’t get told because it doesn’t align with the left-wing bias of most journalists. Too many energy news stories are little more than an op-ed.

The big story in US energy is the increasing use of natural gas, expanding at the most optimistic rate envisaged by the EIA five years ago. It’s also been our biggest source of reduced CO2 emissions, because coal use has simultaneously declined. The shale revolution generated mixed investment results, but it brought cheap energy that has boosted business here, can be exported to our friends and allies and provides energy security.

For several years the dark shadow of the energy transition dissuaded investors from committing capital to reliable energy. There’s a welcome turn in sentiment. Shell is trying to look more like US energy companies who resisted woke protesters to focus on maximizing returns. Blackrock’s Larry Fink has vowed not to use the term “ESG” since it’s become so maligned. Sweden recently adopted energy policies that dropped “only renewables” in favor of “clean”. This sensible shift allows for the inclusion of nuclear, and fuels like natural gas if the emissions are captured.

Midstream energy infrastructure has lagged the market this year, because it’s not a sector synonymous with AI. But relative performance in June was good with the American Energy Independence Index making up for some lost ground. The narrative around renewables and the energy transition is more subtle than the headlines, a realization that is spreading.

If you follow the energy sector you have to pick your journalists and outlets carefully.

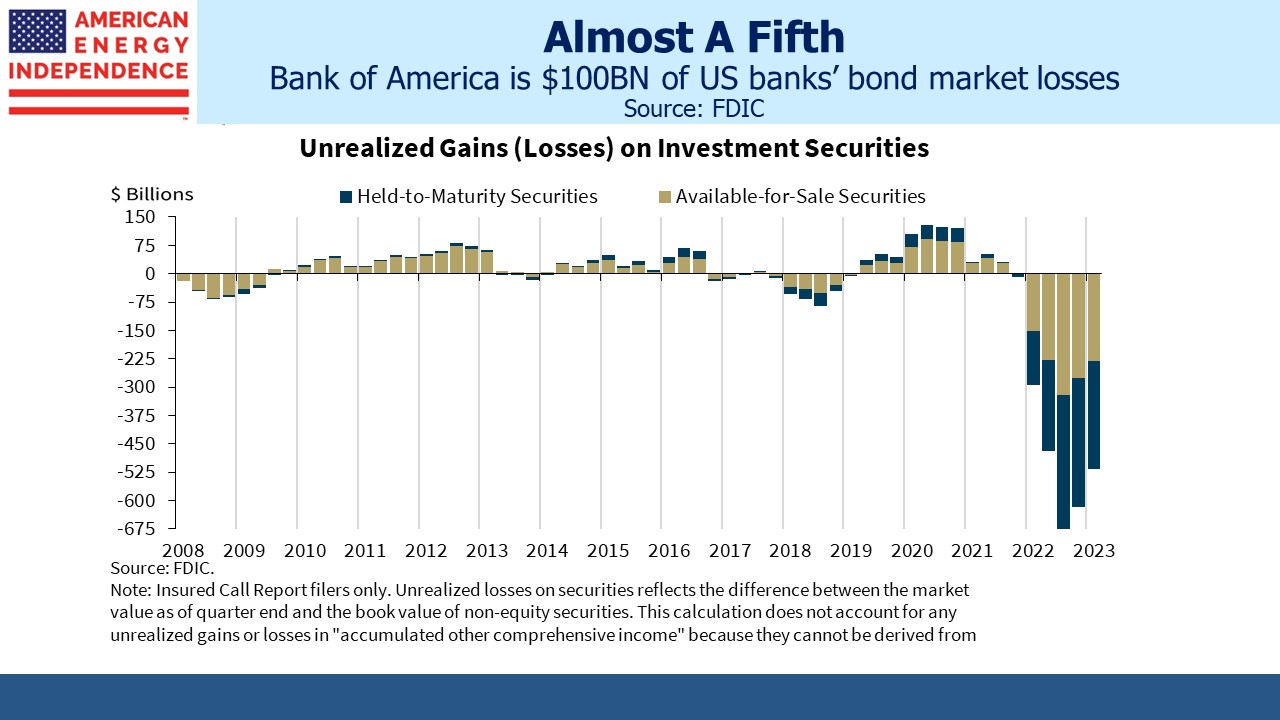

The futures market continues to chart a rate path less hawkish than the FOMC’s blue dots. But the gap is narrowing, in an unusual case of the market correcting towards the Fed. The carnage inflicted on bank securities’ portfolios was shown in Bank of America’s disclosure that they have $100BN in unrealized losses on their securities holdings. They’ve benefited as recipients of deposits fleeing smaller regional banks, but it is depressing their net interest margin because they’re stuck with a lot of low-yielding bonds acquired by competing with the Fed during QE. It shouldn’t have been hard to limit bond exposure. Central banks rendered the entire investment grade sector useless to the return-oriented investor. Yields are still too low. Bank of America flubbed risk management. JPMorgan did much better.

We have three funds that seek to profit from this environment: