American Energy Independence is Imminent

The U.S. Energy Information Administration (EIA) recently published their 2019 Annual Energy Outlook. Whenever your optimism on the prospects for U.S. energy infrastructure waivers, this will restore your confidence. The outlook for domestic energy production is bullish, and in many cases more so than a year ago.

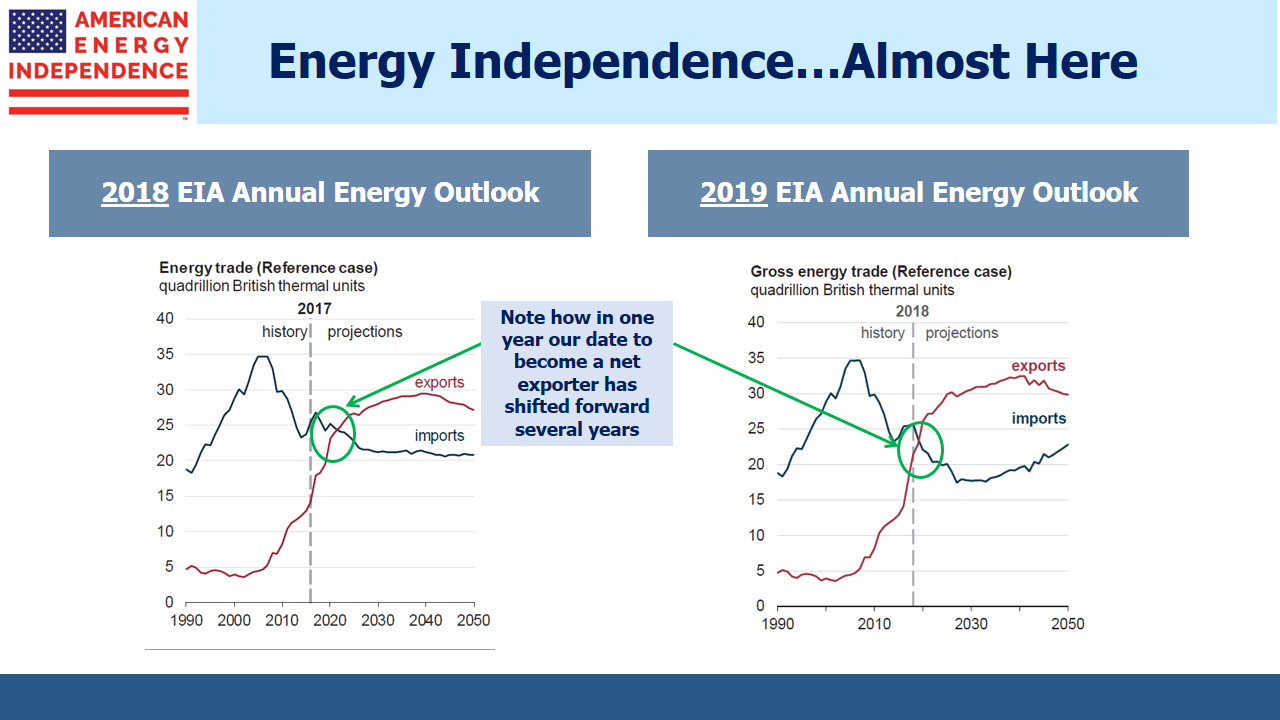

For example, in their 2018 report, the EIA’s Reference Case projected that the U.S. would eventually become a net energy exporter. Now, thanks to stronger crude and liquids production, they expect that milestone to be reached next year.

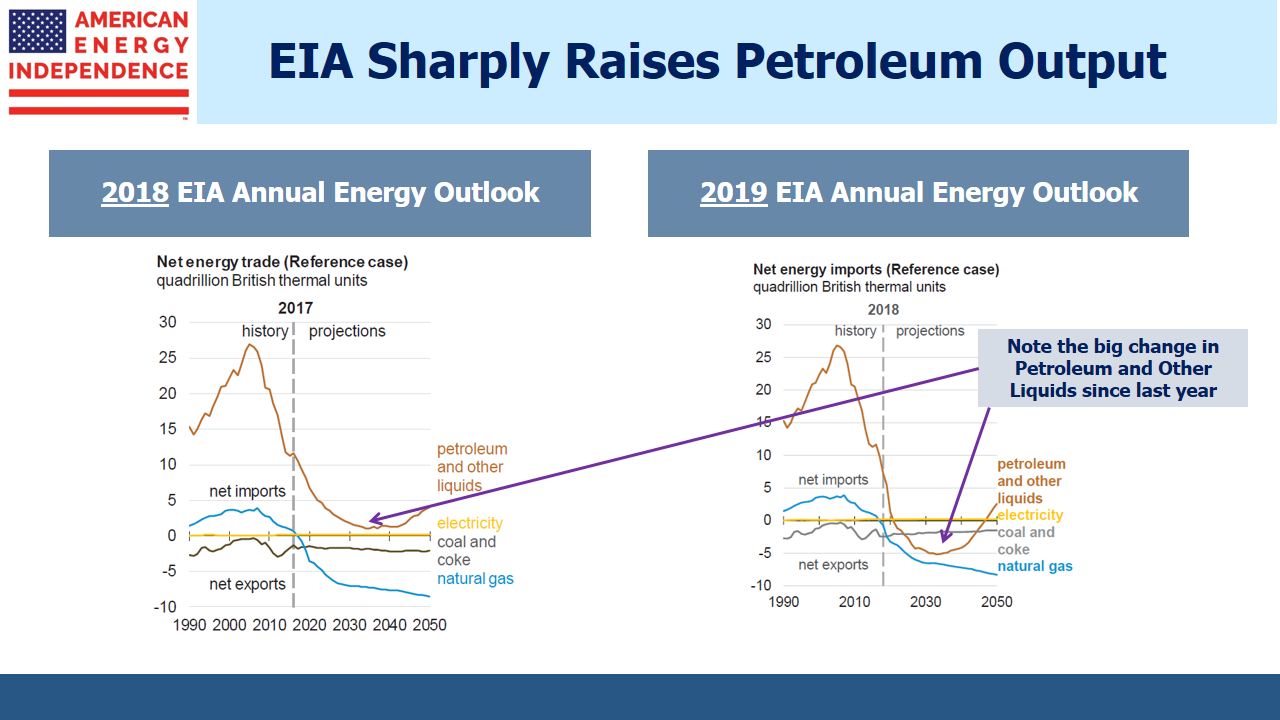

The expected improvement in America’s balance of trade in liquids is dramatic, especially compared with last year’s report. It’s equivalent to an additional 2.5-3.0 Million Barrels per Day (MMB/D) of output.

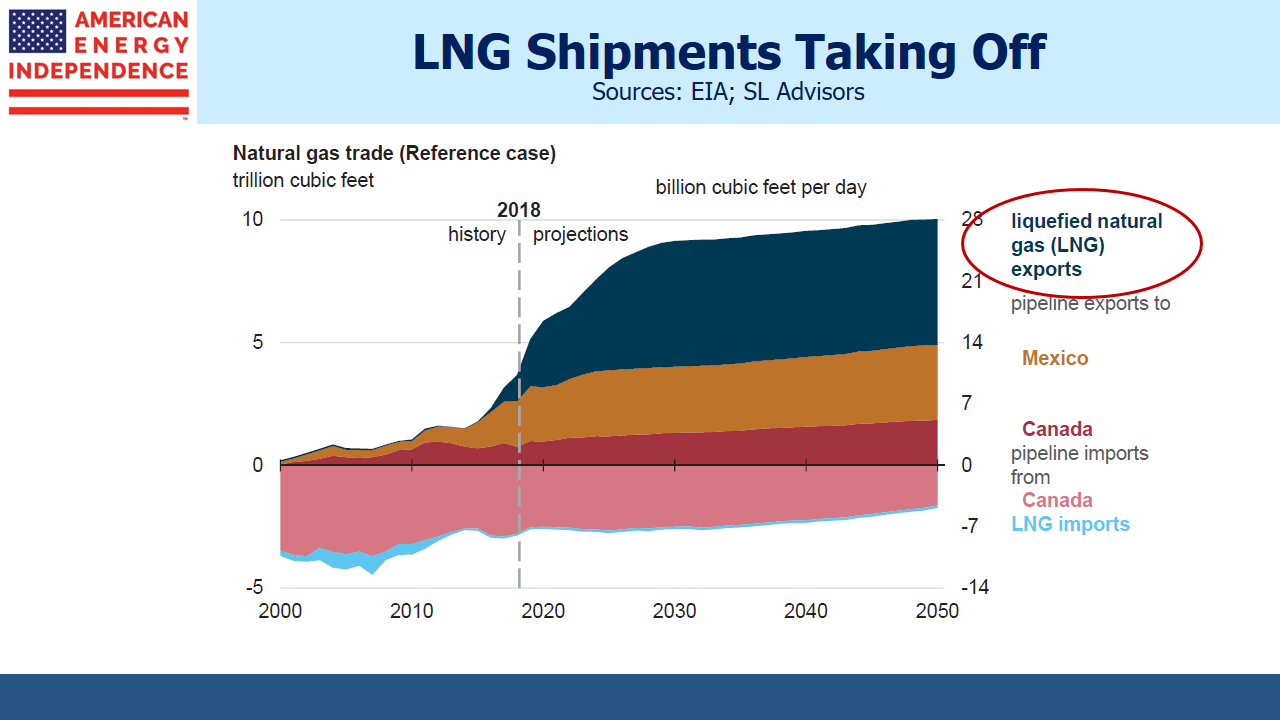

Liquified Natural Gas (LNG) exports are also set to jump sharply, and overall natural gas exports are projected to more than double over the next decade. This is driven by growing Permian crude output, which comes with natural gas as an associated product from oil wells. It’s why flaring is common today, because the needed takeaway infrastructure for natural gas remains insufficient. Mexico’s own infrastructure to import natural gas for electricity generation is still being developed, and new LNG export facilities will provide further demand.

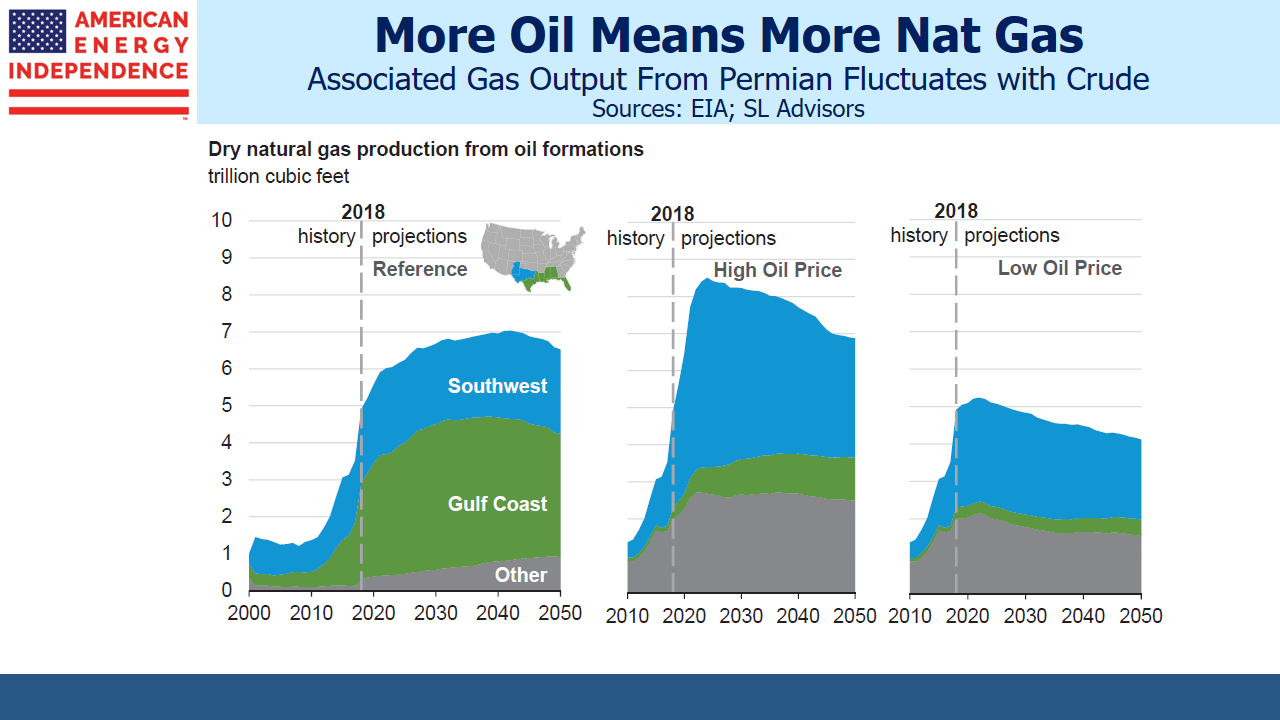

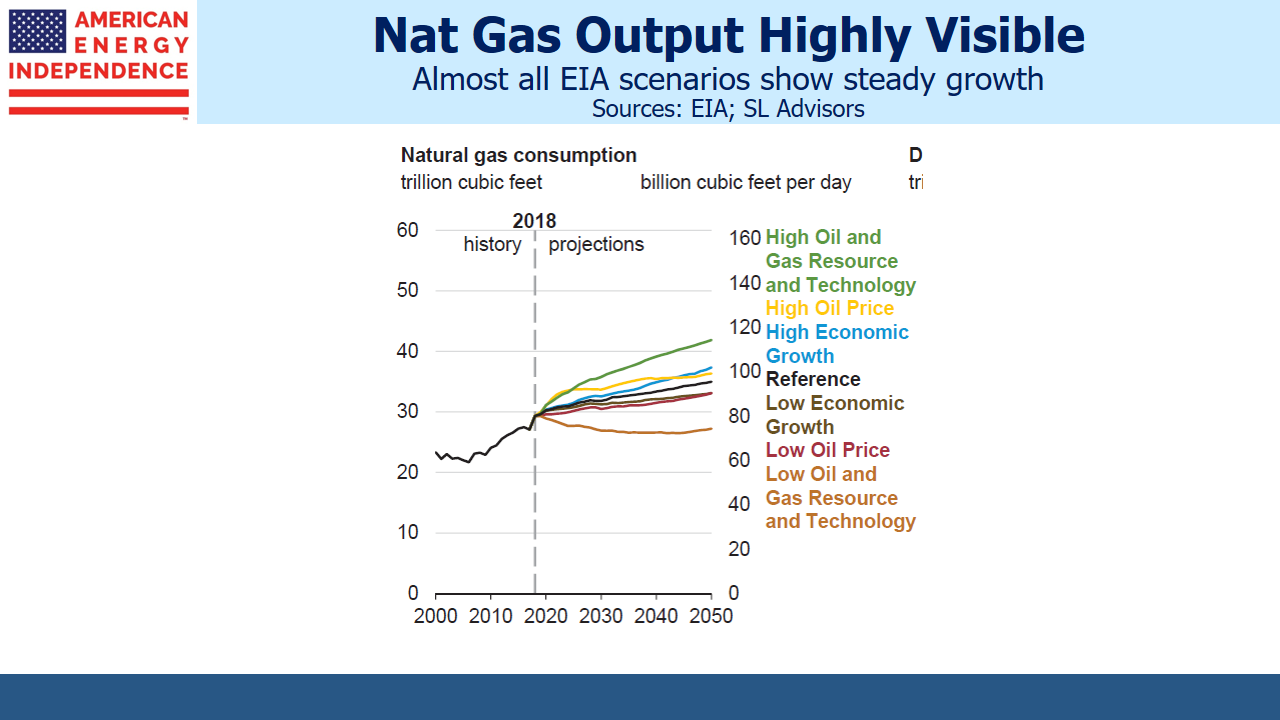

The middle chart in the panel below highlights the correlation of natural gas output with the price of crude oil. This is because the EIA assumes that higher crude prices will stimulate more Permian oil production, producing more associated natural gas.

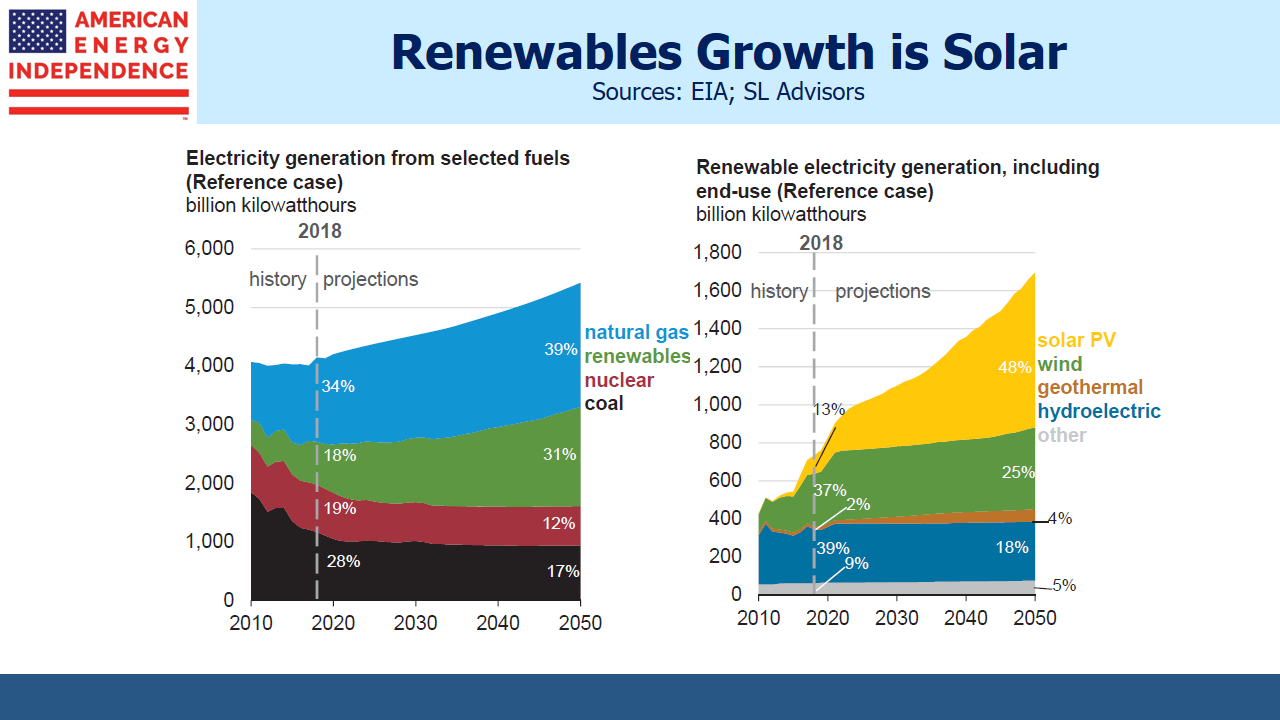

Although use of renewables to generate electricity will grow, they’re still expected to provide less than one third of all electricity even in 30 years. Almost all the growth will be in solar, which works best in southern states that receive more sun. Although my state, New Jersey, is subsidizing residential solar roof panels, they’re not much use in winter. This is especially so because electricity demand generally peaks twice a day, around breakfast and dinner, when people are leaving for work/school or returning home. At this time of year in the northeast, it’s dark during both peak periods. Only half the days are even partly sunny, with cloud cover rendering solar ineffective on the rest.

Moreover, the bucolic, leafy suburbs enjoy plenty of summer shade which can also block the sun from reaching solar panels. Widespread deployment of solar will require cutting down some big old trees that impede southern exposure.

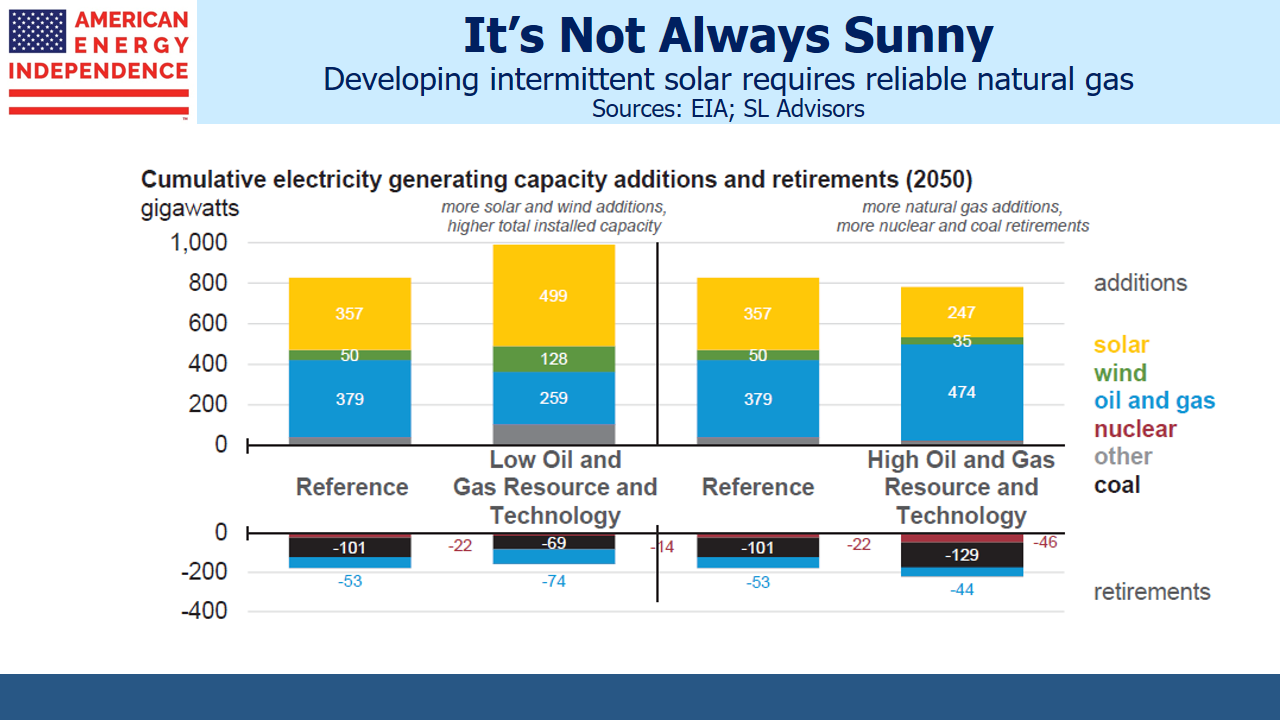

Large-scale battery technology doesn’t exist to store midday solar power for use at peak times Therefore, intermittent sources of power (also including wind) require substantial excess capacity, as well as baseload power that’s always available. Environmental activists haven’t all accepted this yet, but natural gas remains the big enabler for increased solar power.

Some extremists desire a carbon-free world, but that Utopian objective ignores the symbiotic relationship natural gas and solar/wind share. They’re complimentary energy sources. Opposing all fossil fuels impedes the growth of intermittent energy sources and forces more excess, redundant capacity. The Sierra Club and those who share their views seek impractical, purist solutions that will struggle both economically and politically.

Natural gas is in many ways a bigger U.S. success story than crude oil. Its abundance ensures continues low prices, supporting both exports as well as cheaper domestic electricity than most OECD nations. Because the U.S. has some of the lowest-priced natural gas, different scenarios nonetheless offer fairly uniform growth in output. Natural gas prices are less susceptible to the cycles of crude oil, which combined with America’s advantages noted above makes investing in its infrastructure more attractive.

There’s plenty in the EIA’s 2019 Outlook to support a bullish view for midstream energy infrastructure. Financing growth projects has weighed on stock prices for several years, leaving investors frustrated and complaining about insufficient cash returns. But if the peak in growth capex peak is behind us, as looks likely, free cash flow and payouts should start increasing again. Cash flow yields on the sector average 12% before growth capex. This is analogous to the funds from operations metric used in real estate, but double the yield on the Vanguard Real Estate ETF (VNQ), for example. REIT investors should take note.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon,

Thanks for the articles. I read all of them I can and benefit from them.

I would like to introduce to you some happenings in the energy storage market you may not be aware of. Your comments about storing wind power became too negative so I am responding with this. These systems are vanadium, not lithium, with almost zero degradation. I do own Cell Cube as an example of one of these providers. Cell Cube might not make it as a company, but the technology appears sound, and just needs to be sold, and recently is being sold into Germany, Czech, et al. In other words, renewables does have a “take-off and store energy” solution, even at small capacities, thus renewables will not have all the headwinds you seem to dispense too negatively. Storage with no degradation and costs of production halving soon will make these energy storage systems more and more affordable. These words are not meant to say oil and gas and liquid gas pipelines do not have a bright future, only that renewables will have solutions to make that energy worthwhile to generate and to store. Adios.

What is the effect of improving battery technology on the use of natural gas with intermittent solar and wind?