Alerian Still Clinging On

An unintended side-effect of Oneok’s (OKE) proposed acquisition of Magellan Midstream (MMP) has been to give a bid to smaller MLPs. This has come about because of the shrinking pool of names available to populate the Alerian MLP Infrastructure Index (AMZIX) and the Alerian MLP ETF (AMLP) which tracks it.

AMZIX recently increased its maximum weights, from 10% to 12%, because there aren’t enough MLPs. Even before the OKE/MMP transaction NuStar Energy (NS) and Crestwood (CEQP) were both weighted at 3.5X their respective share of MLPs and more than 5X their weight in the American Energy Independence index (AEITR).

MMP is currently the biggest holding in the AMZIX, at 12.5%. NS and CEQP have both performed strongly since the announcement as traders anticipate a reallocation towards them and other small names once the deal closes.

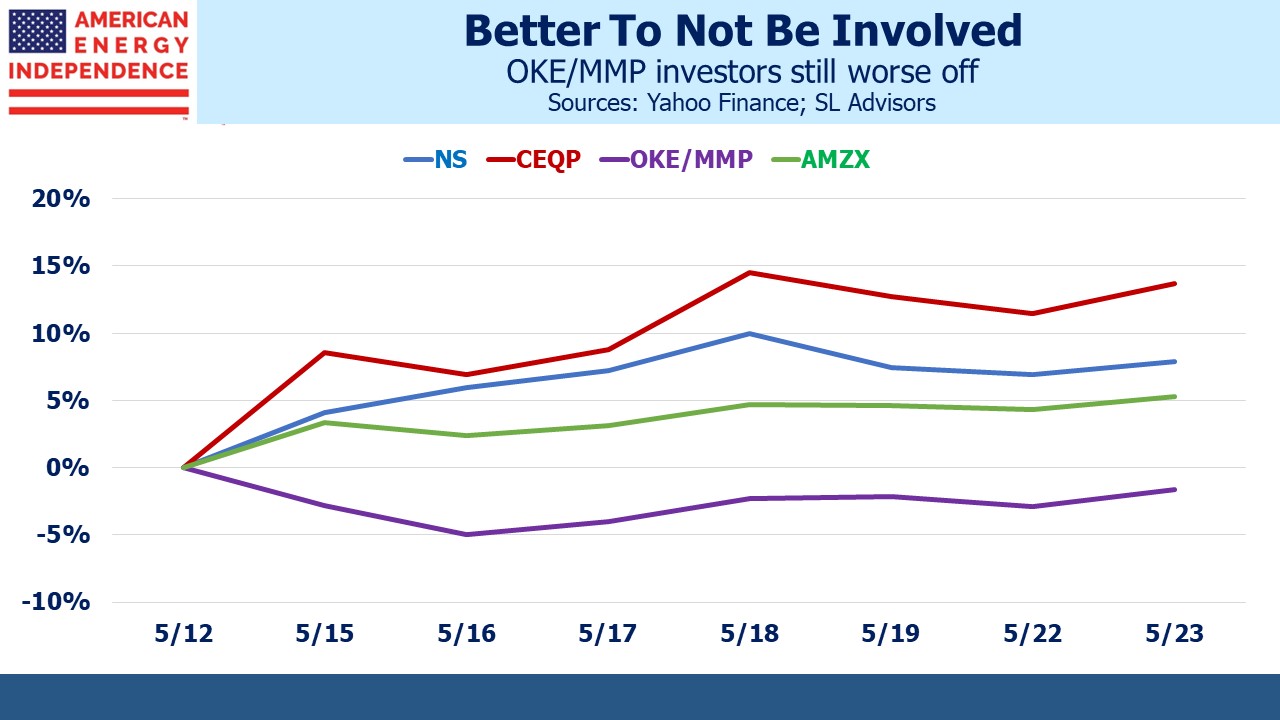

It’s been good for most MLP investors, other than MMP because of the unwelcome recapture of deferred taxes. The worst place to be in the sector has been a market cap-weight investor in OKE and MMP. That combination has underperformed AMZIX by 6%.

Had you been able to trade on the inside information that MMP was being acquired, you would have done better to buy CEQP than the target company itself. It’s a pity for the deal’s proponents that the uninvolved MLPs can’t vote, because it’s been better to be an observer than a participant.

This is the distortion that AMLP’s anachronistic structure is causing.

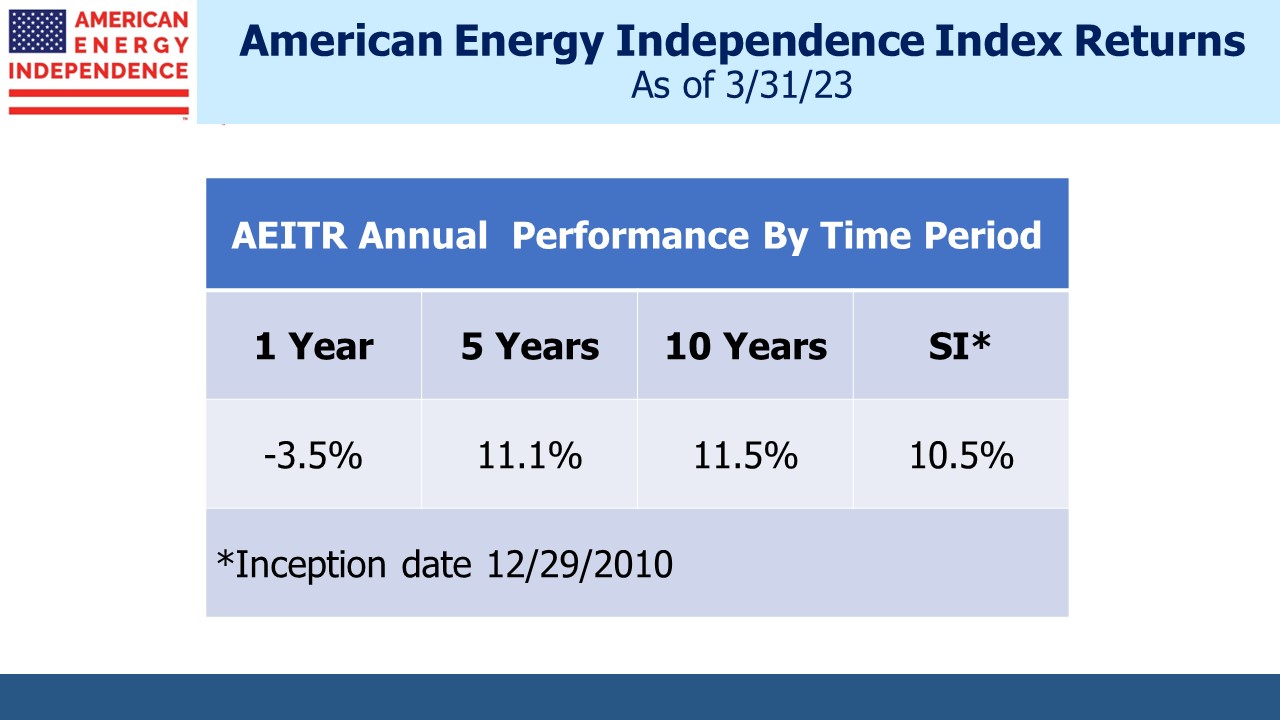

It may sound churlish to knock AMLP when the MLPs which are 100% of its portfolio have just outperformed. But over the past decade AMZIX’s 0.6% annual return lags the AEITR by 11%. Concentrated MLPs haven’t been nearly as good as diversified midstream energy infrastructure.

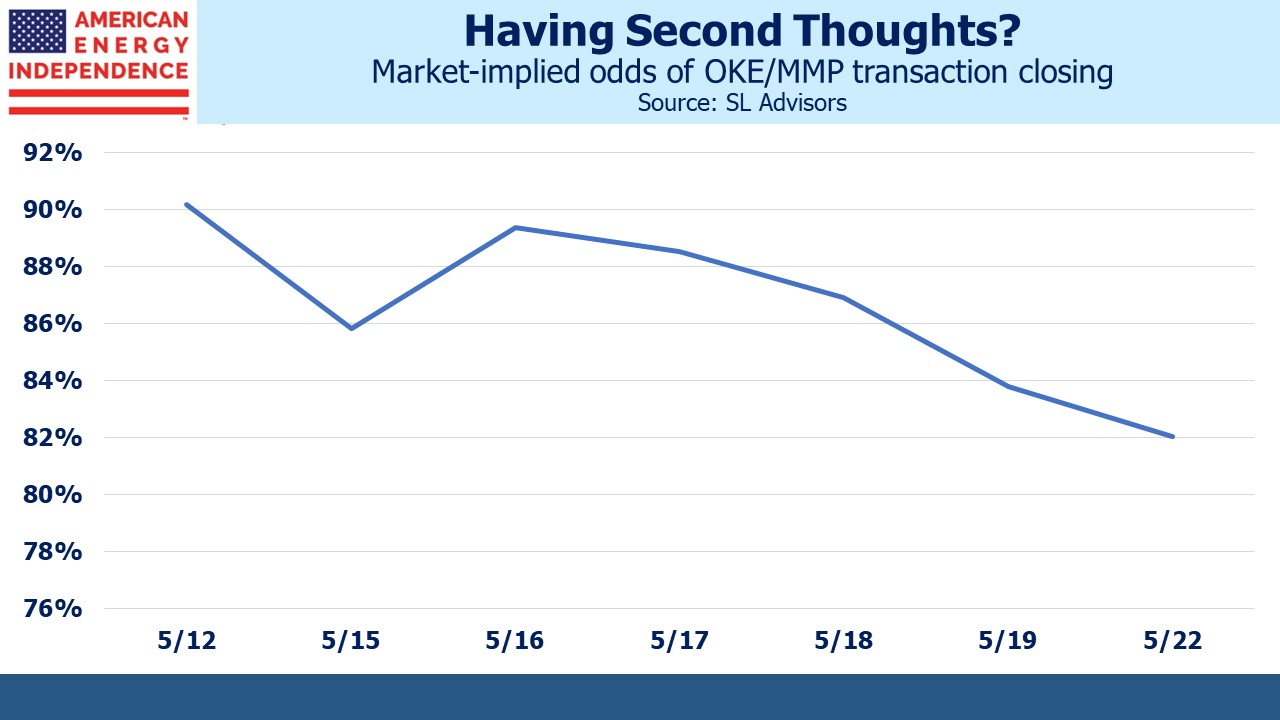

The deal still has to be voted on by the owners of both companies. We own both and will be voting against it twice. The market assesses the transaction as likely to close, although the odds have dipped in recent days. The discount to the deal price divided by the deal premium can be thought of as a rough expression of the odds of a successful completion. We estimate current market prices suggest a high likelihood of 82%, although this is down from 90% early last week.

JPMorgan reported on the weekend that “investor feedback appears mixed to negative on the deal.”

Based on comments our blog has received and other feedback, people are generally against but not all are. One thoughtful reader noted that as a long-time MMP holder living in a high tax state he was already paying 50% on his distributions. He added that MMP management, “… have done an absolutely incredible job – just look at MLP returns over the last 20 years without MMP as evidence. I trusted them all the way and I tend to still trust them in this case to have done their best for their shareholders.”

Another reader, retired tax attorney Elliot Miller, warned that, “In addition to the capital gains taxation due to adjusted basis in MMP units having been reduced by tax deferred distributions, MMP unitholders will have significant ordinary income taxed resulting from depreciation recapture even after the release of suspended passive activity losses.”

I had noted that many MLP investors plan to donate their units, thus eliminating the recapture of deferred taxes. But another reader quoted an IRS publication on the topic:

Donated, publicly traded partnerships – in particular master limited partnerships (MLPs) – are an important exception to the typical fair market value deduction for long-term gain securities, as the charitable deduction must be reduced by the amount of ordinary income that would have been realized if the property had been sold at fair market value on the date contributed.

These comments reflect the complexity of MLPs when it comes to taxes. Many MMP unitholders likely won’t know their precise tax outcome when voting on the transaction.

C-corps and MLPs aren’t easily combined. Whenever it’s happened in the past, such as with Kinder Morgan and its MLP Kinder Morgan Partners in 2014, the MLP unitholders have been mistreated. If there was a case for MMP to sell itself, it would have been preferable to combine with another MLP. This would have avoided the tax issues MMP unitholders will now face.

But most importantly, the deal highlights the challenges facing AMLP with ever fewer names to hold. It’s too big to convert to a more diversified fund – although its holders should hope it never does because it would create a fire sale of MLPs. It remains the biggest ETF in the sector – hoping nothing else changes and that its investors don’t think too hard about what it owns. Nobody would create AMLP today. It’s clinging on.

We have three funds that seek to profit from this environment: