Adapting to New Circumstances

Investors are focusing carefully on the response of Master Limited Partnership (MLP) managements to the impact of a higher cost of equity on their growth plans. Those firms that moderate their growth forecasts in response so as to rely less on issuing equity and maintain their distribution coverage are acting thoughtfully with the best interests of their investors. To that end, Oneok (OKE) announced that they don’t anticipate issuing any equity at their MLP, Oneok Partners (OKS) until well into 2017. Their distribution coverage at OKE is expected to rise to 1.3X. It currently yields 10.2%. OKS yields 10.9% (both based on trailing distributions).

MLPs are reconciling their growth plans with the constrained appetite of investors to provide financing. MLP investors don’t tend to trade their positions that frequently because the tax deferral benefits grow over time for direct investors. Selling causes the recapture of income previously received and a corresponding tax liability. Their long term investment horizon is rare today, with so much focus on the near term trend. OKE and OKS are recognizing the multi-year partnership with their investor base and behaving in a way that’s consistent with retaining their stakeholders.

The lifting of the U.S. ban on oil exports was quickly followed by an announcement by Enterprise Products (EPD) that it would provide pipeline and marine terminal services for the export of domestic, light crude. The first shipment is expected next month. It’s not a game-changer for midstream infrastructure, but is clearly good for them as well as for domestic crude oil producers.

We have concluded that an overlooked but important factor behind the collapse in MLP prices this year relates to capital flows and the investor base. In our first blog of 2016 we will publish a more detailed analysis of why understanding MLP capital flows is important and what it means for the sector going forward.

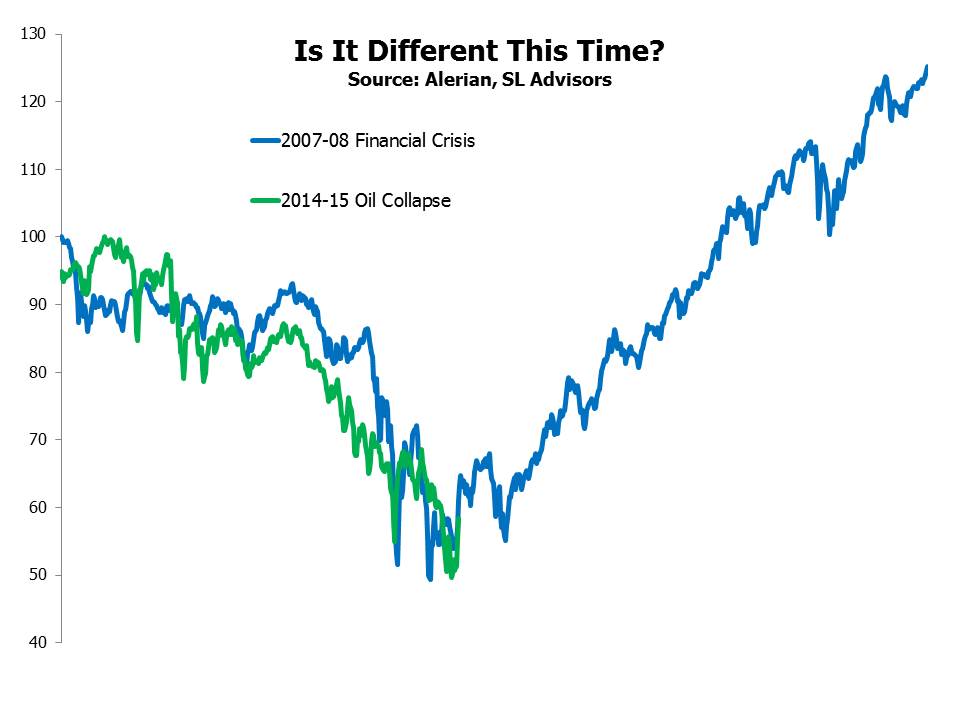

The chart below lines up the Alerian Index as it performed through the 2007-08 Financial Crisis and subsequent rebound with its performance through the crude oil collapse of 2014-15. An optimistic visual interpretation might suggest better days are ahead. We’ll see.