A Good Week For The Fed

Financial advisors probably feel that they’re more than earning their pay recently. Market volatility is high, which means clients want to know what’s going on. Advisors have in the past confided to me that one of their most important roles is to persuade clients from selling impetuously. Their original asset allocation was made after much careful consideration and ought not to be tinkered with just because the market’s moved a bit. Friday’s rally helped, but the S&P500 is still -15% for the year. If you have energy exposure, you’ll have done better.

Global stocks registered their sixth straight weekly decline, the longest streak since 2008. This is a testing environment for financial advisors.

By contrast, Fed chair Jay Powell can look back at the ten days following the last FOMC meeting, 0.50% rate hike and press conference with some satisfaction. Investors won’t hear it said this way but engineering an orderly fall in stock prices is one of the Fed’s goals. Former NY Fed president Bill Dudley, no longer burdened by the requirement to speak responsibly as a senior Fed official, has warned that the Fed’s going to tighten financial conditions enough to push up the unemployment rate (see Criticism Of The Fed Goes Mainstream).

The Fed’s reinterpreted mandate places greater importance on achieving maximum employment. Powell hasn’t offered any warnings that unemployment needs to rise. In a fascinating excerpt from his press conference, he noted that job openings were equal to almost twice the number of unemployed, and said they were trying to reduce this imbalance. A perfect outcome for the Fed would see a drop in job openings without a commensurate increase in unemployment, making possible the vaunted “soft landing”.

When you also consider the FOMC’s Summary of Economic Projections expecting unemployment to remain at 3.6% through 2024, this is further evidence that they are prioritizing continued full employment. They’ve been criticized for this by Larry Summers among others, because it seems inconsistent with simultaneously reducing inflation to 2.3% over the same time period.

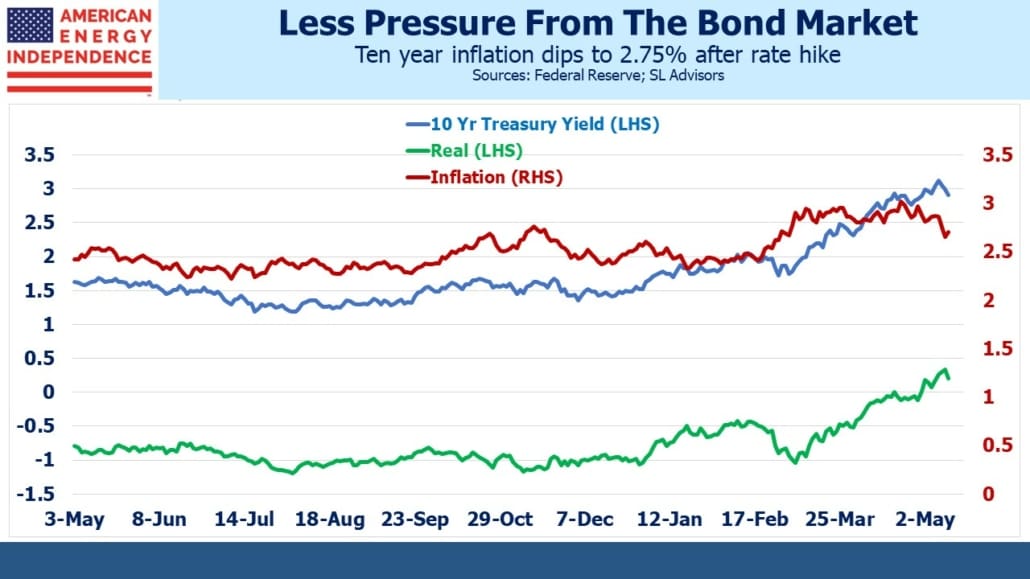

The bond market became a little more convinced that the Fed will pull this off. Although the CPI and PPI reports showed prices continue rising at a fast clip, ten year inflation expectations derived from TIPs dipped to 2.74%, having recently touched 3%. Since CPI, which is the index TIPs follow, typically runs 0.3-0.4% higher than the Fed’s preferred Personal Consumption Expenditures index, they can plausibly conclude that investors are buying the narrative that inflation will return to 2% within a couple of years.

It doesn’t look like a good bet to us. The FOMC is dovish. The disinflationary effects of globalization are petering out. And the US fiscal outlook requires higher inflation so that negative real rates can ease the burden of our growing debt.

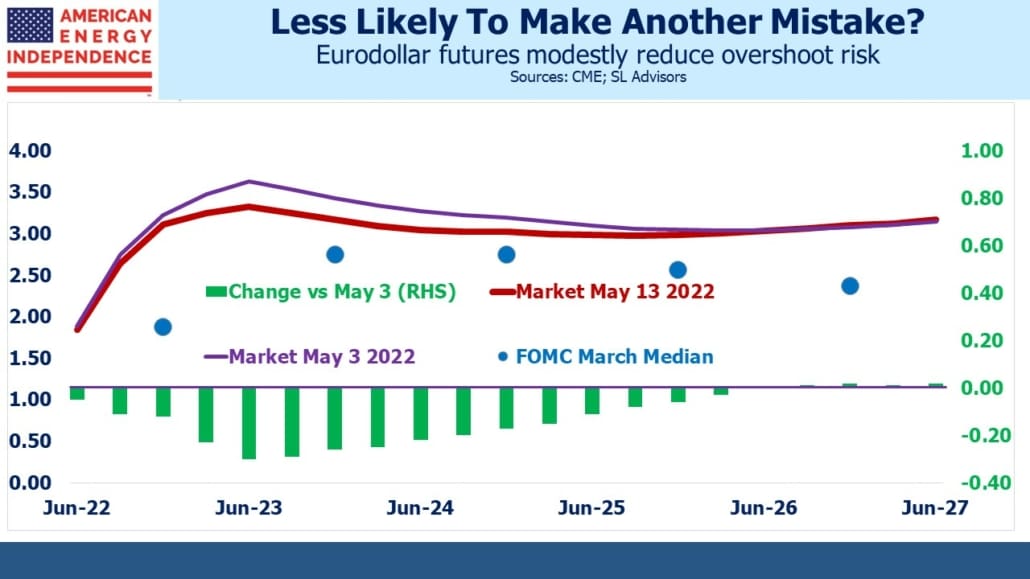

Moderating inflation expectations have caused the twos/tens spread to widen and moderated the inversion that exists in part of the eurodollar futures curve. An inverted yield curve is a forecast from the market of a looming failure of monetary policy, implying an overshoot in tightening that would require it to be reversed.

Hoping that reduced job openings will be sufficient to cool the economy, as Powell seemed to suggest during his press conference, seems wildly optimistic with no historical precedent. Raising rates beyond the 2-3% range the FOMC believes is neutral seems certain to require a pause to assess whether prior hikes are already having an effect.

At his press conference Powell explained, “So what that really means is, to get the kind of labor market we really want to get, we really want to have a labor market that serves all Americans, especially the people in the lower income part of the distribution, especially them.” This is a laudable public policy objective, if a dubious addition to the Fed’s objectives. Monetary policy is notoriously slow and blind to the individuals it impacts. Hence the eurodollar futures curve should be priced for cautious rate hikes next year that lower the odds of requiring a reversal.

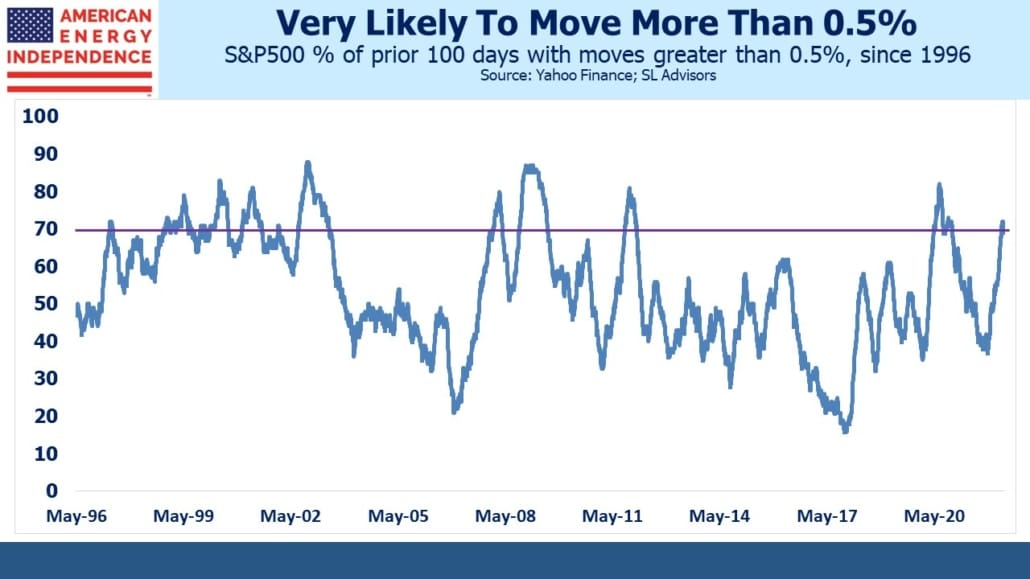

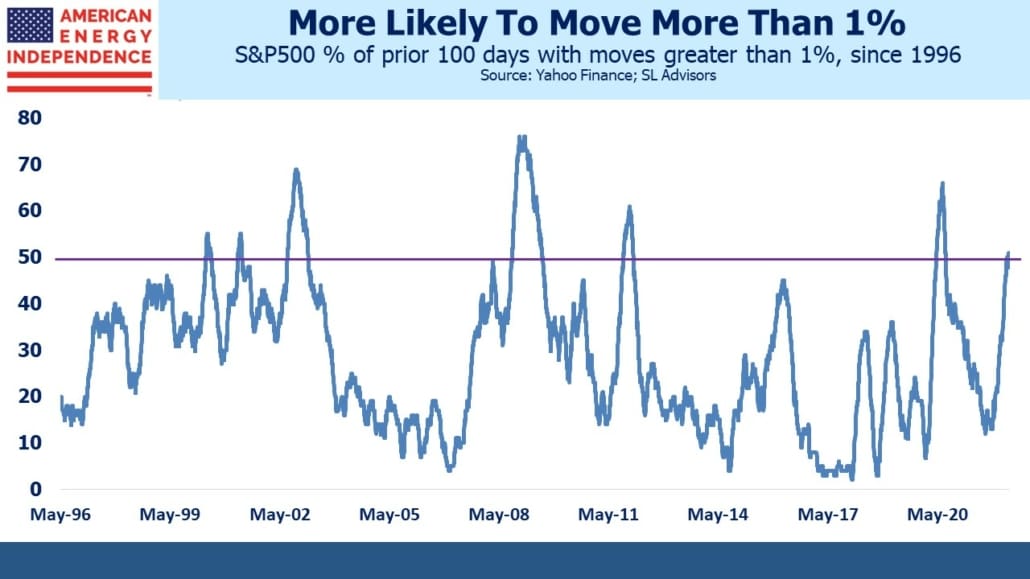

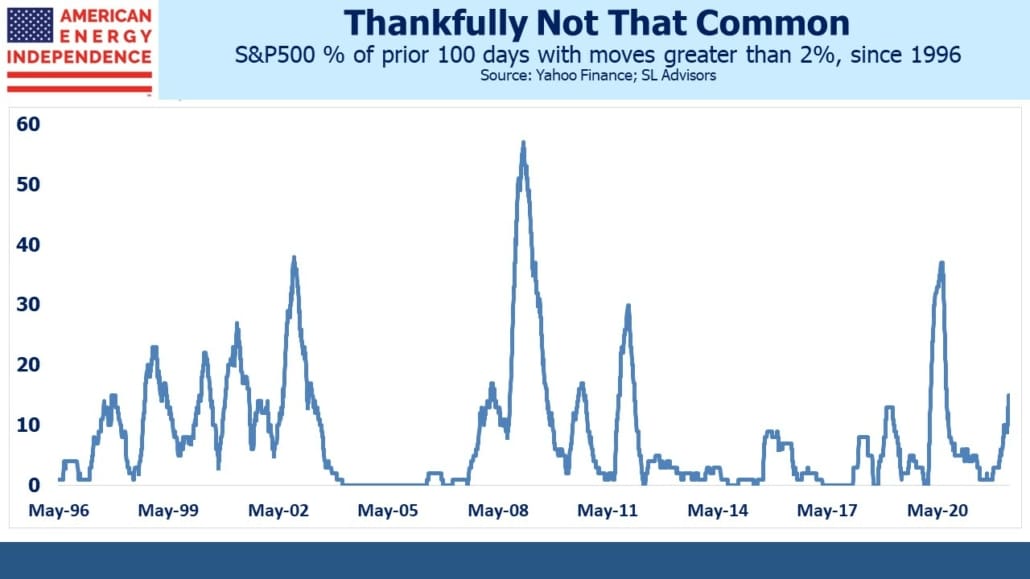

I was chatting with an investor on Friday about the increasing incidence of 1% daily moves in the S&P500. Such moves are now more likely than not based on the past 100 trading days (see Pipelines Are Less Volatile Than You Think). He found it an interesting way to think about volatility, one that’s easily intuitive. Such 100 day regimes have existed only 8% of the time over the past quarter century.

Daily moves greater than 0.5% currently occur 70% of the time. 100 day periods like this have existed less than a fifth of the time.

2% daily moves remain uncommon but are creeping up, currently 15% of the last 100 trading days (including the 3.2% drop on Monday 9th).

Even if increased volatility doesn’t lead to lower stock prices, it probably tempers exuberant economic activity. The University of Michigan’s consumer sentiment survey registered its lowest reading since 2013, with inflation cited as the biggest area of concern. Long term inflation expectations remained at 3%, slightly above the rate derived from ten year treasury securities.

In sum, lower stock prices, a steepening yield curve and falling long term inflation expectations are a positive grade on the FOMC’s report card. Investors may not feel quite as sanguine after another volatile week, but Jay Powell might permit himself a moment of quiet satisfaction.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.