MLPA Conference Attendees Cautiously Assess the Future

Last week was the annual Master Limited Partnership Association (MLPA) Conference, held in Orlando, Florida. Conferences held in the Sunshine State in June undoubtedly receive a discounted rate compared with January – perhaps some frugality was appropriate given last year’s sector performance. Many were happy simply to have survived the 2015 Crash with their businesses still intact. The Hyatt Regency is a vast facility, although within such a cavernous venue the 10-20% drop in attendance meant it was never crowded, reflective of MLPs remaining an out of favor sector. While there were certainly no signs of a bubble, I can personally attest to the high quality hors d’oeuvres and how they helped promote warm feelings among attendees at the end of each day.

![]()

Although events revolve around the formal presentations made by MLP executives, far more useful is the opportunity for more intimate meetings with key individuals running our portfolio companies as well as comparing views with other industry professionals. While most MLPs were represented, a notable absence were Energy Transfer and Williams Companies (WMB). They no doubt concluded that questions would revolve around their contentious merger which has generated multiple lawsuits, and since there’s probably little they can say on the matter there was no point in being there. They were a subject in countless conversations though.

Energy Transfer CEO Kelcy Warren has drawn widespread opprobrium for the recent convertible preferred issue that dishonestly transfers wealth from Energy Transfer Equity (ETE) investors to management (see Is Energy Transfer Quietly Fleecing Its Investors?). WMB has already filed suit on the matter, although their interest in its resolution will drop once the bigger question of the proposed merger is concluded. But conference participants widely derided ETE’s newly granted securities as self-dealing, even fraudulent. It would seem likely that others will sue ETE over this issue if it’s not resolved by WMB. ETE’s ability to credibly engage other managements on possible combinations in the future has been damaged, perhaps irreparably. The question for Kelcy Warren is whether his legacy will include amassing great wealth in part by defrauding his investors. We monitor developments with interest.

One participant noted that there were more bankers in attendance than actual investors, no doubt reflective of the sharp drop in capital markets activity in recent months. M&A deals haven’t occurred in sufficient quantity to fill the gap in bankers’ fee income, as the common refrain about overly wide bid/asks on possible transactions was widely blamed. The same search for transactions attracted an abundance of lawyers, including fifteen from one firm.

In recent years the midstream sector responded to the Shale Revolution with sharply increased growth plans. Much of this was a logical reaction to the huge increase in domestic hydrocarbon production. However, several management teams noted that this put pressure on cashflows since projects must be financed before they generate any return. They attributed the 2015 collapse to this as well as a tendency to “just-in-time” finance, in that equity capital is raised only when actually needed rather than at the inception of a project. The downturn exposed balance sheets in a way that won’t soon be forgotten, and a more conservative approach to funding projects is likely to be the industry norm.

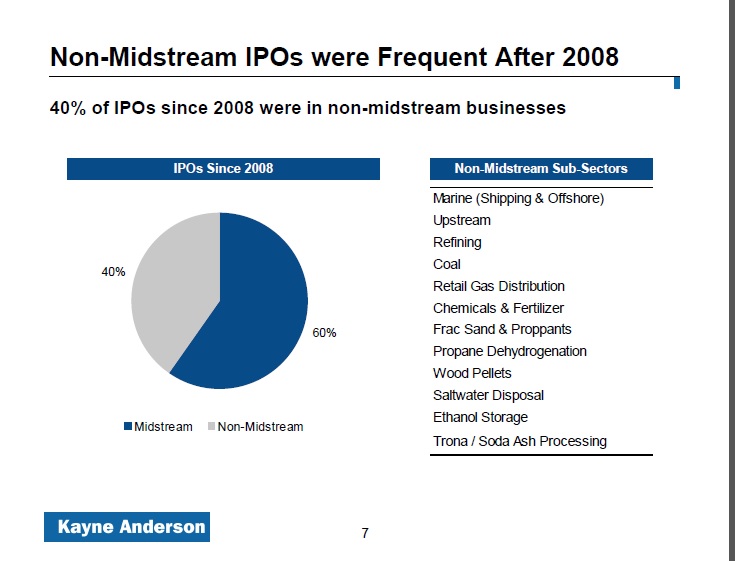

A panel discussion titled “Is the MLP Model Broken” predictably concluded it wasn’t, but a slide from Kevin McCarthy at Kayne Anderson (reproduced below) showed how far from home some underwriters had strayed, with 40% of IPOs since 2008 being non-midstream. Midstream is all we invest in, and most of the 40% non-midstream issues should never have been offered in the MLP structure. Their subsequent performance was a whopping 37% worse than midstream IPOs – examples include recently bankrupt Linn Energy (see Why Linn Energy Was the Wrong Kind of MLP).

The overall atmosphere was cautiously positive, in the same way that surviving a near-death experience makes one appreciate even the mundane. Churchill once noted there was nothing more exhilarating than to be shot at and missed. Such might accurately reflect the emotions of MLP investors following last year’s crash. Just being at an MLP conference provides welcome proof of one’s continued financial existence.

As mentioned, the smaller meetings with senior management of companies in which we’re invested were far more useful than the formal presentations in the enormous ballroom. EnLink Midstream (ENLC), Western Gas Equity Partners (WGP), Plains GP Holdings (PAGP), Crestwood Equity Partners (CEQP) and SemGroup (SEMG) were among those who provided helpful additional information as well as confirmation of their appropriateness in our investment portfolios. Although such interactions are governed by “Reg FD” to ensure all relevant information is fully disclosed to all investors at the same time, it’s still possible to draw insights about strategy with well-crafted, open-ended questions. Asking a CFO what element of their business is least appreciated by most investors can produce useful insights.

Over the past several months increasing concern has been voiced about the enforceability of gathering contracts by midstream MLPs on oil and gas drillers facing bankruptcy. On this question anecdotal feedback overwhelmingly supported the conclusion that hydrocarbon production not dispatched through its contracted gathering and processing infrastructure has few good options. No bankrupt E&P company will induce a new G&P provider to build new infrastructure following a contract dispute with its existing G&P firm. The midstream MLP in such cases holds the stronger negotiating hand. One banker reported to me that he had an MLP borrower with two E&P customers in bankruptcy and he wasn’t worried; even in bankruptcy they’d still need cashflow, and continuing production was the only plausible way to generate it.

The cautiously optimistic tone from a crowd largely chastened by last year’s crash reflected little complacency and a conviction to avoid some of the overly ambitious growth that occurred in the recent past. This should provide a solid foundation for returns in the future.

We are invested in CEQP, ENLC, ETE, PAGP, SEMG and WGP