Energy Transfer's Kelcy Warren Thinks Like a Hedge Fund Manager

Last Monday, June 22nd, Energy Transfer Equity (ETE) went public with their rejected merger proposal to Williams Companies (WMB) in an effort to force WMB to the negotiating table. WMB’s stock rose by most of the 32% premium ETE has offered, and in recent days has held on to most of that gain as the market has assessed likely outcomes. ETE’s presentation highlights the synergies of such a combination. Another comforting fact is the ownership of WMB stock by hedge funds Corvex and Soroban, who hold 5.6% and 2.8% respectively. Corvex has not always been a positive influence for stockholders, and last year we wrote about the “Corvex Discount” that should apply to any stock they own (see Williams Companies Has a Corvex Discount). However, in spite of this we are long-time investors in WMB. It’s worth noting that Corvex and Soroban are on WMB’s board, so their views will be a factor in any decision.

The headlines will focus on developments at WMB as they consider their strategic options in light of ETE’s interest in them. We think WMB is likely to move higher as a result. What’s drawn less attention is the likely outcome for Williams Partners (WPZ), the MLP that WMB controls as its GP. On May 13th, WMB announced plans to acquire the outstanding units of WPZ, in a transaction intended to boost WMB’s dividend growth in part through tax gains from depreciating the newly acquired assets from a higher valuation. It’s the same technique used by Kinder Morgan last year to fuel faster distribution growth at KMI when they announced plans to combine Kinder Morgan Partners, El Paso and Kinder Morgan Management into one entity (see The Tax Story Behind Kinder Morgan’s Big Transaction). The tax insight KMI had was that acquiring assets from a limited partnership allows them to be revalued at the purchase price, and thereafter depreciated against taxes from this higher level. The practical consequences were $20 billion in tax savings for KMI which helped fuel a doubling of their forecast dividend growth to 10%, and an unexpected tax bill for Kinder Morgan Partners unitholders since the transaction resulted in a sale of their LP units not necessarily at a time of their choosing.

WMB’s previously announced plan to acquire outstanding WPZ units is also driven in part by this favorable tax treatment. However, ETE’s merger proposal is conditional on WMB dropping its announced plans to buy WPZ. ETE doesn’t want that transaction to go through. As a result, although WMB’s stock rose substantially following the announcement, the price of WPZ units fell.

To understand why, you have to regard MLPs as hedge funds and MLP GPs as hedge fund managers, a view we’ve long articulated and one evidently shared with the senior managers of many MLPs (see Follow the MLP Money). If you want to control the assets of a hedge fund, you do that by controlling the hedge fund manager, not by investing in the hedge fund. Similarly, Kelcy Warren (ETE’s CEO) understands that to control the assets owned by WPZ he need only control WMB’s GP, not WPZ itself. Under this analysis, paying a premium to acquire WPZ units may not be the best use of capital, and in fact leaving WPZ as a publicly traded MLP (albeit with two thirds of its LP units owned by WMB) provides optionality. If WPZ’s cost of capital falls, ETE may drop assets into it where they can be cheaply financed. Or, if WPZ’s yield remains high they may retire some LP units. Having WPZ remain out there is, in ETE’s view, a good thing. It shows that the decisions get made by the owners of the MLP GPs, not the MLP unitholders themselves. As we’ve said before, the MLP GP is like a hedge fund manager.

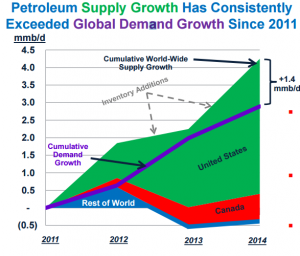

wn. Moreover, North America has met more than 100% of this increase in global demand, since output in the rest of the world has net fallen somewhat. This simple graphic illustrates as well as anything that the Shale Revolution in the U.S. has not just been a North American story but has impacted the global oil market, most obviously through the drop in prices since last Summer.

wn. Moreover, North America has met more than 100% of this increase in global demand, since output in the rest of the world has net fallen somewhat. This simple graphic illustrates as well as anything that the Shale Revolution in the U.S. has not just been a North American story but has impacted the global oil market, most obviously through the drop in prices since last Summer.