Activist Update

Activist hedge funds can be a positive force. Although this isn’t always true (Keith Meister of Convergex so abused ADT investors that his actions caused us to apply the “Corvex Discount” to other stocks in his viewfinder), it’s probably more often than not beneficial to existing investors when a hedge fund shows up.

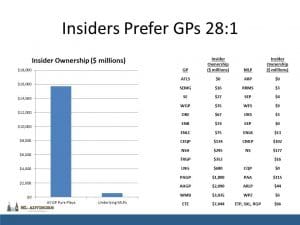

The most recent case involves Tetra Technologies (TTI), about which we wrote a few weeks ago as an example of the power of the MLP General Partner. Dimitri Balyasny just filed a 13G (indicating a passive stake) in TTI and a 5.3% investment. Acquiring 4.3 million shares of TTI is quite a trick, considering their average daily volume of under 1 million shares.

Other activist-owned stocks of interest to us that were recently in the news include Dow Chemical (DOW), which last week announced the sale of its chlorine business (DOW shareholders will own 50.5% of the resulting chlorine business with Olin Corp). Hedge fund Third Point has been a long-time advocate for value-enhancing moves. Another is Hertz (HTZ), which is owned by a virtual who’s who of hedge funds including funds run by Carl Icahn, Larry Robbins, Jeffrey Tannenbaum and Barry Rosenstein. HTZ has been recovering from some self inflicted wounds including accounting mistakes, poor pricing strategy and the relocation of its headquarters to Naples, Florida so as to be close to the (now former) CEO’s golf club. The persistent lethargy in HTZ’s stock price shows that it takes more than four activist investors to raise the price. However, moves in recent months to hire new management are positive signs. Today Morgan Stanley lifted its sell recommendation.

We are invested in TTI, DOW and HTZ.