Litigating Away From a Cleaner Future

Earlier this month I visited a good friend and client in London where he invited me to address some Summer interns about what we do. In the first moments I was asked if I’d considered the moral aspects of enabling fossil fuel use. Recently armed by Alex Epstein (see The Moral Case for Fossil Fuels), I was able to parry by challenging them to define the metric by which energy use should be justified. Greater use of fossil fuels has led to enormous benefits for humanity (the only proper metric). Draconian cuts in fossil fuel use as advocated by some simply mean rationing energy. Developing nations use less energy than America and suffer shorter life expectancy as a result. Energy improves lives in countless ways.

When U.S. Secretary of State John Kerry advised Indonesians in 2014 to insist on clean energy while 31 million of them can’t access clean water, he was not occupying the high moral ground. Hygiene requires energy. Debating such issues with young college students is wonderfully stimulating; this group was smart and quickly willing to consider views that they initially perceived as unconventional. It’s impossible to leave such exchanges with anything other than a very positive outlook for the future.

Every rational person cares about the environment. However, sometimes those who describe themselves as “Environmentalists” hold an absolutist view that in its extreme formulation works against the very goals they strive for.

When the Federal Energy Regulatory Commission (FERC) approves a pipeline, they are usually required by Federal law to prepare an Environmental Impact Statement (EIS). This examines the impact on the surrounding area of building the pipeline, and assesses whether it’s in the public interest to proceed. Although the Sierra Club pursues many admirable goals, a recent legal challenge to a FERC-issued EIS reflects the practical challenges of being a purist.

Last month, the Sierra Club successfully argued in the U.S. Court of Appeals (DC Circuit) that an EIS should include the impact of burning the natural gas moving through a pipeline. Currently, FERC only considers the direct impact of pipeline construction. The Court found that the emissions from burning the natural gas delivered by the pipeline also needed to be considered in the EIS. The project in question is the Southeast Market Pipelines Project (SMPP) and it is already in operation transporting natural gas to Florida from points west. It’s possible the SMPP network may at some point be forced to suspend operations, although for now the legal battle continues and may even reach the Supreme Court. But the results won’t necessarily meet the Sierra Club’s goals.

Put aside the chilling impact on future infrastructure investment of a project approved by the regulator that might yet be hampered by legal challenges, even following completion. The Sierra Club, by opposing ALL fossil fuels (as well as nuclear power), makes their goal of a fully solar/wind energy sector Utopian, even farther out of reach.

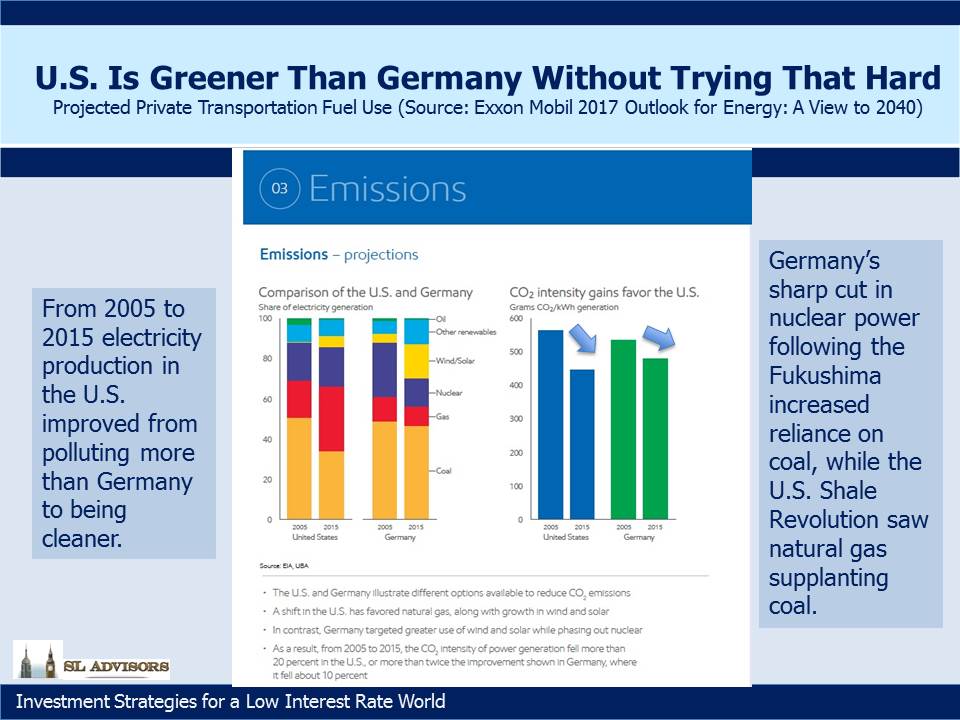

Recent history shows that natural gas has helped the U.S. achieve cleaner electricity production than Germany, a proud champion of renewable energy. As we wrote earlier this year (see It’s Not Easy Being Green), because it’s not always sunny and windy, solar and wind rely on conventional sources of power to provide baseload supply. There’s still no commercial technology to store electricity from sunny days for use at night. In the U.S. that baseload is increasingly from natural gas, which is replacing coal over which it enjoys substantial emission advantages; not just less CO2 but no Sulfur, Mercury or other nasty particulates. What Germany is finding is that because their baseload reflects a higher mix of coal, the positive effects of sunny, windy days are being offset.

Although it’s known as the Sunshine State, today Florida uses very little solar. Only 2.4% of its electricity comes from renewables (mostly biomass). However, that is changing and Florida Power and Light (FPL) is adding 2,100 MW of new solar capacity by 2023. Duke Energy Florida plans to add 700 MW by 2021. In June, Florida’s power plants produced 21,611 GWH of electricity. The 2,800MW of solar capacity additions noted could, if run at 100% of capacity 24X7, represent 10% of Florida’s electricity.

But they won’t, because even Florida is not permanently sunny. Solar’s intermittency means lower utilization than gas or coal plants and creates a symbiotic relationship with other, reliable sources of power. The Shale Revolution has unlocked enormous reserves of natural gas, and its abundance has led directly to a preference by utilities to switch away from coal. Across America, power stations have been exploiting this huge advantage to achieve significant improvements in emissions. This success is all the more remarkable when you consider that the Federal government is ambivalent at best about adopting formal goals to reduce emissions.

There’s a certain intellectual incoherence in opposing a source of energy that enables wider use of renewables and is already driving emissions down. FPL needs reliable power in order to use solar. Coal doesn’t travel through pipelines and can be moved by truck or rail without requiring a FERC EIS that is subject to a legal challenge. Coal still provides 15% of Florida’s electricity. An unintended consequence of the Sierra Club’s well-intentioned single-mindedness may be a longer reliance on coal than would be otherwise necessary.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!