Hedging MLPs

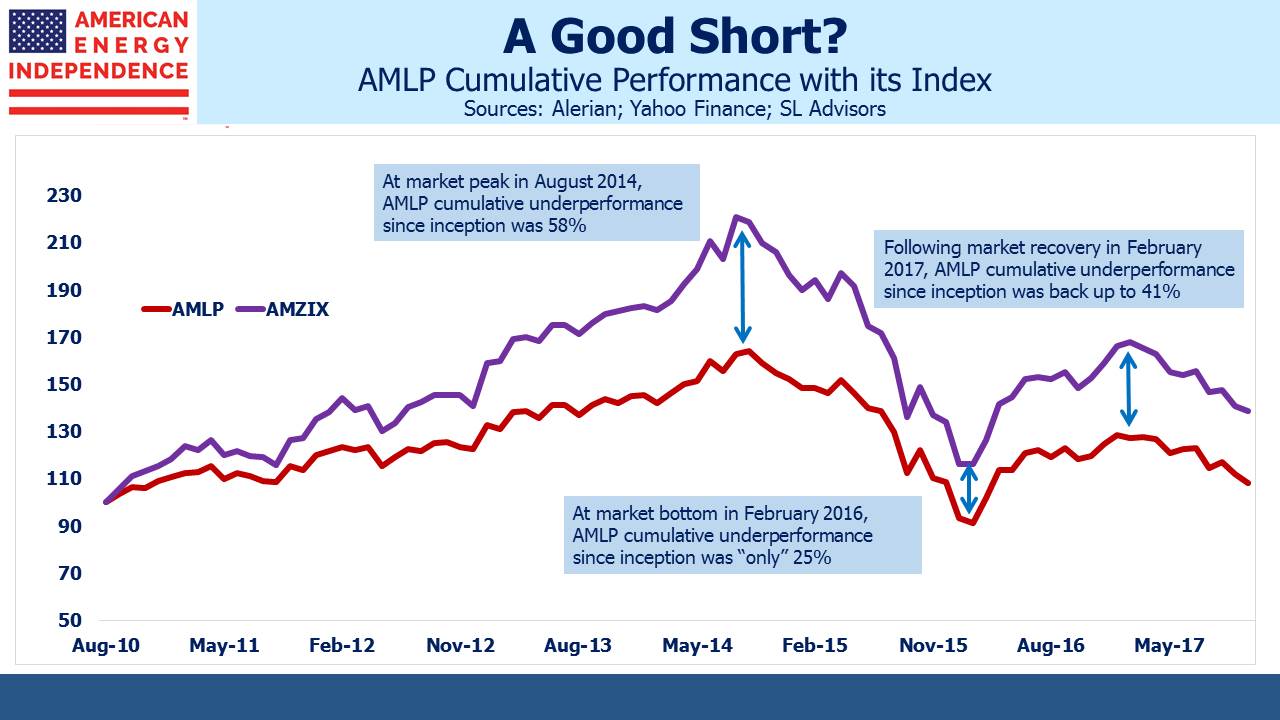

It’s not easy to hedge energy infrastructure stocks or MLPs. The relationship with crude oil is unreliable. There’s no MLP futures contract, and if you think the K-1s that come with owning MLPs are onerous, try shorting one and see how complex the tax reporting can be. The past few months has been a time when hedging such exposure would have reduced a lot of angst. For those interested in protecting against short term adverse price moves without completely foregoing upside, shorting the Alerian MLP ETF might make sense. We’ve written before about the tax drag that faces owners of AMLP (see Are You in the Wrong MLP Fund and Some MLP Investors Get Taxed Twice). This comes about because AMLP is a C-corp, rather than a Regulated Investment Company (RIC). Most ETFs and mutual funds don’t owe corporate tax, but AMLP does, at least when it makes money. When it’s down, its taxes owed are reduced. If it’s +1% pre-tax, its NAV will move up 1% less taxes owed. If it’s -1% pre-tax, its NAV will fall less than 1% because it’ll get a credit for owing less in tax. This makes AMLP less volatile than its index (the Alerian MLP Infrastructure Index) most of the time, since the taxes owed rise and fall with the market. However, it’s generally bad for owners because the taxes have contributed to AMLP lagging its index by 2.6% annually since inception in 2010, a cumulative 31%. It does best in a falling market, but since the point of owning it is to profit from the sector rising, the tax drag hurts. AMLP probably has the worst track record in the history of passive ETFs.

There’s an added wrinkle though, which is that taxes are only owed on unrealized gains. When the market falls enough to wipe those out, the tax issue temporarily disappears. Unrealized losses don’t create any tax benefit, so AMLP just roughly follows its index with similar volatility. What’s interesting is we’re close to an inflection point, in that we estimate AMLP’s unrealized losses will swing to unrealized gains with 5-6% further rally in the sector. As it crosses the line from losses to gains, AMLP will once again be subject to tax drag. So we’re close to a point at which it falls with the market but rises less than the market. Hedge funds were widely believed to be using AMLP to short the sector in just this fashion two years ago. This asymmetry could make it an interesting short position today. Its $9.5BN market cap means it isn’t hard to borrow. It could be used to hedge an existing portfolio of energy infrastructure securities, or even paired with a RIC-compliant not subject to corporate tax. The lower corporate tax rate will not alter AMLP’s taxable status, but will reduce its magnitude. Its future volatility will also rise closer to that of its index. Its value as a short position highlights its poor use as an investment, so if you’re simply long AMLP, the chronic history of underperformance will continue to work against you. We are short AMLP