An Expensive, Greenish Energy Strategy

Most of the U.S. has been unseasonably cold – enduring twelve consecutive days of sub-freezing highs in New Jersey while owning a home in SW Florida is your blogger’s self-inflicted wound. The pain is only slightly ameliorated by news of record natural gas consumption of over 140 Billion Cubic Feet (BCF), almost twice the annual daily average.

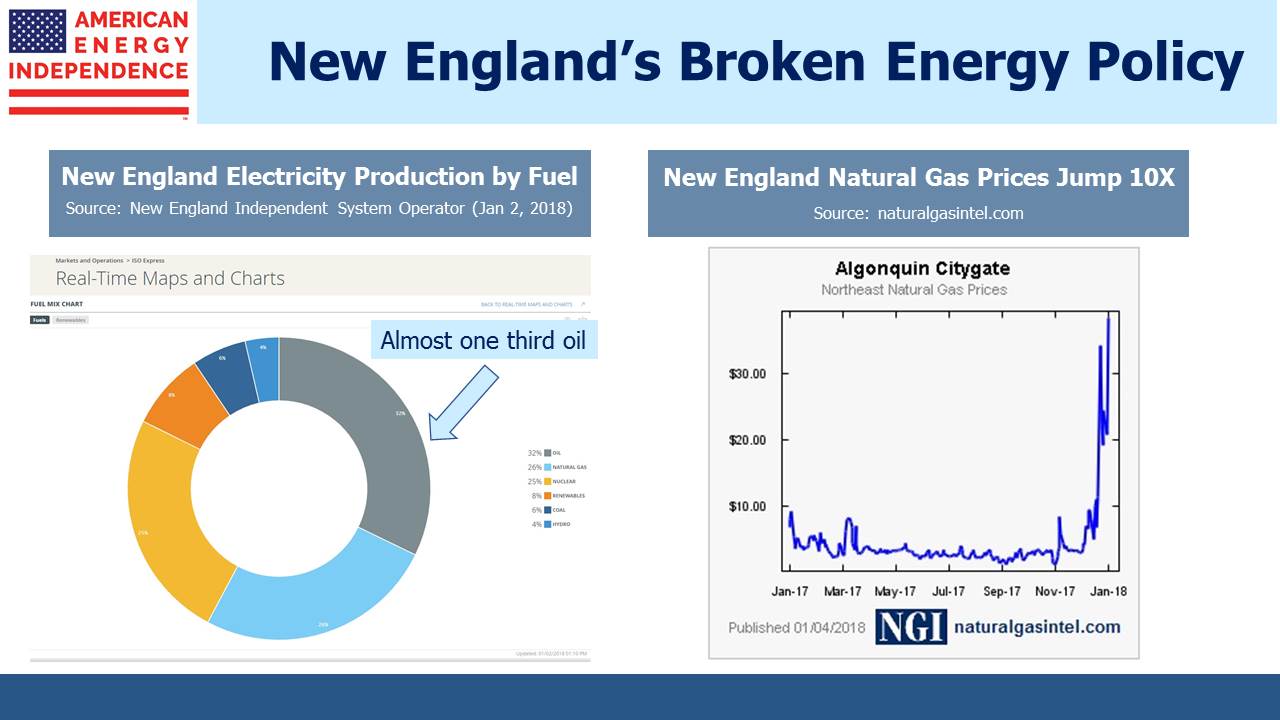

You’d think that would be enough to satisfy demand, but the extended cold weather has exposed gaps in New England’s energy strategy. The region’s desire to increase its use of natural gas for electricity production is not matched by enthusiasm for infrastructure to get it there. Consequently, prices reached $35 per Thousand Cubic Feet (MCF) recently, roughly ten times the benchmark. Even at that price sufficient quantities weren’t available where needed, with the consequence that burning oil was the biggest source of electricity generation during this period.

In many cases, environmentalists’ views on natural gas are self-defeating. As a replacement for coal it surely reduces harmful emissions, and the widespread switching of coal-burning power plants for gas-burning ones represents a great success for environmentalists — for all of us. U.S. electricity generation is cleaner than in Germany (see It’s Not Easy Being Green). The New England Independent System Operator (ISO) has increased natural gas usage from 15% of electricity generation in 2000 to where it’s the most used fuel (other than very recently). They correctly note that natural gas supports increased use of renewables, since wind and solar power are intermittent.

It should be a good story, except that the ISO’s increasing reliance on natural gas is opposed by environmentalists blocking the necessary additional infrastructure. In the last couple of years Kinder Morgan (KMI) and Enbridge (ENB) both cancelled projects that would have improved natural gas distribution and storage in the region. This was because of adverse court rulings, and regulations that dis-incentivize utility customers from making the necessary long term purchase commitments, without which infrastructure doesn’t get built.

As well as enduring the highest natural gas prices in the country, Massachusetts also imports Liquified Natural Gas (LNG). New England relies on LNG for 20-40% of its natural gas needs during winter. The Jones Act is a Federal law which requires intra-U.S. shipping to be carried out on U.S. owned, built and crewed ships. It’s expensive, and although this point is not the fault of Massachusetts, it means they’re importing LNG from Trinidad, even though the U.S. exports some of the cheapest LNG in the world. There’s little natural gas storage in the region, because the geology doesn’t support underground storage and opponents have prevented construction of above-ground facilities. Consequently, LNG is imported to Boston when needed in the winter, as long as a winter storm doesn’t disrupt shipping.

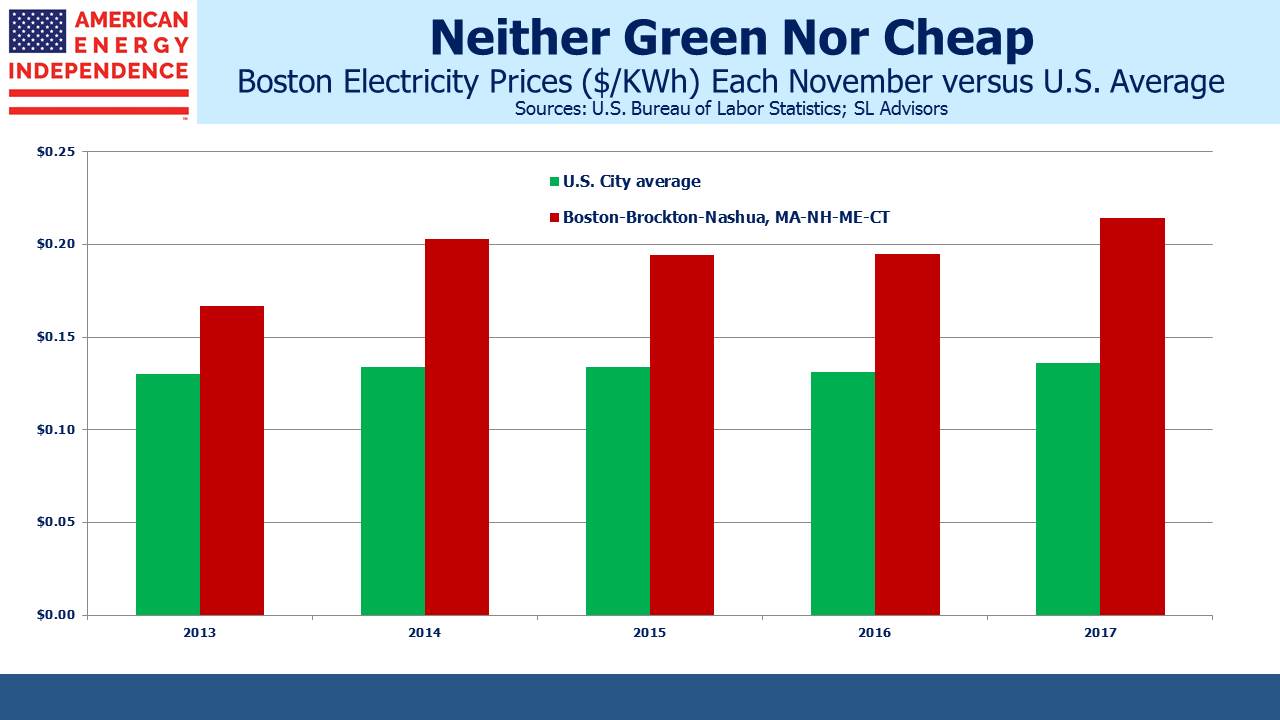

The high prices for natural gas in New England aren’t the only problem though. The recent jump in oil use for electricity generation is hardly consistent with lowering emissions. Meanwhile, New England’s ISO is warning that infrastructure development is inadequate, which risks the reliability of the electricity supply and in extreme cases may result in “controlled power outages”. The U.S. Bureau of Labor Statistics reported that in November 2017 the Boston area paid 57% more for electricity than the U.S. average, compared with only 28% more five years ago. It’s not just a winter problem. For 2017 (through November) Boston prices were 175% of the national average. New England is a wonderful region of the U.S., but its residents are poorly served by a dysfunctional energy strategy.

On a different topic, global auto sales exceeded 90 million units for the first time last year. China was 25% of the total. 2018 is likely to be another record. This is why the International Energy Agency is forecasting a 1.3% increase in crude oil demand this year.

The investable American Energy Independence Index (AEITR) finished the week +2.7%. Since the November 29th low in the sector, the AEITR has rebounded 12.4%. For most of 2017 the strength in Utilities contrasted with energy infrastructure weakness. However, this relationship has sharply reversed, with the Utilities Sector SPDR ETF (XLU) falling 9.3% since the late November low in AEITR. In mid-November we highlighted the poor relative valuation of the Utility sector (see Why the Shale Revolution Hasn’t Yet Helped MLPs). As the Administration announced plans to open up most of the offshore U.S. for oil and gas exploration, Interior Secretary Ryan Zinke declared, “We’re going to become the strongest energy superpower.”

We are invested in ENB, LNG and KMI.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Also potentially worth noting the shutdown of the nuclear power plants in the North East. We do not have very much left up here.