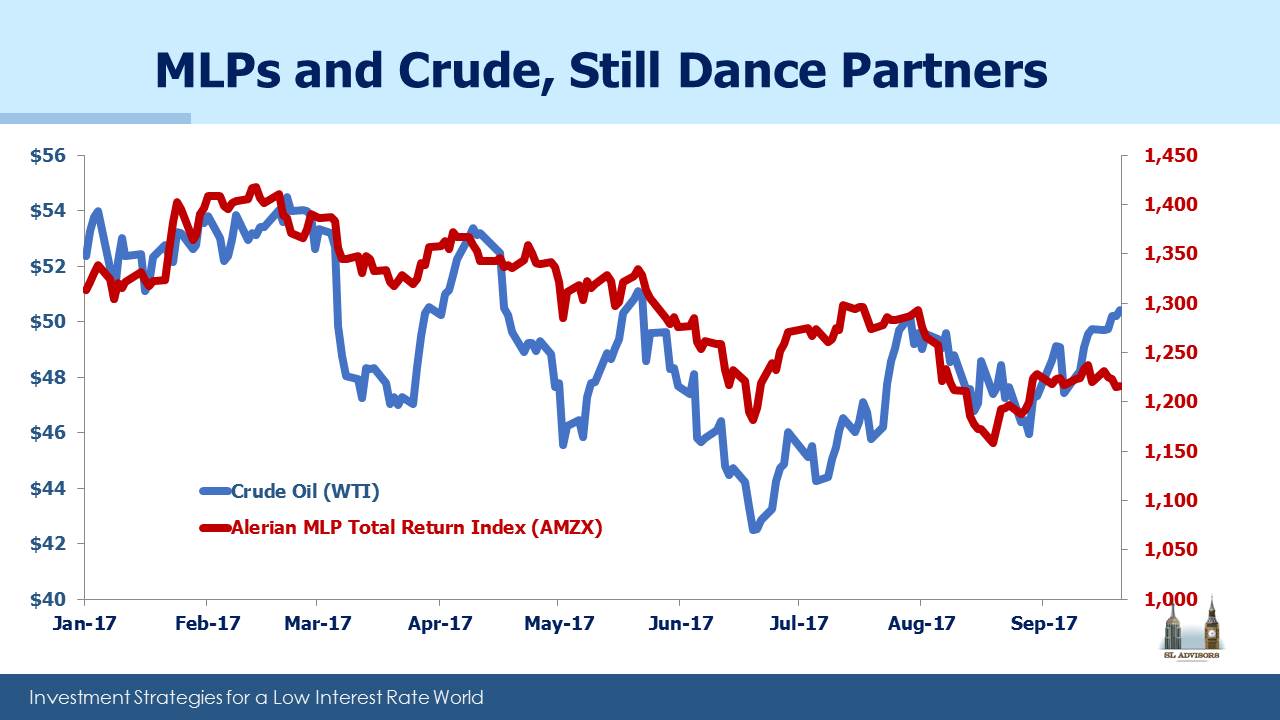

Crude and MLPs March Higher Together

For the first half of the year crude oil prices moved irregularly lower before bottoming in June, since when they’ve moved smartly higher. Master Limited Partnerships (MLPs) have roughly followed this path, and have also moved smartly higher in recent weeks. Non-crude cashflows drive MLP operating performance, but crude drives investor sentiment. No amount of typing by this blogger will shake the relationship between the prices of MLPs and crude.

Interestingly though, U.S. crude oil production has continued to grow all year, seemingly impervious to prices. From 8.85 Million Barrels a Day (MMB/D) in January, output reached 9.2 MMB/D in June. Hurricane season caused a slight late Summer dip in the Gulf of Mexico, but the Energy Information Administration (EIA) is forecasting an average of 9.3 MMB/D for the full year. Production is therefore forecast to continue rising into 2018, for which the EIA is forecasting 9.8 MMB/D. That would eclipse the prior record of 9.6 MMB/D set in 1970. America is Great!

.avia-image-container.av-4xsm6p-1ff3149566031adbd1ec1a416f589b15 img.avia_image{ box-shadow:none; } .avia-image-container.av-4xsm6p-1ff3149566031adbd1ec1a416f589b15 .av-image-caption-overlay-center{ color:#ffffff; }

Longer term oil forecasts from both the EIA and the International Energy Agency (IEA) are for rising prices. The EIA’s International Energy Outlook 2017 models crude oil roughly $25 higher by 2020. The IEA goes even further, warning of the risk of a price spike by 2020. They cite growth in annual demand of 1.6MMB/D (around 1.7%) as well as too little new investment in new sources of production. They note that spare capacity (mostly OPEC) of 2 MMB/D doesn’t even cover two years of growth in demand, and expect OPEC to eventually abandon their production limits.

As an aside, a friend recently told me about an investor he knows who is convinced oil prices will collapse as consumers flock to electric vehicles (EVs) and shun the internal combustion engine. That is almost certainly not going to happen. In fact, depressed crude oil would be just about the worst thing for Tesla fans, because it would hurt their competitiveness. High oil prices combined with strong demand for EVs is a possibility; low oil prices and disinterest in EVs is another. Cheap gasoline will dampen the enthusiasm of those opting for environmentally-inspired transportation choices. Moreover, internal combustion engine technology improvements continue to reduce emissions, narrowing the gap with EVs.

The EIA expects overall energy use to grow worldwide even while energy intensity drops (meaning it’s used more efficiently for a given level of GDP). Other than coal, all sources of energy will see growing production with renewables growing the fastest. Non-OECD Asia is responsible for most of the forecast growth in energy consumption through 2040, including 80% of the growth in petroleum and other liquid fuels.

During the 2015 collapse in crude prices, U.S. production dipped but surprised many (including OPEC) at how robust it stayed. The drop in crude early this year didn’t seem to affect domestic output at all. We now seem to be moving into a period of rising prices combined with rising production. U.S. shale output just isn’t growing fast enough to satisfy the 1.6 MMB/D in new demand noted above as well as offset global depletion (estimated at 3-4 MMB/D annually; see Why Shale Upends Conventional Thinking). The world needs another 5-6 MMB/D in new supply, annually. Rising prices will stimulate shale drillers into more activity, but not enough to depress prices.

In presenting their latest forecast, IEA oil markets head Neil Atkinson conceded, “We underestimated the resilience of U.S. shale producers. We failed to understand the resilience. We failed to appreciate the technical ingenuity.” In other words, the IEA underestimated America. So did OPEC last year (see OPEC Blinks). Both the EIA and the IEA have had to recalibrate their models to reflect the ongoing success of U.S. shale (see Oil Forecasters Have to Work Harder).

Rising crude prices along with rising U.S. output could be just as potent for energy infrastructure stocks as the opposite combination was bad in 2015. Moreover, it’s not only crude output that is rising; the EIA is forecasting natural gas production to average 73.7 Billion Cubic Feet per Day (BCF/D) in 2017. This is up 1.4 BCF/D from 2016, and in 2018 a further jump of 4.4 BCF/D is expected.

Clearly, for the U.S. energy sector, its best days are still ahead.

Below is a new trademarked logo we have designed for our energy infrastructure business. We believe the Shale Revolution is leading to American Energy Independence, and our investment choices increasingly reflect the search for those businesses that will most clearly benefit. Expect to see more of this logo in the months ahead.

.avia-image-container.av-1x62v5-f033a7135b930eab2638efea138d2421 img.avia_image{ box-shadow:none; } .avia-image-container.av-1x62v5-f033a7135b930eab2638efea138d2421 .av-image-caption-overlay-center{ color:#ffffff; }