More on the Changing MLP Investor

Last week’s blog post, The Changing MLP Investor, received more interest than usual. There’s no shortage of research explaining why MLPs are cheap, but it seems few stop to consider the mindset of those who decline to act on this opportunity. Sometimes it’s more helpful to understand the non-buyers.

Following the collapse two years ago (see The 2015 MLP Crash; Why and What’s Next) the sector staged a strong recovery in 2016. However, over the last six months prices have sagged. Oil weakness earlier in the year was blamed, but in June crude began to recover and the previously high correlation with MLPs inconveniently fell. Prices for oil and MLPs are linked when sentiment dictates, but are economically not that close. Consequently, the relationship can weaken with little warning, revealing their transitory affinity for one another.

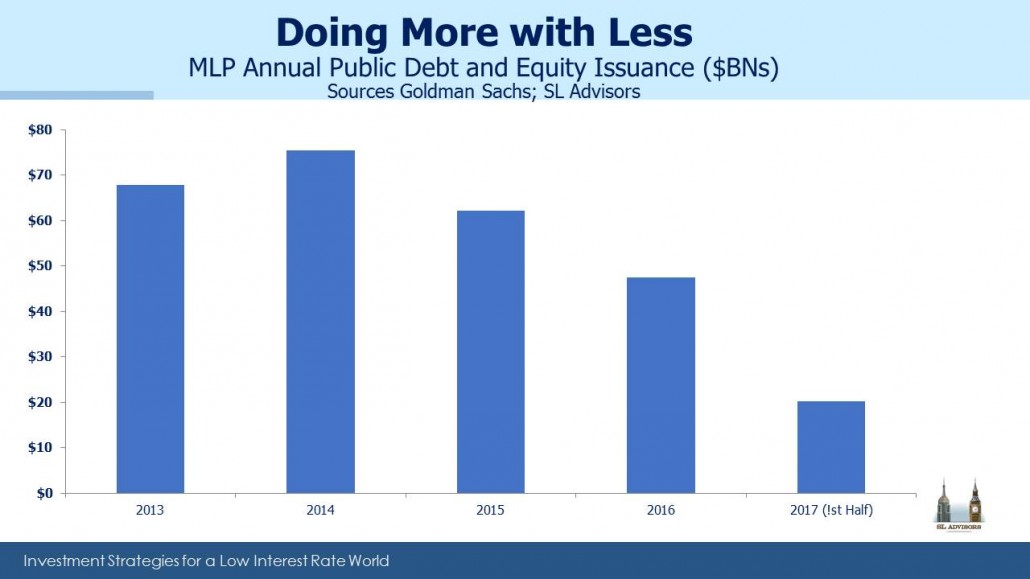

Continuing the theme from last week’s blog that focused more on investors, for a time the Shale Revolution led MLPs to substantially increase their annual capital needs. Subsequently, some lost access to equity financing. The result was that acquisitions, new projects and expansions led to increased use of internally generated cash, leaving less for distributions. In some cases there were distribution cuts. But there are indications that we are over the hump – a higher cost of equity for those firms needing more of it has imposed discipline, and projects are increasingly financed without tapping the capital markets. Annual capital needs are down for the third successive year and are running at about half the pace of 2014.

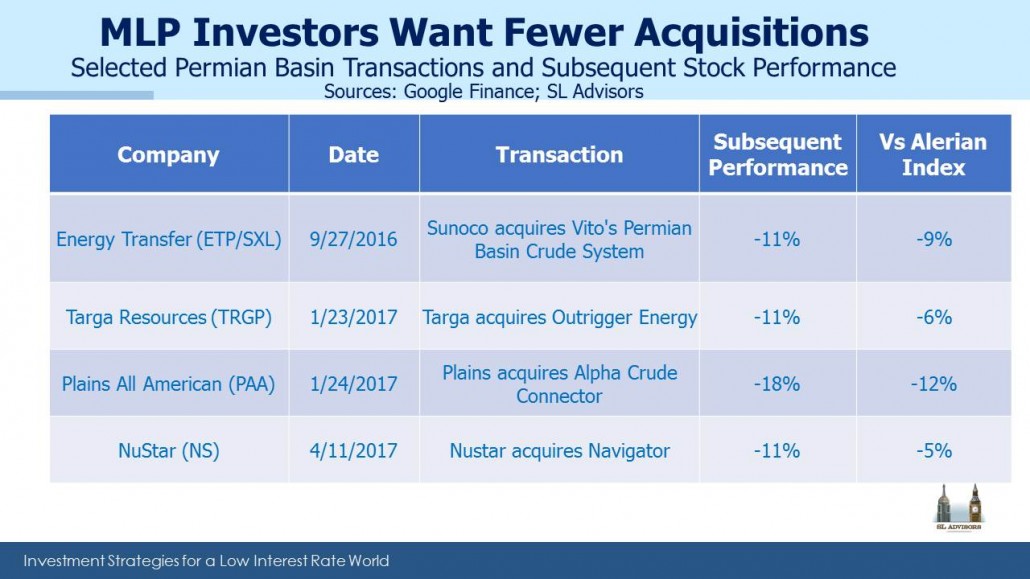

Nonetheless, investors continue to punish those firms that are growing their asset base. The table below highlights four transactions in the past year that have all led to stock price underperformance. The message is that traditional MLP investors prefer income over growth. The choice of many management teams to favor asset growth has led to investor turnover and today’s attractive valuations.

Interestingly, Blackstone recently acquired Harvest Fund Advisors, an MLP investment manager, reflecting their recognition that long-lived energy infrastructure assets offer attractive returns.