Same Assets, Different Payout

We regularly get questions from investors about why the dividend yield on MLPs is often higher than for energy infrastructure C-corps that are in the same business. In recent years several MLPs have transferred their assets into their C-corp parent. Examples are Kinder Morgan (KMI), Targa Resources (TRGP) and Oneok (OKE). The merger of an MLP with its C-corp parent has typically been accompanied by a dividend cut for the MLP investors, who wind up with C-corp shares through a swap.

The assets don’t perform any differently just because they’ve been moved to another entity. But it highlights the differences between C-corps and MLPs from both a taxation and a financing perspective.

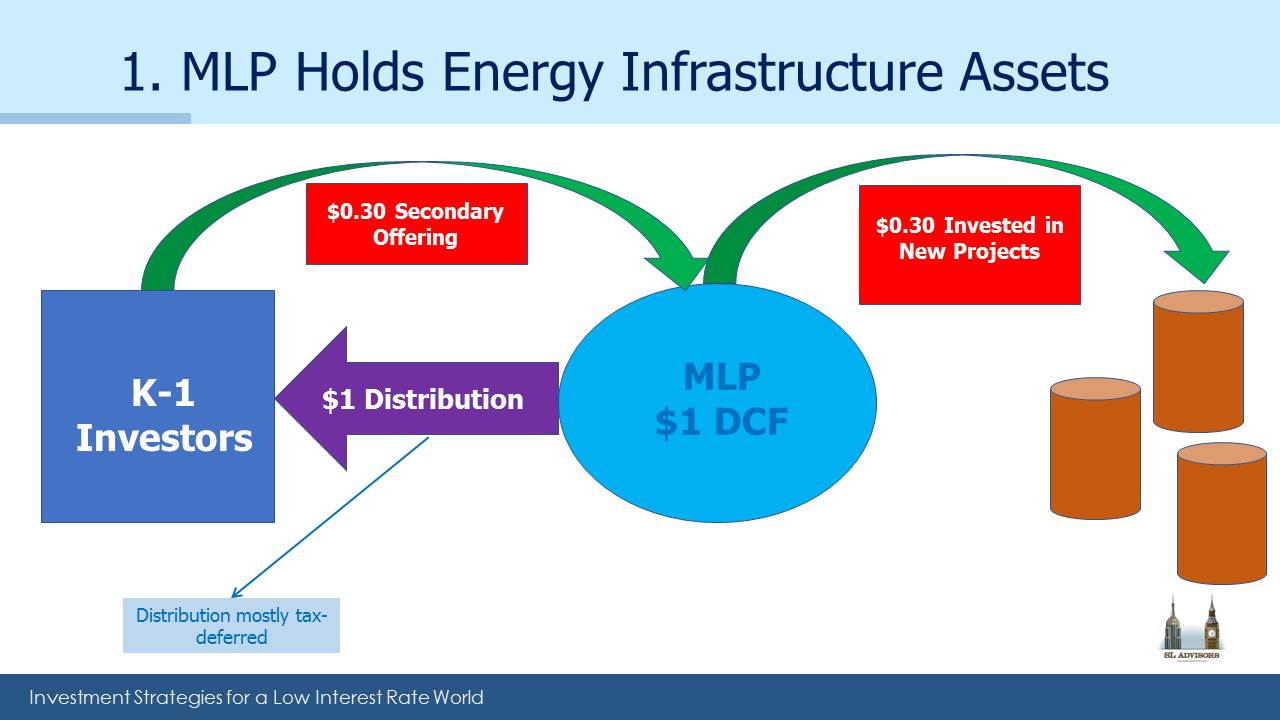

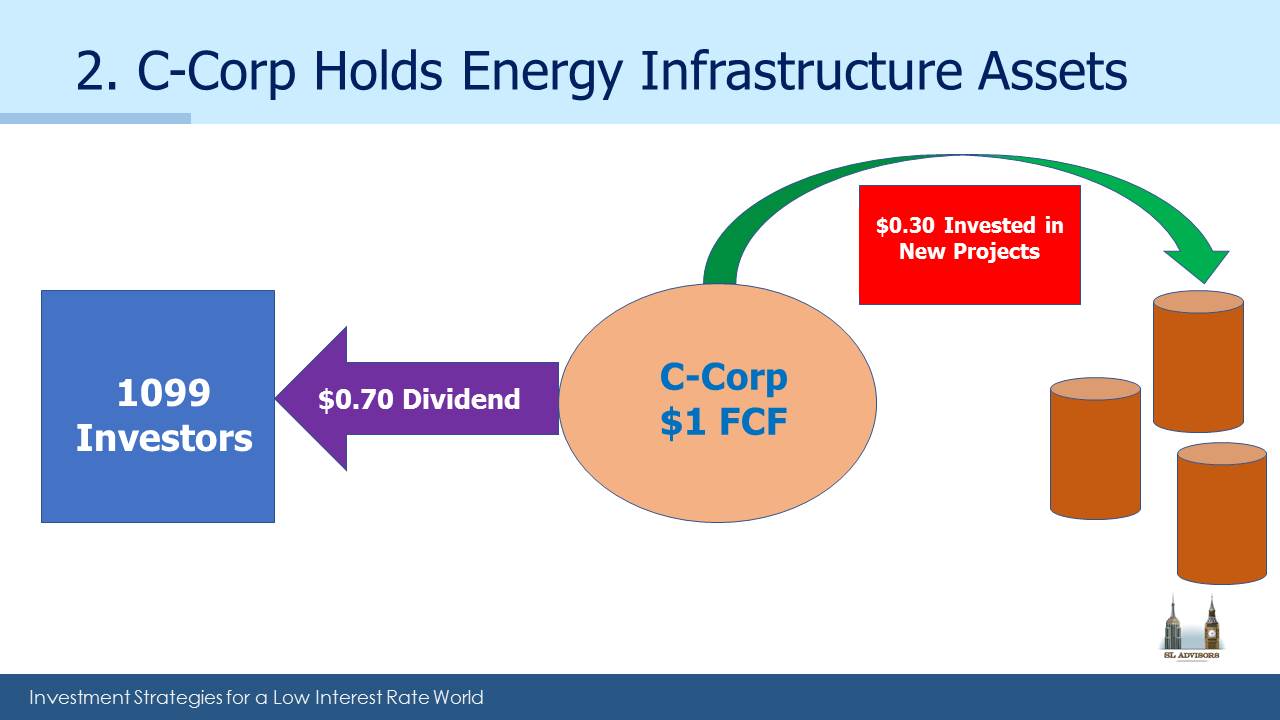

The two diagrams below show this. In each case, assume the underlying assets and the need for growth capital are the same; the only difference is the type of entity (MLP or C-corp) owning the assets.

.avia-image-container.av-40rwv2-ea5466e24a6abc85653bce537f8324f0 img.avia_image{ box-shadow:none; } .avia-image-container.av-40rwv2-ea5466e24a6abc85653bce537f8324f0 .av-image-caption-overlay-center{ color:#ffffff; }

Traditionally, MLPs pay out >90% of their Distributable Cash Flow (DCF) in distributions. DCF is defined as cash generated from operations less the cost of maintenance expenditure on existing assets. Note that generally companies (i.e. C-corps) pay out substantially less than this. Across the S&P500 the average payout ratio is currently 42%. This is largely because of the “double taxation” of dividends, in that corporate profits are taxed first at the corporate level (via corporate income tax), and then again at the investor levels (via personal taxes on dividends and capital gains).

Since paying dividends is a very tax-inefficient way for corporations to return value to shareholders, high pay-out ratios would be exceptionally inefficient. The recent trend is for companies to return profits via buying back their stock. S&P500 companies are currently spending 28% more buying back stock than paying dividends. This also reduces their share count, boosting per share growth.

MLPs don’t face the same tax inefficiency, hence the higher payouts. Consequently, they pay out most of their DCF and then issue equity to finance growth. Their number of units outstanding therefore grows, diluting per unit DCF.

When assets formerly held by an MLP are moved into a C-corp, their cashflows are treated differently. Because C-corps have lower payout ratios, less of the Free Cash Flow (roughly analogous to the MLP’s DCF) is paid out in dividends. This has two results:

- Assets held in an MLP will pay a higher yield to investors than those same assets held in a C-corp.

- The C-corp’s lower payout leaves more cash to finance growth, which in our example eliminates the need to issue equity. Not issuing equity means no dilution for shareholders, which in turn means faster per share dividend growth.

-

.avia-image-container.av-1ydl3y-5a10e8f9998bd5f05d93d1580960fc4f img.avia_image{

box-shadow:none;

}

.avia-image-container.av-1ydl3y-5a10e8f9998bd5f05d93d1580960fc4f .av-image-caption-overlay-center{

color:#ffffff;

}

Across the energy infrastructure investments we hold, dividends are covered approximately 1.5X by free cashflow. An extreme example is Kinder Morgan (KMI) which has a FCF yield of 10% but a dividend yield of 2.5% (they have announced they’ll be raising it next year). KMI is reinvesting most of its FCF in growth, thereby not issuing any dilutive equity and so driving FCF higher. In addition, since FCF is generally growing, the total return on these investments should exceed the FCF yield itself.

Some will note that the point of MLPs is to hold eligible assets without having to pay corporate tax on the returns, and argue that use of the C-corp subjects those returns to taxes needlessly. In practice, energy infrastructure C-corps that have acquired assets from an MLP have employed tax strategies to minimize or eliminate any corporate tax liability, so this concern is moot (see The Tax Story Behind Kinder Morgan’s Big Transaction).

In summary, C-corps pay less of each dollar earned and reinvest more, compared with an MLP holding the same assets. Lower payouts lead to faster growth, since cash not paid out is reinvested in the business. The dividend yield on a portfolio of equities is an unreasonably low estimate of total return. For example, the S&P500 yields 2%, whereas most observers would assign a higher long term return target to stocks (unless they’re very bearish), because dividends grow over time which contributes to an investors overall return. C-corps that own energy infrastructure exhibit similar characteristics, albeit with higher yields and growth prospects.

We are invested in KMI, OKE and TRGP