Plain Talk On Oil Production

Last Wednesday Plains All American (PAGP) held their Investor Day. These events typically afford investors the opportunity to get more detail on the company, but Plains also has a sophisticated macro view of the oil market. As the biggest crude oil transportation company in America they naturally care a lot about North American output. CEO Greg Armstrong invariably provides many great insights. Below are some selected slides from their presentation.

Plains’ research focuses more on forecasting volumes rather than prices; as befits an energy infrastructure operator, the volumes of crude oil moved are more important than the value, although there’s clearly a linkage because high prices stimulate output.

.avia-image-container.av-144z1l-8ce5a6c4ddb34e21599f7608059a4a4a img.avia_image{ box-shadow:none; } .avia-image-container.av-144z1l-8ce5a6c4ddb34e21599f7608059a4a4a .av-image-caption-overlay-center{ color:#ffffff; }

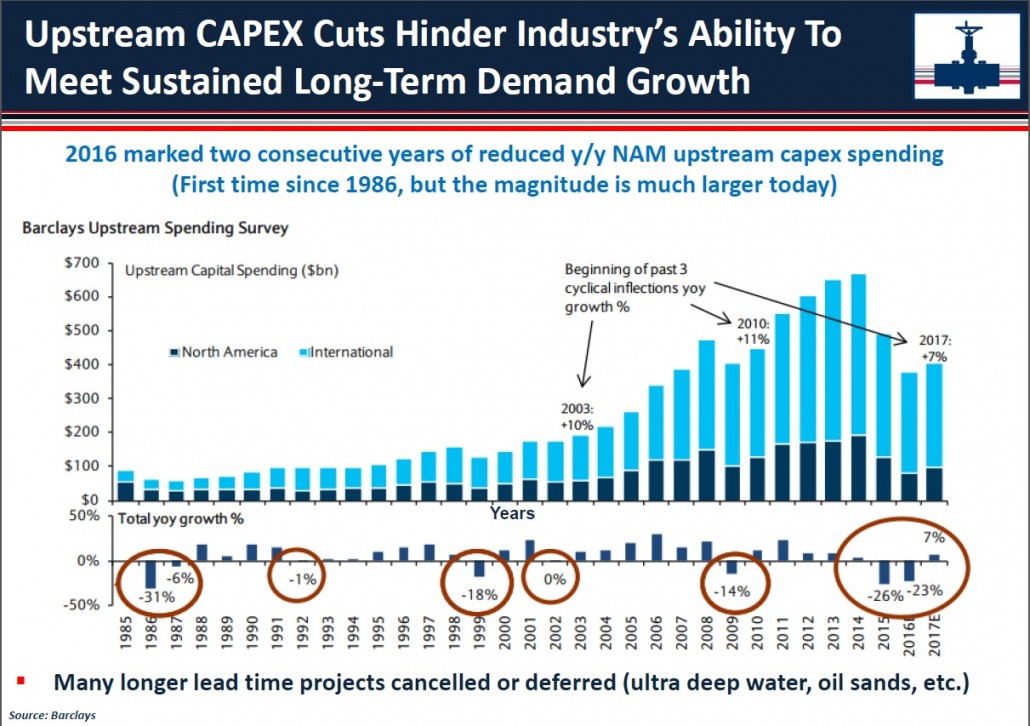

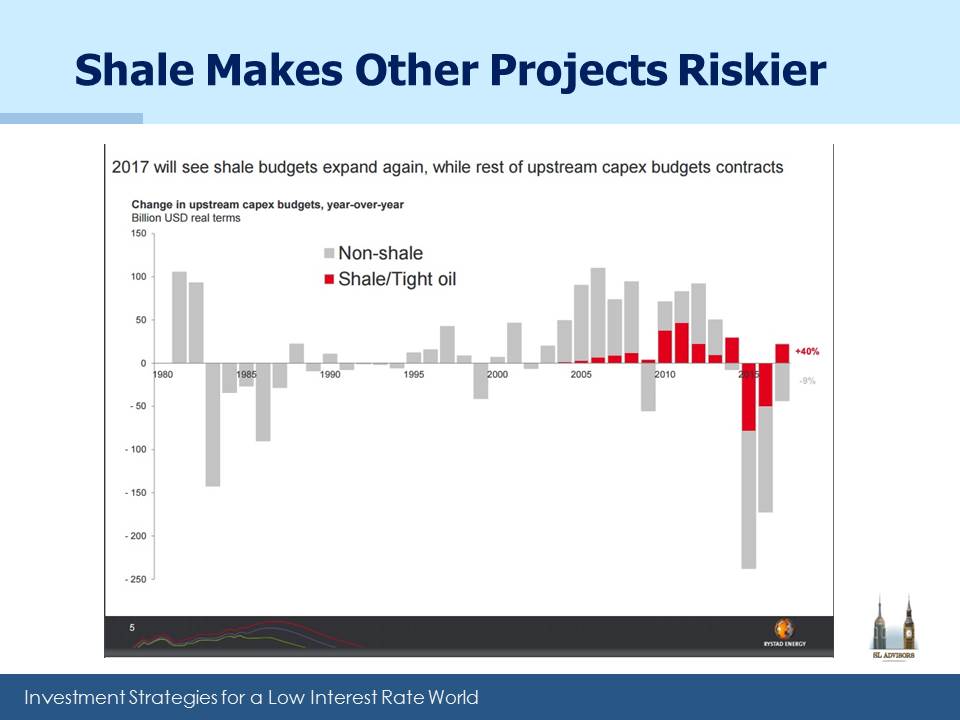

The first slide notes the sharp drop in upstream capex budgets which will eventually manifest itself through constrained supply. The 2015-16 drop in budgets is the biggest in thirty years. There is little excess output capacity, and notwithstanding recent weakness in oil prices, over time the market will be increasingly vulnerable to a spike.

.avia-image-container.av-8xufmx-12bbdaec62167d8a5160a677053d2a10 img.avia_image{ box-shadow:none; } .avia-image-container.av-8xufmx-12bbdaec62167d8a5160a677053d2a10 .av-image-caption-overlay-center{ color:#ffffff; }

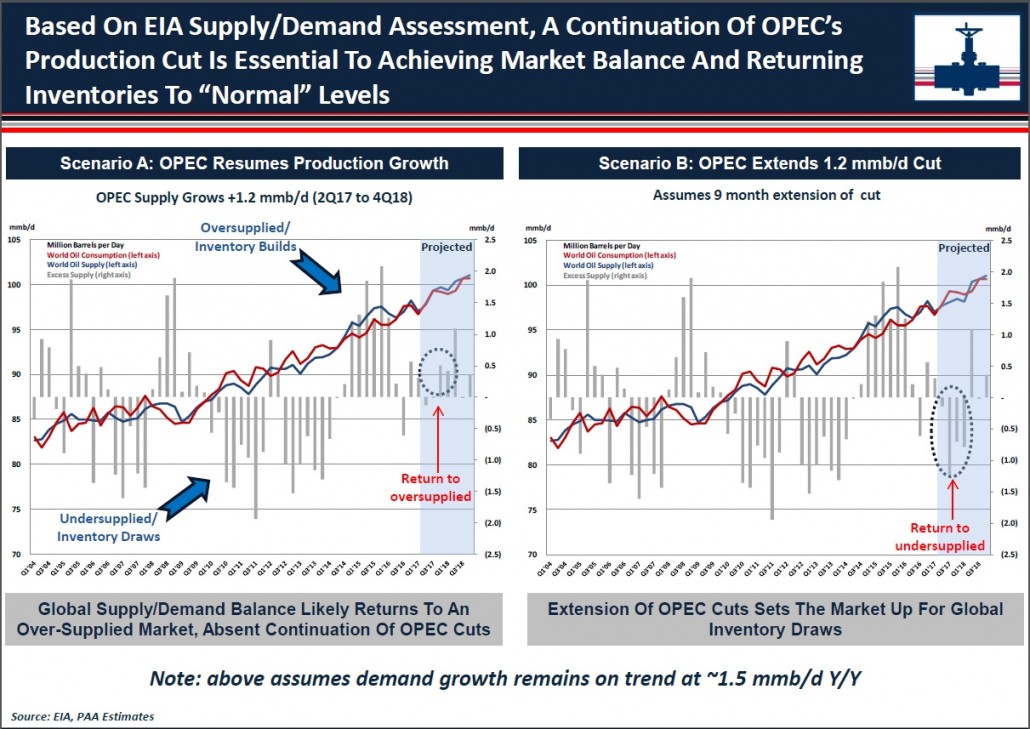

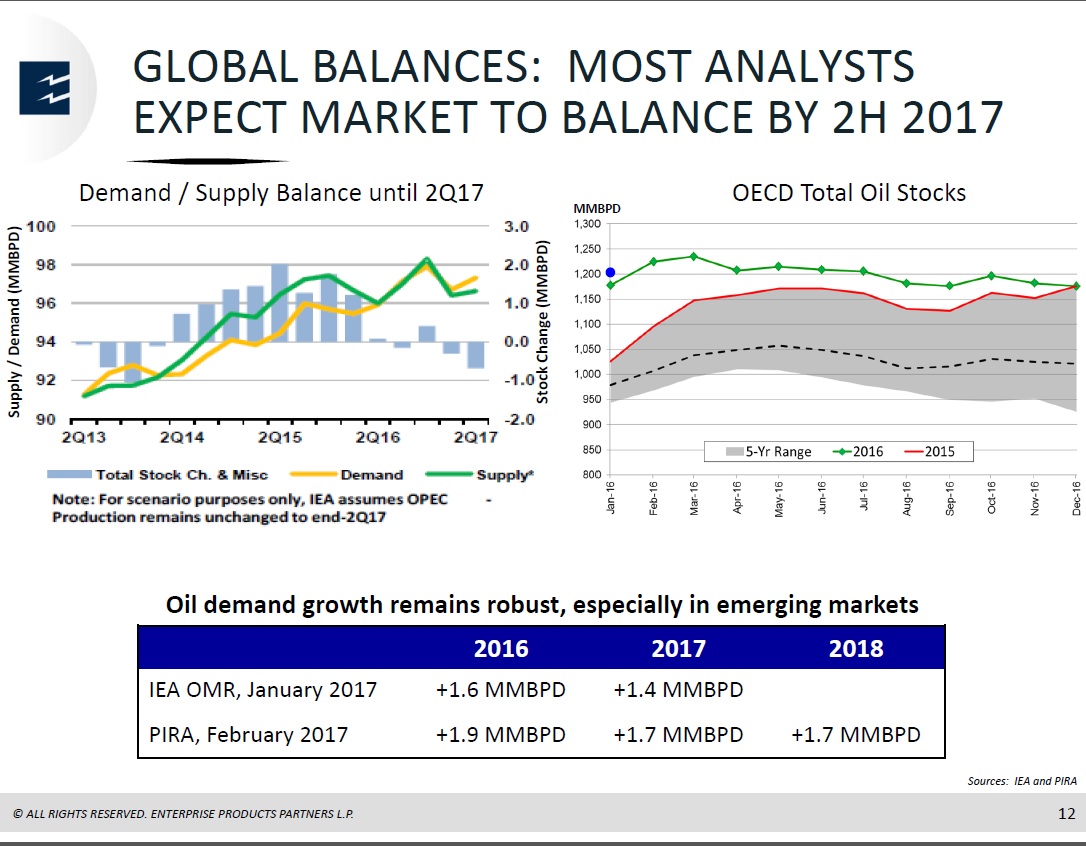

The second slide notes the impact of OPEC’s production cuts. Plains held their Investor Day a day before the OPEC meeting which extended the cuts through 1Q18. Note that the right hand chart assumes the 1.2 Million Barrel/Day (MMB/D) OPEC cut is extended, which should approximately absorb global inventories in excess of historic averages. Russia and other non-OPEC producers are expected to make up the balance of the 1.8MMB/D contained in their announcement. In short, Plains believes the market will balance as a result.

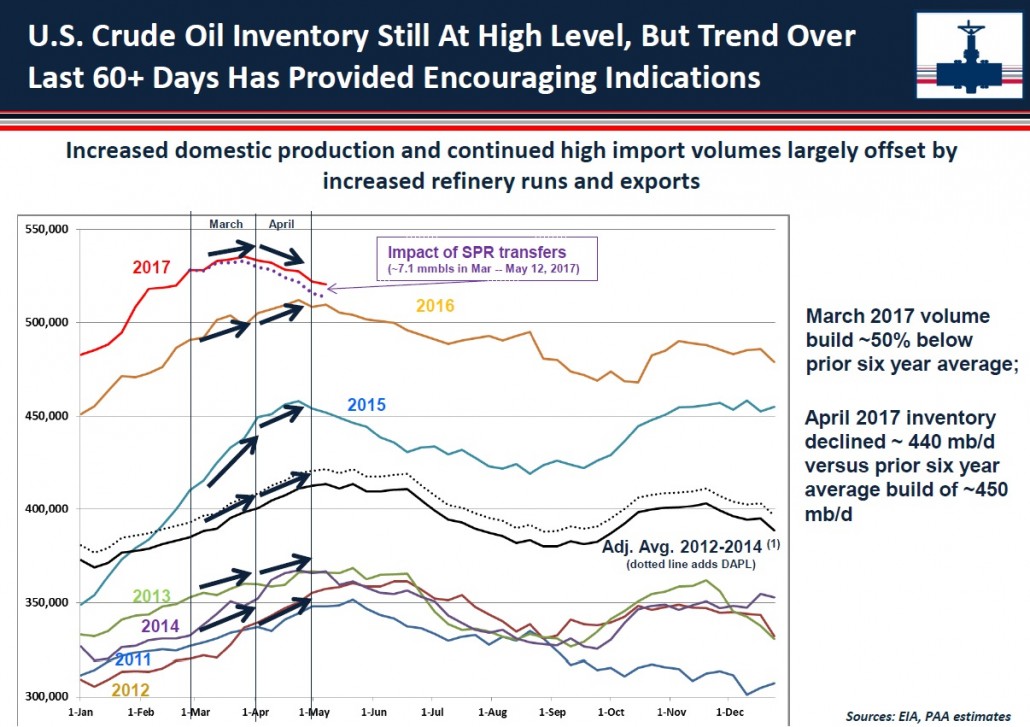

This slide on U.S. inventories notes their currently high level compared with prior years but also that recent builds have been substantially lower than in the past.

.avia-image-container.av-shqg9-9290ac869099a3a2db20633f180f74bd img.avia_image{ box-shadow:none; } .avia-image-container.av-shqg9-9290ac869099a3a2db20633f180f74bd .av-image-caption-overlay-center{ color:#ffffff; }

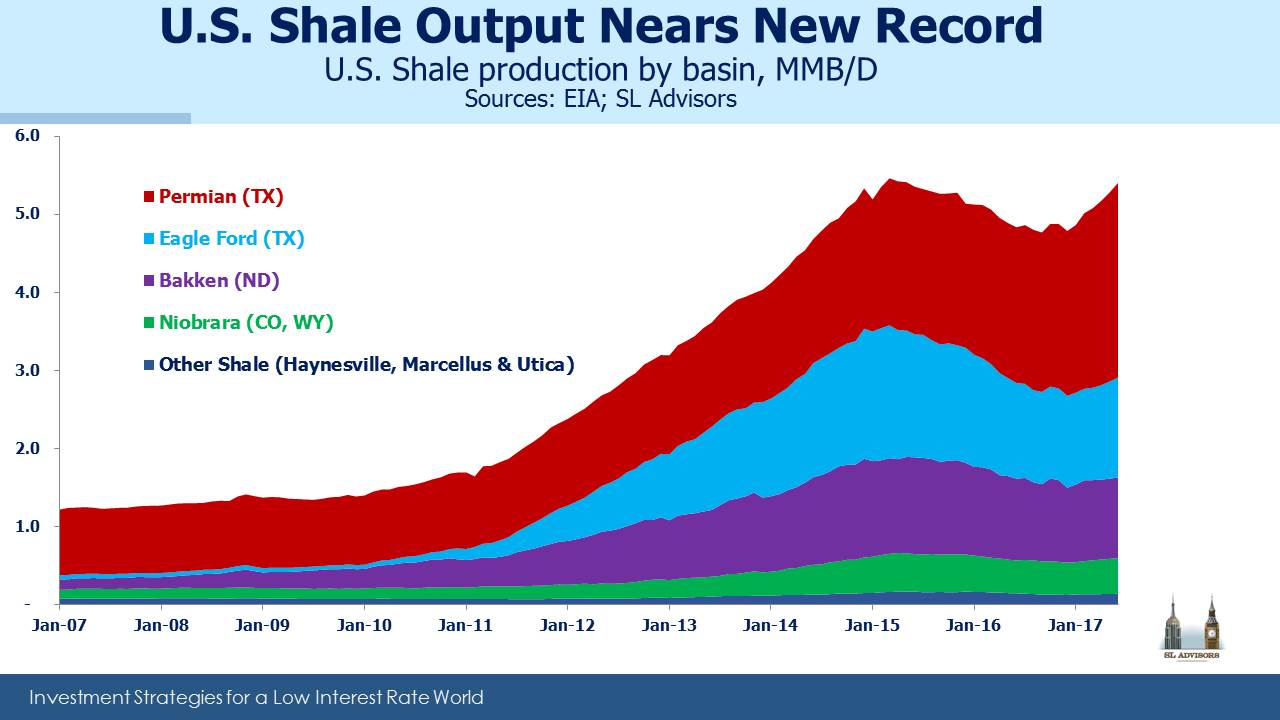

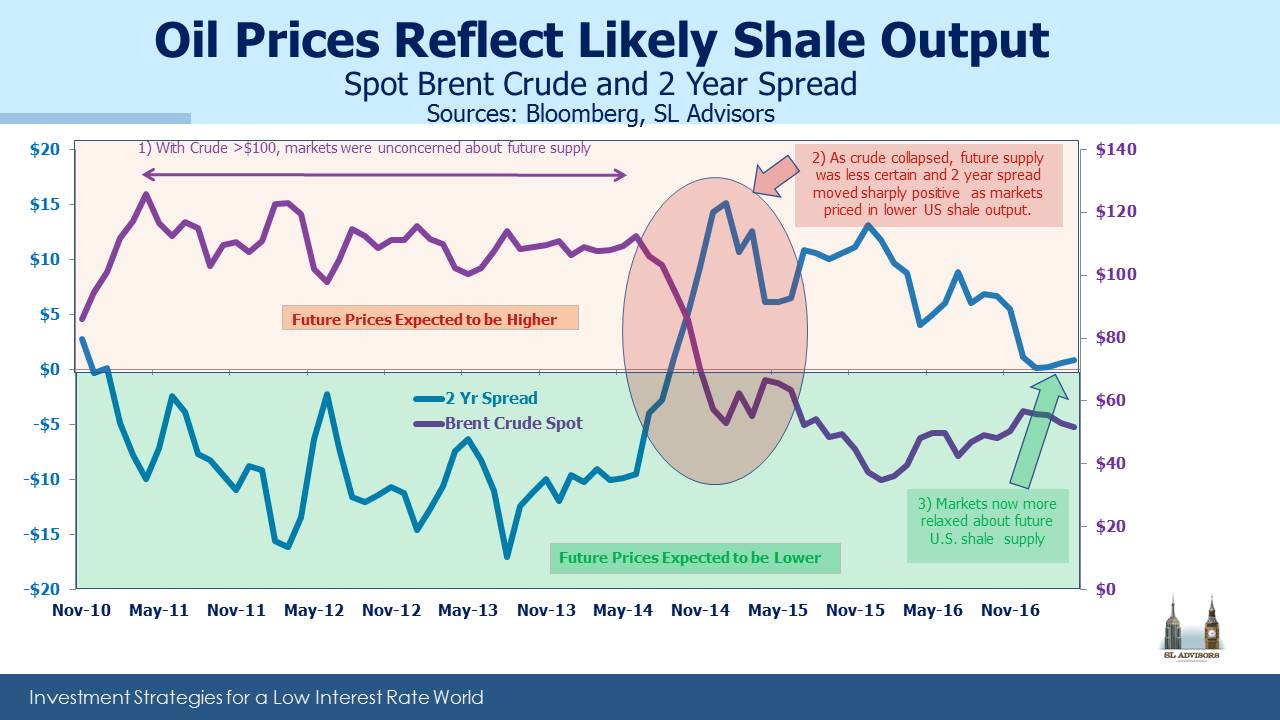

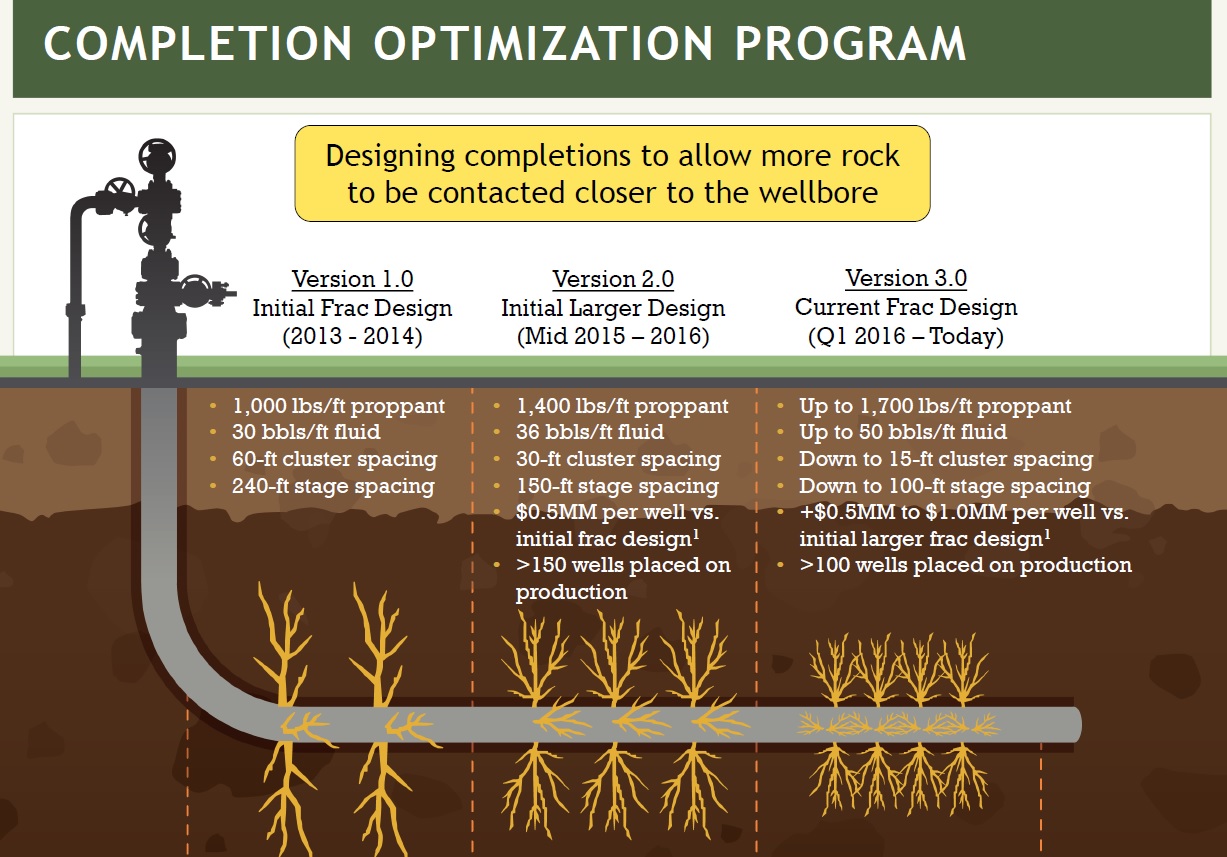

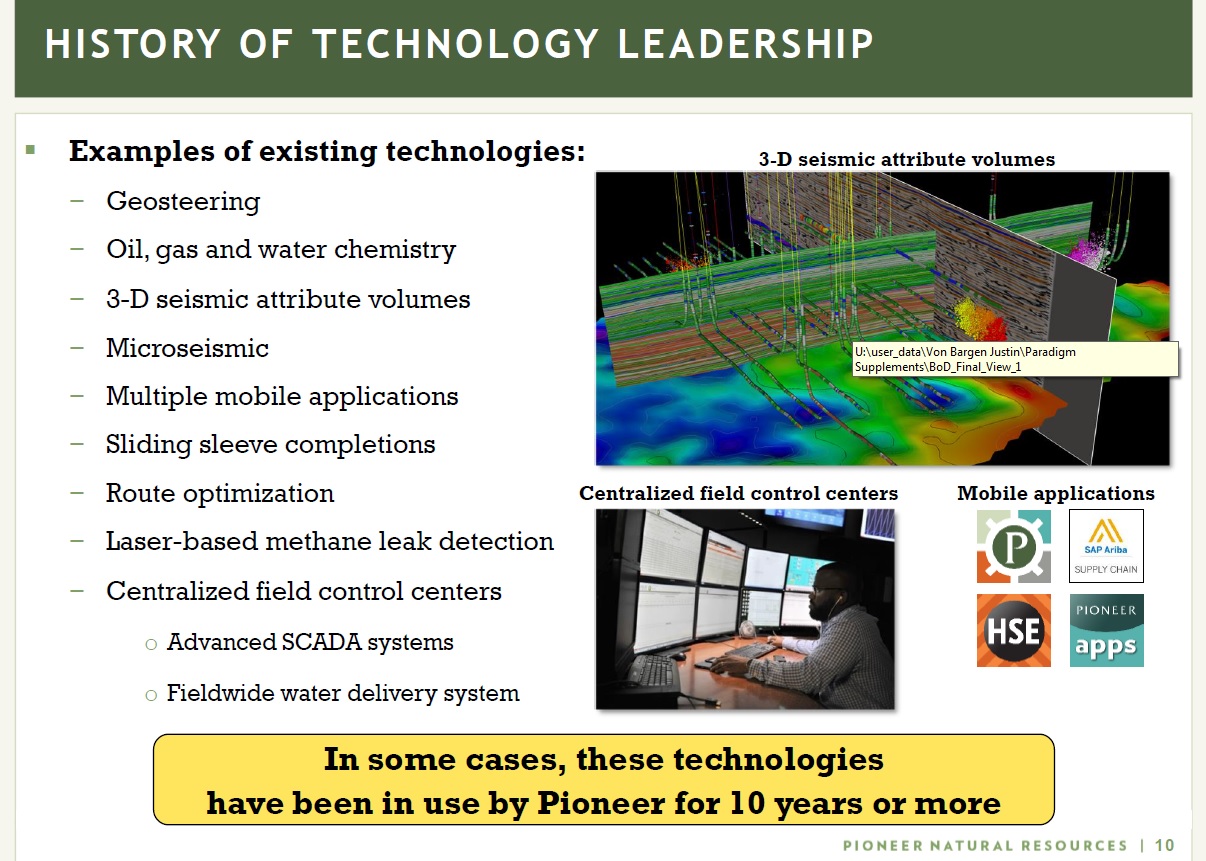

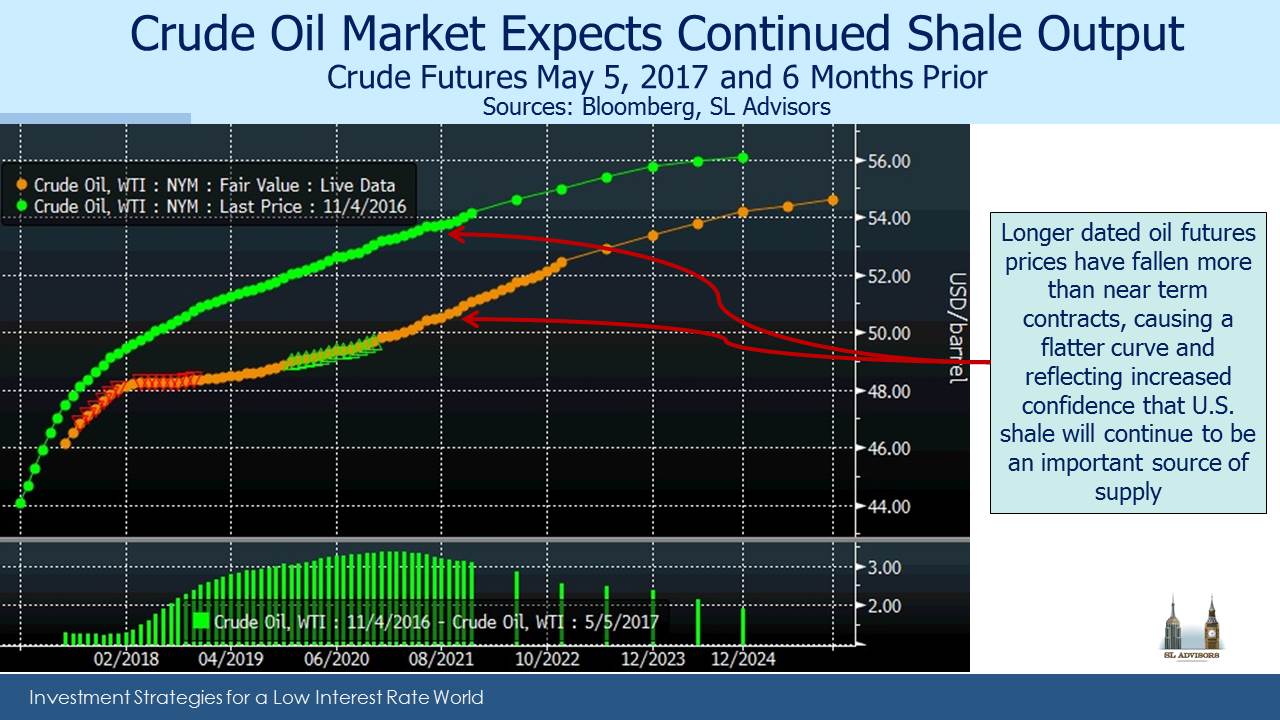

During the Q&A session, CEO Armstrong referred to shale drilling as a manufacturing process, a common analogy nowadays because the short cycle nature of shale projects (see Oil Futures Say Shale’s Here to Stay) results in fast return of capital with commensurately less risk. Much of this higher capital velocity is driven by improving efficiencies (see Extracting Supply Forecasts from Oil Futures).

.avia-image-container.av-574wax-679c8cb907fc411455f65c36894f349b img.avia_image{ box-shadow:none; } .avia-image-container.av-574wax-679c8cb907fc411455f65c36894f349b .av-image-caption-overlay-center{ color:#ffffff; }

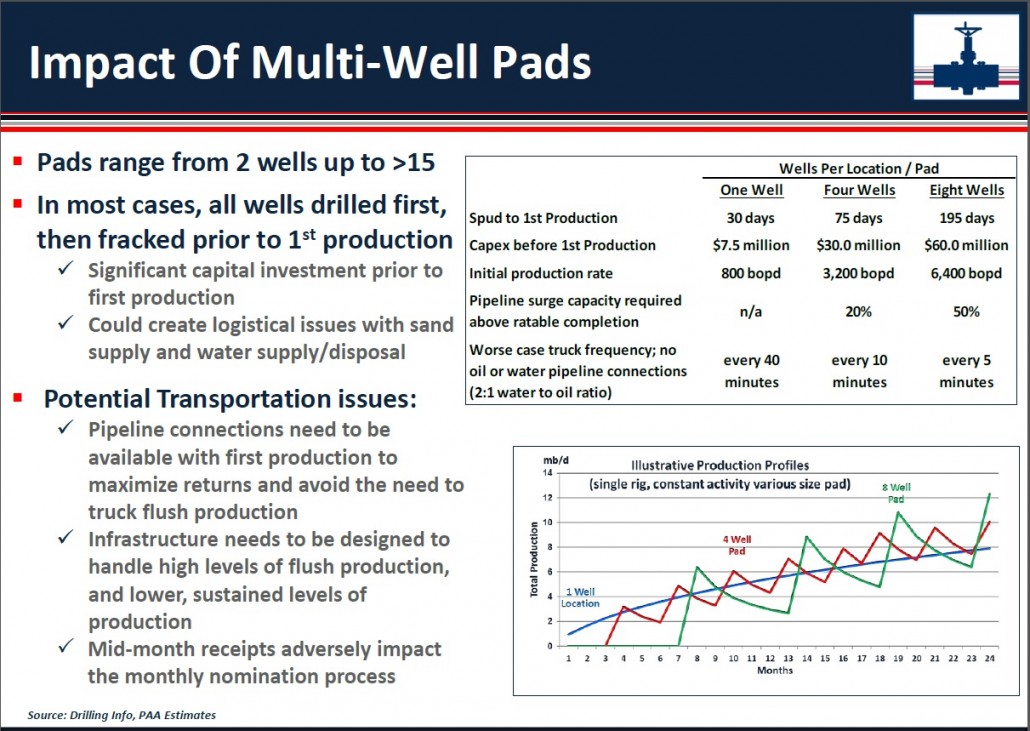

One example of efficiencies is the use of multi-well pads. This can sharply increase the production from each rig in use, but comes with logistical challenges. Typically, all the wells are drilled first, then fracked. This lengthens the time from initiation until production and increases the upfront capital investment; it also results in more variable output as the bottom right illustration in the above slide shows, with volumes coming in spurts. The uneven output creates additional challenges for the Exploration and Production (E&P) company as well as the supporting infrastructure.

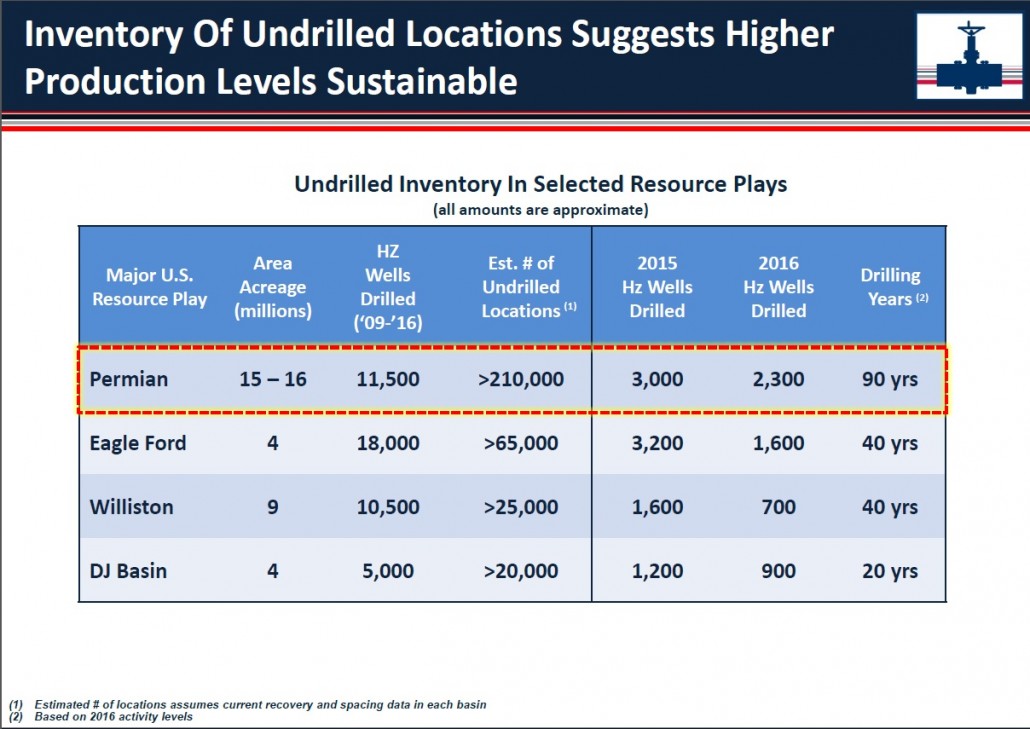

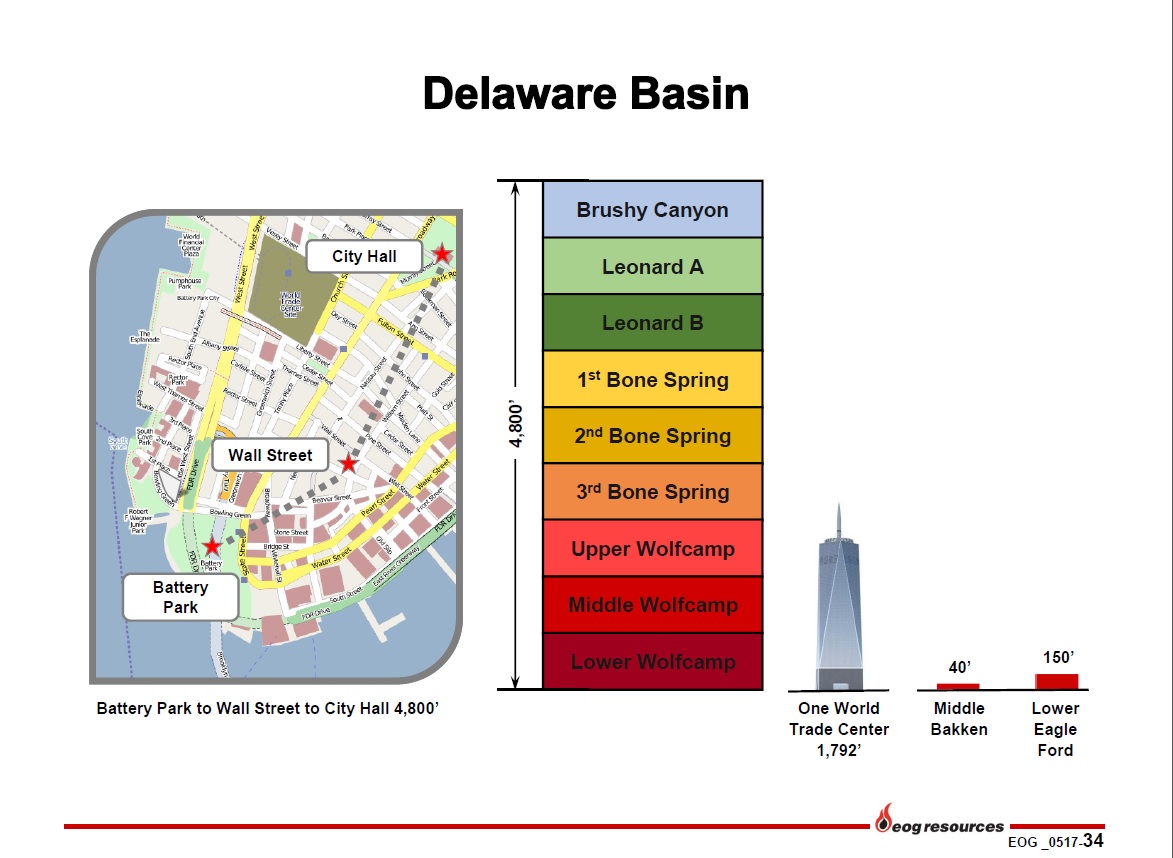

Today there is far greater certainty about the returns from a given level of investment than has traditionally been the case for the energy industry. In fact, Armstrong noted that forecasting production relies heavily on knowing how much capital E&P companies will commit (which is itself dependent on expected returns). The reasonably high visibility around output given capex informs the table below, showing several decades of resource availability. In a memorable quote, Greg Armstromg said, “The world may not need another million barrels a day of Permian crude, but it’s coming.”

.avia-image-container.av-4cc56h-5f5dcc3ff5d94a539833f0177e7f37ea img.avia_image{ box-shadow:none; } .avia-image-container.av-4cc56h-5f5dcc3ff5d94a539833f0177e7f37ea .av-image-caption-overlay-center{ color:#ffffff; }

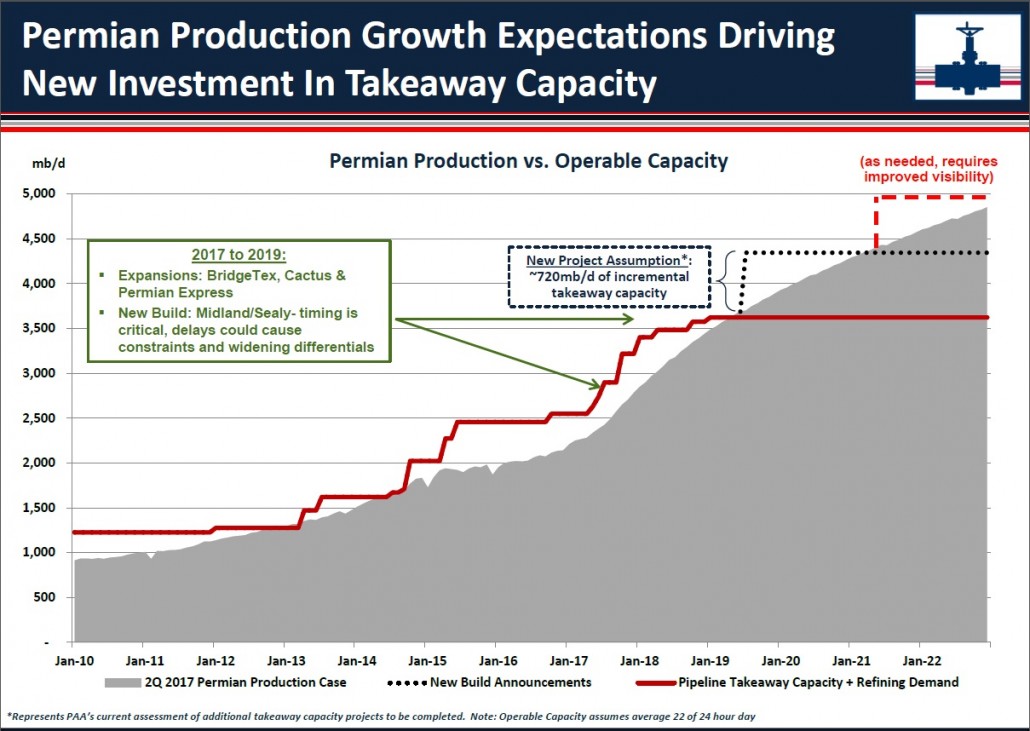

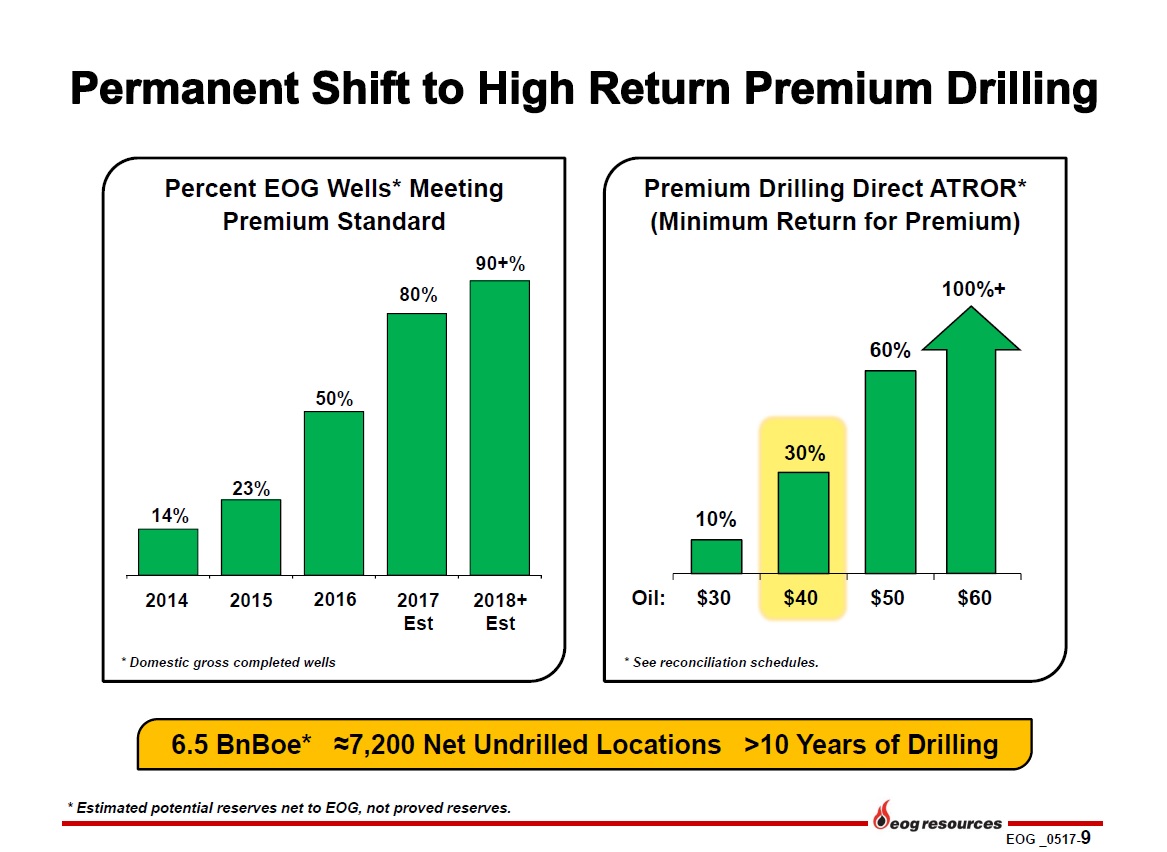

Lastly, investors often ask whether there is excess infrastructure. The answer is never simply yes or no. New pipelines are typically built in anticipation of growing supply. Production ramps up steadily, whereas a pipeline offers capacity only when it’s completed.

.avia-image-container.av-1w1zll-23ba68f4e574ee6469d86879432608f9 img.avia_image{ box-shadow:none; } .avia-image-container.av-1w1zll-23ba68f4e574ee6469d86879432608f9 .av-image-caption-overlay-center{ color:#ffffff; }

The result is, when you plot pipeline capacity and supply of product, you get a chart like this one. The market seeks a narrow gap between the red line (pipeline takeaway capacity plus refinery demand) and the grey area (production). But capacity comes online in a step function, while production moves more gradually. Too much capacity can hurt pipeline margins, but insufficient capacity can leave E&P companies scrambling for alternative transportation (rail or truck, both much more expensive). The challenge for companies like Plains is to build charts like this correctly and then plan their infrastructure investments accordingly. It’s why they focus so carefully on the fundamentals driving their E&P customers.

On a lighter note, I can report that hydraulic fracturing (“fracking”), the process by which water is injected at high pressure into the porous rock holding hydrocarbons, thereby creating millions of cracks and releasing it, has found its way into popular culture. Brockmire, a show available on Amazon Prime, centers on a baseball announcer covering a minor league team in Pennsylvania (think Marcellus Shale) called the Frackers. A local E&P company sets its sights on the (poorly attended) Frackers stadium for waste water disposal. I won’t spoil the plot any further, but discussion of fracking and shale are no longer limited to members of the energy sector. Our thanks to MLP investor Michael Hickey of Forest Park, IL for drawing this to our attention.

We are invested in PAGP